The largest deal of the week hit the municipal bond market early on Thursday with the institutional pricing of the state of Massachusetts' general obligation bond offering.

Primary Market

Citigroup priced the Bay State’s $767.97 million GO sale for institutions Thursday after holding a retail order period on Wednesday.

The $400 million of Series A consolidated loan of 2017 GOs were priced for institutions as 5s to yield from 2.88% in 2032 to 3.11% in 2037. A split 2042 maturity was priced as 5s to yield 3.20% and as 5 1/4s to yield 3.07% and a split 2047 maturity was priced as 5s to yield 3.25% and as 5 1/4s to yield 3.12%

The $100 million of Series B consolidated loan of 2017 green bond GOs were priced for institutions as 5s to yield from 1.81% in 2023 to 2.40% in 2027, 3.11% in 2037 and 3.25% in 2047.

The $267.97 million of Series C consolidated loan of 2017 refunding GOs were priced for retail as 5s to yield from 1.71% in 2022 to 2.44% in 2027. A 2017 maturity was offered as a sealed bid.

On Wednesday, the $400 million of Series A GOs were priced for retail as 5s to yield 2.88% in 2032. The 2033-2037 maturities were not offered to retail investors. The $100 million of Series B GOs were priced for retail as 5s to yield from 1.83% in 2023 to 2.42% in 2027 and 3.11% in 2037. A 2047 maturity was not offered to retail investors. The $277.6 million of Series C GOs were priced for retail as 5s to yield from 1.73% in 2022 to 2.46% in 2027. A 2017 maturity was offered as a sealed bid.

The Massachusetts deal is rated Aa1 by Moody’s Investors Service and AA-plus by S&P Global Ratings and Fitch Ratings.

Also on Thursday, Bank of America is set to price the California State Public Works Board’s $537.53 million of Series 2017 B&C various capital lease revenue refunding bonds for institutions after holding a one-day retail order period.

The $382.62 million of Series 2017B bonds were priced for retail as 5s to yield from 0.85% in 2017 to 2.96% in 2030. No retail orders were taken in the 2028-2029 maturities.

The $154.91 million of Series 2017C bonds were priced for retail to yield from 0.90% with a 3% coupon in 2018 to 3.28% with a 5% coupon in 2035.

The deal is rated A1 by Moody’s and A-plus by S&P and Fitch.

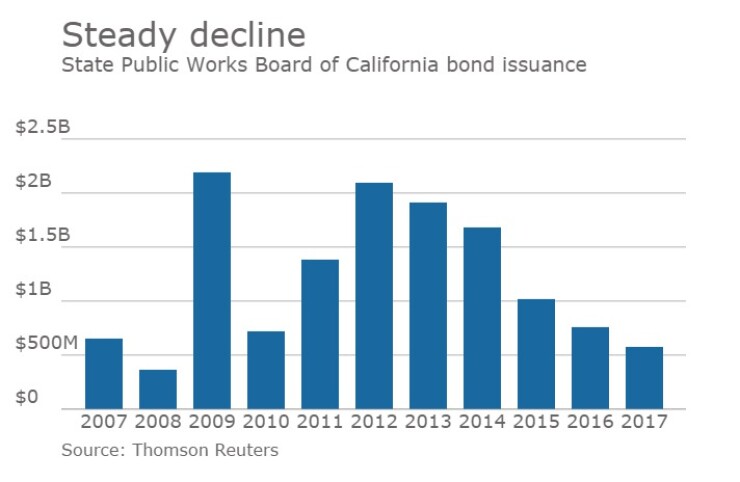

Since 2007, the board has sold about $13.4 billion of bonds, with the most issuance occurring in 2009 when it offered $2.19 billion of debt. The board saw a low year of issuance back in 2008, when it sold $365 million, one of only four times during that period when it sold less than $1 billion in a calendar year.

BAML is also expected to price the Maryland Department of Housing and Community Development’s $263 million of Series 2017 taxable residential revenue bonds.

The deal is rated Aa2 by Moody’s and AA by Fitch.

RBC Capital Markets priced the Desert Community College District, Calif.’s $125.31 million of Series 2017 crossover refunding GO refunding bonds.

The issue was priced to yield from 0.92% with a 2% coupon in 2018 to 2.81% with a 5% coupon in 2031; a 2033 maturity was priced as 5s to yield 2.95% and a 2039 maturity was priced as 4s to yield 3.63%.

The deal is rated Aa2 by Moody’s and AA by S&P.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar decreased $1.39 billion to $10.81 billion on Thursday. The total is comprised of $4.15 billion of competitive sales and $6.66 billion of negotiated deals.

Secondary Market

U.S. Treasuries were stronger on Thursday. The yield on the two-year dipped to 1.24% from 1.25% on Wednesday, while the 10-year Treasury yield dropped to 2.33% from 2.36%, and the yield on the 30-year Treasury bond decreased to 2.99% from 3.01%.

Municipal bonds ended stronger on Wednesday. The yield on the 10-year benchmark muni general obligation fell two basis points to 2.20% from 2.22% on Tuesday, while the 30-year GO yield dropped one basis point to 3.00% from 3.01%, according to the final read of Municipal Market Data's triple-A scale.

On Wednesday, the 10-year muni to Treasury ratio was calculated at 93.6% compared to 94.5% on Tuesday, while the 30-year muni to Treasury ratio stood at 99.9%, versus 100.6%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 46,166 trades on Wednesday on volume of $13.69 billion.

Tax-Exempt Money Market Fund Inflows

Tax-exempt money market funds experienced inflows of $92.4 million, bringing total net assets to $130.24 billion in the week ended April 3, according to The Money Fund Report, a service of iMoneyNet.com. This followed an outflow of $949.2 million to $130.15 billion in the previous week.

The average, seven-day simple yield for the 232 weekly reporting tax-exempt funds rose to 0.39% from 0.32% in the previous week.

The total net assets of the 862 weekly reporting taxable money funds decreased $12.97 billion to $2.489 trillion in the week ended April 4, after an inflow of $6.42 billion to $2.502 trillion the week before.

The average, seven-day simple yield for the taxable money funds increased to 0.40% from 0.38% in the prior week.

Overall, the combined total net assets of the 1,092 weekly reporting money funds decreased $12.87 billion to $2.619 trillion in the week ended April 4, after inflows of $5.47 billion to $2.632 trillion in the prior week.