The municipal bond market is in for a sleepy Thanksgiving holiday week with a small slate of supply ahead as trading activity is confined to two and a half days.

Ipreo forecasts weekly bond volume will drop to $1.1 billion from a revised total of $6.1 billion in the prior week, according to updated data from Thomson Reuters. The calendar is composed of $845.6 million of negotiated deals and $253.1 million of competitive sales.

Wednesday’s trading will be curtailed at 2 p.m., ahead of the long holiday weekend.

On Friday, market participants were looking at the big deal from Chicago’s Sales Tax Securitization Corp. late Thursday.

The deal was priced by lead managers Loop Capital Markets and Stifel, Nicolaus along with co-managers RBC Capital Markets, Williams Capital Group, Mesirow Financial and Academy Securities.

The bonds are rated AAA by Fitch Ratings and Kroll Bond Rating Agency and AA-minus by S&P Global Ratings.

Bond sale results

Illinois

Primary market

There are only two deals on next week’s calendar over $100 million.

JPMorgan Securities is expected to price the North Carolina Turnpike Authority’s $394 million of Series 2018 senior lien turnpike revenue refunding bonds for the Triangle Expressway System on Tuesday.

The deal is rated BBB by S&P and BBB-minus by Fitch Ratings.

Also on Tuesday, RBC Capital Markets is set to price Colorado’s Series 2018N tax-exempt certificates of participation for the Building Excellent School Today program.

The deal is rated Aa2 by Moody’s Investors Service and AA-minus by S&P.

There are no competitive deals over $100 million.

Bond Buyer 30-day visible supply at $3.68B

The Bond Buyer's 30-day visible supply calendar decreased $2.14 billion to $3.68 billion for Friday. The total is comprised of $1.17 billion of competitive sales and $2.51 billion of negotiated deals.

Secondary market

Municipal bonds were stronger on Friday, according to an early read of the MBIS benchmark scale. Benchmark muni yields dipped as much as two basis point in the one- to 30-year maturities.

High-grade munis were stronger, with yields calculated on MBIS' AAA scale decreasing as much as two basis points across the curve.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on 30-year muni maturity falling as much as two basis points.

Treasury bonds were stronger as stocks traded mixed. The Treasury 10-year stood at 3.085% while the Treasury 3-month bill was at 2.366%.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 86.1% while the 30-year muni-to-Treasury ratio stood at 99.4%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 50,668 trades on Thursday on volume of $18.72 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 17.069% of the market, the Empire State taking 11.586% and the Lone Star State taking 9.679%.

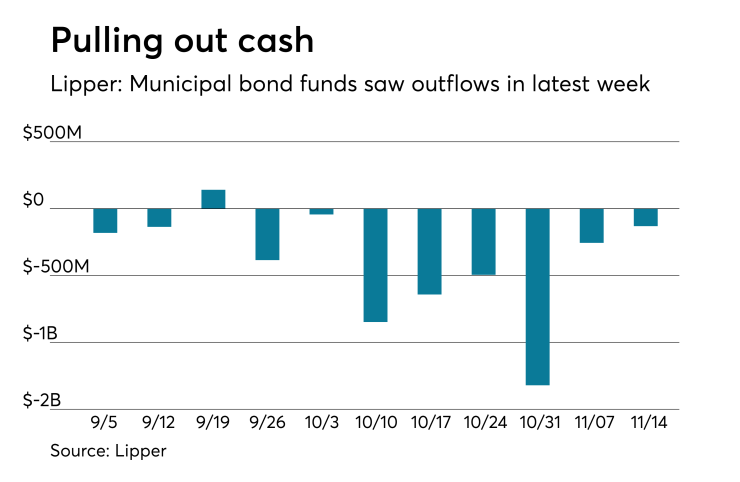

Lipper: Muni bond funds saw outflows

Investors in municipal bond funds again pulled cash out of the funds during the latest reporting week, according to Lipper data released on Thursday.

The weekly reporters saw $131.118 million of outflows in the week ended Nov. 14 after outflows of $255.812 million in the previous week.

Exchange traded funds reported inflows of $90.396 million, after outflows of $89.409 million in the previous week. Ex-ETFs, muni funds saw outflows of $224.514 million after outflows of $166.403 million in the previous week.

The four-week moving average remained negative at -$550.628 million, after being in the red at -$678.357 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had outflows of $361.143 million in the latest week after outflows of $286.728 million in the previous week. Intermediate-term funds had inflows of $375,000 after outflows of $39.001 million in the prior week.

National funds had outflows of $23.857 million after outflows of $87.939 million in the previous week. High-yield muni funds reported outflows of $129.541 million in the latest week, after outflows of $161.205 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.