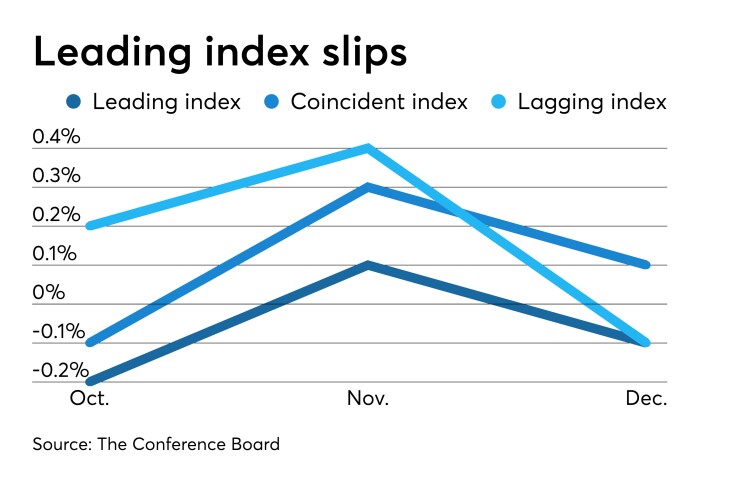

The Leading Economic Index fell 0.3% in December to 111.2, while the coincident index rose 0.1% and the lagging index dipped 0.1%, the Conference Board reported Thursday.

LEI rose a revised 0.1% in November (it was initially reported as flat), and fell 0.2% in October.

Economists polled by IFR Markets expected a 0.2% decline.

The coincident index gained 0.3% in November and dipped 0.1% in October, while the lagging index rose 0.4% in November and 0.2% in October.

The drop was the largest one-month fall since 2016, IFR said. The 111.2 level is “the lowest in 11 months and unchanged from a year earlier, marking the worst 12-month performance in 10 years,” IFR said.

The drop was “driven by large negative contributions from rising unemployment insurance claims and a drop in housing permits,” said Ataman Ozyildirim, senior director of economic research at the Conference Board. “The LEI has now declined in four out of the last five months. Its six-month growth rate turned slightly more negative in the final quarter of 2019, with the manufacturing indicators pointing to continued weakness in the sector. However, financial conditions and consumers’ outlook for the economy remain positive, which should support growth of about 2 percent through early 2020.”

Although the index has been weak, Bank of the West Chief Economist Scott Anderson, said, “our forecast is for real GDP growth to average over 1.5% in the first half of this year, supported by government and consumer spending.”

Separately, initial jobless claims rose to 211,000 on a seasonally adjusted basis in the week ended Jan. 18 from 205,000 a week earlier, the Labor Department said Thursday.

“The continued strength in the U.S. labor market implies consumer spending will continue to grow over the near term,” Anderson said.

Continued claims fell to 1.731 million in the week ended Jan. 11 from 1.768 million a week earlier.

Economists expected 215,000 claims.

The four-week average for initial claims fell to 213,250 from 216,500.

Manufacturing

Manufacturing activity in the Federal Reserve Bank of Kansas City region contracted in January, the Bank said Thursday.

“Regional factory activity was down only slightly in January, and firms reported a modest increase in employment,” said Chad Wilkerson, vice president and economist at the Bank. “Contacts reported slightly less difficulty finding workers than six months ago, but still over 60% of firms were experiencing labor shortages.”

The composite index narrowed to negative 1 from negative 5 in December, while the expectations composite rose to 14 in January from 9.

The production, volume of shipments, volume of new orders, backlog of orders, average workweek and prices received for finished product indexes all remained negative, as did new orders for exports and inventories.

Mortgage rates

Freddie Mac reported 30-year fixed-rate mortgages averaged 3.60% in the week ended Jan. 23, down from 3.65% a week earlier and 4.45% a year ago.

“Rates fell to the lowest level in three months and are about a quarter point above all-time lows,” according to Freddie Mac Chief Economist Sam Khater. “The very low rate environment has clearly had an impact on the housing market as both new construction and home sales have surged in response to the decline in rates, the rebound in the economy and improving financial market sentiment.”