Massachusetts and Texas will be in the market next week as the unofficial summer season winds down during the last week before Labor Day.

Ipreo forecasts weekly bond volume will inch up to $3.9 billion from a revised total of $3.7 billion in the prior week, according to updated data from Thomson Reuters. The calendar is composed of $2.8 billion of negotiated deals and $1.1 million of competitive sales.

Primary market

Morgan Stanley is set to price Massachusetts’ $727.145 million of general obligation and GO refunding bonds on Wednesday after holding a one-day retail order period.

The issue is tentatively structured as $500 million of Series E consolidated loan of 2018 GOs and $227.145 million of Series 2018C refunding GOs.

Proceeds from the new money bonds will be used to finance authorized capital projects while the refunding bonds will be used to refund certain outstanding GOs.

The deal is rated Aa1 by Moody’s Investors Service, AA by S&P Global Ratings and AA-plus by Fitch Ratings. All three rating agencies assign stable outlooks to the credit.

The financial advisor is PFM and the bond counsel in Mintz Levin.

Also in the Bay State, Citigroup is expected to price the Massachusetts Clean Water Trust’s $162 million of Series 21 state revolving fund green bonds on Tuesday.

The deal is rated triple-A by Moody’s, S&P and Fitch.

Piper Jaffray is set to price the Texas Public Finance Authority’s $300 million of Series 2018 taxable GO and refunding bonds on Tuesday.

The deal is rated triple-A by Moody’s and S&P.

JPMorgan Securities is set to price the West Virginia Hospital Finance Authority’s $260 million of hospital refunding and improvement revenue bonds for the Cabell Huntington Hospital Obligated Group on Tuesday. The issue consists of Series 2018A bonds and Series 2018B taxable bonds.

The deal is rated Baa1 by Moody’s and BBB-plus by S&P.

In the competitive arena, Washington state is selling $502.13 million of GOs in three offerings on Wednesday. The deals are comprised of $262.915 million of Series 2019A various purpose GOs, $145.78 million of Series 2019T taxable GOs and $93.435 million of Series 2019B motor vehicle fuel tax GOs.

Montague DeRose & Associates and Piper Jaffray are the financial advisors and Foster Pepper is the bond counsel.

The deals are rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

Also on Wednesday, Dallas is selling $155.66 million of Series 2018C waterworks and sewer system revenue refunding bonds.

Hilltop Securities and Estrada Hinojosa are the financial advisors and McCall Parkhurst and Escamilla & Poneck are the bond counsel.

The deal is rated AAA by S&P and AA-plus by Fitch.

Bond Buyer 30-day visible supply at $8.62B

The Bond Buyer's 30-day visible supply calendar increased $32.2 million to $8.62 billion for Friday. The total is comprised of $3.23 billion of competitive sales and $5.39 billion of negotiated deals.

Week's actively quoted issues

Puerto Rico and Pennsylvania names were among the most actively quoted bonds in the week ended Aug. 24, according to Markit.

On the bid side, the Puerto Rico Sales Tax Financing Corp. revenue 6s of 2042 were quoted by 63 unique dealers. On the ask side, the Northampton County General Purpose Authority, Pa., revenue 5s of 2047 were quoted by 342 dealers. And among two-sided quotes, the Puerto Rico GO 8s of 2035 were quoted by 16 dealers.

Secondary market

Municipal bonds were mostly stronger on Friday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell less than one basis point in the three- to seven-year and 10- to 30-year maturities and rose less than a basis point in the one- to two-year and eight- and nine-year maturities.

High-grade munis were mostly stronger, with yields calculated on MBIS’ AAA scale falling less than one basis point in one- to seven- and 20- to 28-year maturities, rising less than a basis point in the eight- and nine-year and 30-year maturities and remaining unchanged in the 29-year maturity.

Municipals were steady on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on 30-year muni maturity remaining unchanged.

Treasury bonds were stronger as stock prices traded higher.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 86.6% while the 30-year muni-to-Treasury ratio stood at 100.9%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 43,692 trades on Thursday on volume of $16.73 billion.

California, Texas and New York were the municipalities with the most trades, with Golden State taking 14.586% of the market, the Lone Star State taking 13.867% and the Empire State taking 9.358%.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended Aug. 24 were from Puerto Rico, Texas and New York and New Jersey issuers, according to

In the GO bond sector, the Puerto Rico 8s of 2035 traded 34 times. In the revenue bond sector, the Texas 4s of 2019 traded 204 times. And in the taxable bond sector, the Port Authority of N.Y. & N.J. 4.031s of 2048 traded 55 times.

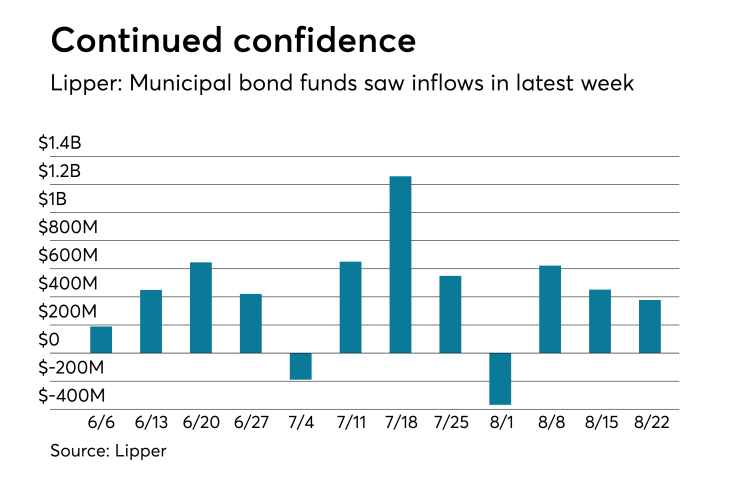

Lipper: Muni bond funds saw inflows

Investors in municipal bond funds once again showed confidence and put cash into the funds during the latest reporting week, according to Lipper data released on Thursday.

The weekly reporters saw $378.371 million of inflows in the week ended Aug. 22, after inflows of $452.026 million in the previous week.

Exchange traded funds reported inflows of $82.831 million, after inflows of $63.628 million in the previous week. Ex-ETFs, muni funds saw $295.540 million of inflows, after inflows of $388.397 million in the previous week.

The four-week moving average remained positive at $271.150 million, after being in the green at $314.068 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $348.356 million in the latest week after inflows of $322.370 million in the previous week. Intermediate-term funds had inflows of $90.321 million after inflows of $128.601 million in the prior week.

National funds had inflows of $338.960 million after inflows of $445.582 million in the previous week. High-yield muni funds reported inflows of $240.718 million in the latest week, after inflows of $244.232 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.