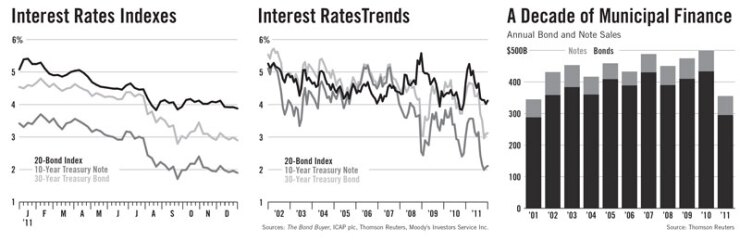

By almost every measure, 2011 was a down year for long-term volume in the municipal bond market.

Total long-term muni volume fell 32% from a year earlier, to $294.7 billion in 10,556 issues. That compares with 13,800 issues amounting to $433.2 billion in 2010.

The decrease cut a wide swathe across sectors. Volume was down in all 10 sectors measured by Thomson Reuters, except for development.

Issuance was down an average of 49% per month for the first five months of 2011 against a backdrop of weak price performance and concerns about the stability of municipal governments in general.

Investors early in the year were pulling billions of dollars out of muni bond mutual funds. Adding to the overall glum mood for bond dealers, a newfound sense of fiscal austerity gripped state and local governments and that discouraged any willingness to take on additional debt, said Peter Hayes, head of municipal bond trading at BlackRock.

The combination of factors kept new issuance exceptionally low.

By springtime, issuance rose somewhat as most states balanced their fiscal year budgets for 2012 and market sentiment improved, Morgan Stanley Smith Barney’s John Dillon wrote in a year-end report.

A volatile summer for the global markets prompted by concerns surrounding the European debt crisis resulted in a flight to quality that sent muni yields to record lows in September.

Low rates launched refunding deals, as issuers sought to further reduce their cost of capital. Nevertheless, refundings fell 6% in 2011 to $93 billion.

The year-end rally gained momentum as cash from December redemptions hit the market and high muni yields relative to Treasurys drew crossover buyers.

Among sectors, issuance in environmental facilities and electric power saw the largest downturn from 2010, at decreases of 64.7% and 62.4%, respectively. Environmental facilities bonds fell to $2.8 billion in issuance in 2011 from $7.8 billion one year earlier. Volume for electric power bonds dropped to $11.3 billion last year from $$30.2 billion in 2010.

Transportation issuance fell dramatically, as well, to $32.9 billion in new bonds last year from $66.9 billion in 2010.

Some found the decline in the three sectors unexpected.

“We think a lot about the needs of the country, infrastructure, roads, bridges, etc., and even the power grid issues that the U.S. has, it’s a little surprising that those numbers were down as large as they are,” BlackRock’s Hayes said. “Perhaps those are two sectors that rebound more than others this year.”

The largest sector, general purpose, fell about 30% from its numbers in 2010. Volume dropped to $83.8 billion in 2011 from $119.4 billion one year earlier.

The market saw tax-exempt issuance fall 7.7% form 2010, to $254.3 billion from $275.5 billion.

The taxable market saw issuance plunge almost 79% in 2011 from a record level the year earlier, to $32.3 billion from $151.9 billion. The obvious reason for that: expiration of the popular Build America Bond program at the end of 2010.

Once again, the largest number and amount of issuance hailed from the negotiated side of the market. But business there fell almost 37% in 2011 from one year earlier, to 6,675 issues worth $225.7 billion from 9,327 issues worth $357.3 billion.

Competitive market issuance fell in 2011 as well, though by a smaller amount: 18.5%. Competitive deals totaled 3,499 worth $59.6 billion last year, against 4,234 issues worth $73.1 billion in 2010.

There was also less overall issuance in revenue and general obligation bonds in 2011, compared with one year earlier. Revenue bond issuance dipped about 34% last year, to 3,820 deals worth $188.9 billion from 5,491 sales worth $285.8 billion in 2010. GO volume slipped in 2011 to 6,736 deals worth $105.8 billion from 8,309 issues worth $147.3 billion one year earlier.

State agencies, the largest entity among municipal borrowers, saw 29% less in issuance last year compared with a year earlier. Overall volume in the group dropped last year to 1,103 deals at $89.6 billion against 1,347 sales worth $125.9 billion in 2010.

Local authorities followed with a 35.3% decline in total issuance year-over-year in 2011. That translated into a decline to 1,245 deals worth about $60 billion last year versus 1,836 deals at $86.6 billion.

Among the largest of the group of municipalities, counties and parishes saw the biggest decline in issuance from 2011 to 2010, at 43.3%. The group totaled 668 deals worth $16.5 billion in 2011 compared with 1,165 deals worth 29 billion a year earlier.

The number of refundings shrank to a total of 3,892 deals worth $92.6 billion in 2011, compared with 4,174 deals totaling $98.5 billion in 2010. That surprised Priscilla Hancock, an executive director and municipal strategist at JPMorgan Asset Management.

“We did not see as many refundings as we would’ve expected, given the rate environment,” she said. “The level was probably impacted to some extent by the budget paralysis, as well as the fact that advance refundings were hindered by periods of negative arbitrage.”

The largest bond sellers among states almost all did less business in 2011. New York switched positions with California as the country’s biggest issuer, a position the Golden State has held for years. And among the top-five largest states, it saw its issuance business fall the least.

Issuers in New York offered 621 bond deals for $39.3 billion. That’s down 3.1% from the amount it did in 2010, when it issued 741 bonds for $40.5 billion.

Issuers in California did 741 deals for $35.4 billion. New issuance there fell 42% from 2010, when it led all states with 865 issues totaling $61.1 billion.

Rounding out the top five largest issuer states, Texas again ranked third, but saw issuance fall 37% to $23.3 billion from $37 billion. Illinois came in fourth, as it did in 2010. Volume there fell 50.1%, to almost $13 billion from $26 billion.

Pennsylvania placed fifth, switching positions with Florida. Its issuance dropped 32.2%, to $12.8 billion from $18.9 billion.