Want unlimited access to top ideas and insights?

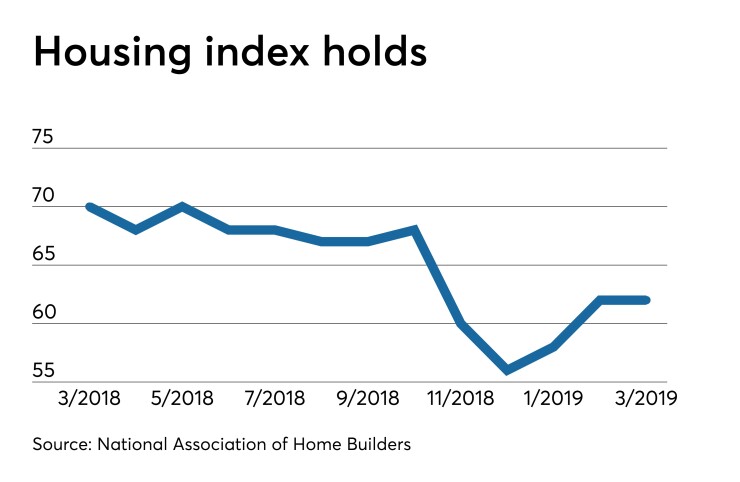

Builders’ confidence in the market for new single-family homes was steady as the National Association of Home Builders' housing market index remained at 62 in March, as builders said affordability is still an issue.

IFR's poll of economists predicted the index would be 63.

“Builders report the market is stabilizing following the slowdown at the end of 2018 and they anticipate a solid spring home buying season,” NAHB Chairman Greg Ugalde said.

“In a healthy sign for the housing market, more builders are saying that lower price points are selling well, and this was reflected in the government’s new home sales report released last week,” according to NAHB Chief Economist Robert Dietz. “Increased inventory of affordably priced homes — in markets where government policies support such construction — will enable more entry-level buyers to enter the market.”

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as either "good," "fair" or "poor." The survey also asks builders to rate traffic of prospective buyers as either "high to very high," "average" or "low to very low." Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view sales conditions as good than poor.

The current single-family home sales index grew to 68 from 66, the sales expectations index for the next six months climbed to 71 from 68 and the traffic of prospective buyers index dropped to 44 from 48.