The last of the week's large municipal bond deals came to market on Thursday, led by a $1.5 billion offering from Ohio.

Primary market

Barclays Capital priced the mostly taxable deal for ProMedica Healthcare Obligated Group and Toledo Hospital. The deal included Lucas, County, Ohio’s $251.61 million of tax-exempt Series 2018A hospital revenue bonds.

The tax-exempts were rated Baa1 by Moody’s Investors Service, BBB by S&P Global Ratings and BBB-plus by Fitch Ratings except for the 2042 maturity for $23 million which was insured by Assured Guaranty Municipal and rated A2 by Moody’s and AA by S&P.

Of the taxable portion of the deal, AGM insured $500 million of the 20-year November 2038 bonds.

The tax-exempt proceeds issued through Lucas County will finance the system’s Generations of Care Tower at ProMedica Toledo Hospital and other building and equipment projects.

In the competitive arena, the Clark County School District, Nev., sold $200 million of Series 2018B limited tax general obligation bonds.

Citigroup won the bonds with a true interest cost of 3.8365%.

Proceeds will be used to acquire, construct, improve, and equip the district’s school facilities. The financial advisor was Zions Public Finance and the bond counsel was Sherman & Howard.

The deal is rated A1 by Moody’s Investors Service and A-plus by S&P Global Ratings except for the 2037 and 2038 maturities, which are insured by Assured Guaranty Municipal and rated AA by S&P.

Barclays Capital priced Lucas County, Ohio’s $251.61 million of Series 2018A

RBC Capital Markets priced the Arlington Higher Education Finance Corp.’s $102.71 million of Series 2018 education revenue bonds for Kipp Texas, Inc.

The deal, backed by the Permanent School Fund Guarantee Program, is rated AAA by S&P.

Raymond James & Associates priced Mississippi’s $152.98 million of taxable Series 2018 GOs.

The deal is rated Aa2 by Moody’s and AA by S&P and Fitch Ratings.

Thursday’s bond sales

Ohio

Nevada

Texas

Mississippi

Bond Buyer 30-day visible supply at $5.5B

The Bond Buyer's 30-day visible supply calendar decreased $6.17 billion to $5.50 billion for Thursday. The total is comprised of $3.12 billion of competitive sales and $2.37 billion of negotiated deals.

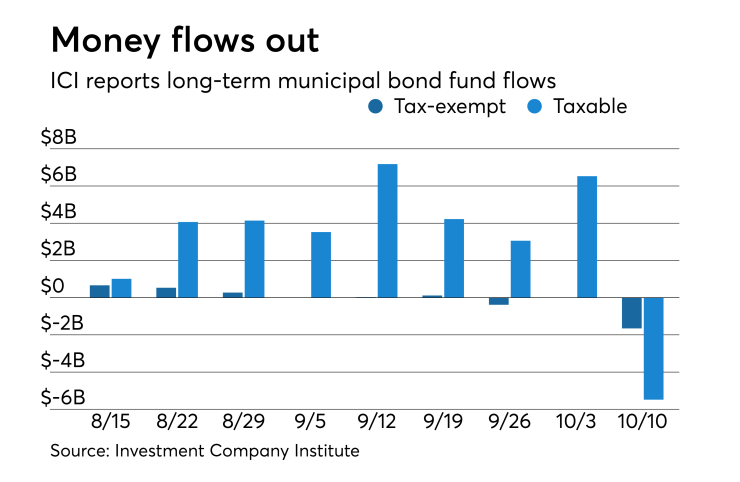

ICI: Long-term muni funds see $1.65B outflow

Long-term tax-exempt municipal bond funds saw an outflow of $1.653 billion in the week ended Oct. 10, the Investment Company Institute reported.

This followed an outflow of $2 million in the week ended Oct. 3 an outflow of $385 million, and inflows of $116 million. $30 million, $4 million, $273 million, $531 million, $662 million, $723 million, and $163 million in the nine prior weeks.

Taxable bond funds saw an estimated outflow of $5.484 billion in the latest reporting week, after seeing an inflow of $6.499 billion in the previous week.

ICI said the total estimated outflows to long-term mutual funds and exchange-traded funds were $11.353 billion after outflows of $72 million in the prior week.

Secondary market

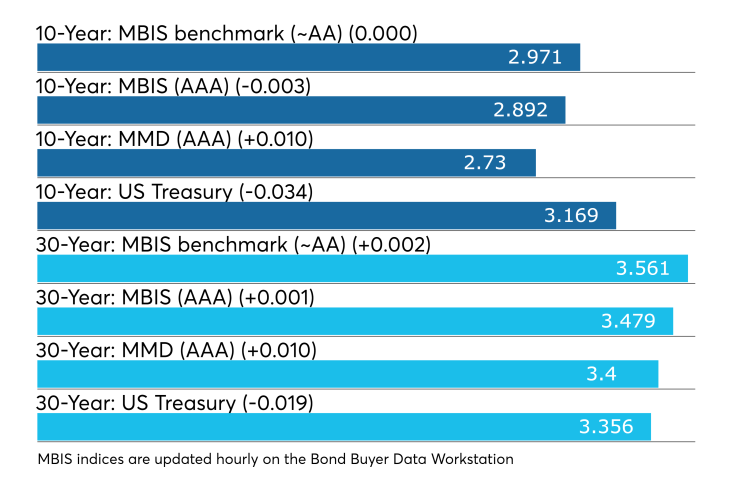

Municipal bonds were little changed on Thursday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell less than one basis point in the 23-year maturity, rose less than a basis point in the one- to seven-year, 11- to 20-year and 26- to 30-year maturities and remained unchanged in eight- to 10-year, 21- and 22-year and 24- and 25-year maturities.

High-grade munis were mixed, with yields calculated on MBIS' AAA scale falling less than one basis point in the seven- to 12-year and 19- to 28-year maturities, rising less than a basis point in the one- to five-year and 13- to 17-year and 30-year maturities and remaining unchanged in six-year, 18-year and 29-year maturities.

Municipals were weaker on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on 30-year muni maturity rising by one basis point.

Treasury bonds were stronger as stocks traded lower.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 86.1% while the 30-year muni-to-Treasury ratio stood at 101.3%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 44,970 trades on Wednesday on volume of $17.75 billion.

New York, California and Texas were the municipalities with the most trades, with the Empire State taking 17.364% of the market, the Golden State taking 15.011% and the Lone Star State taking 9.693%.

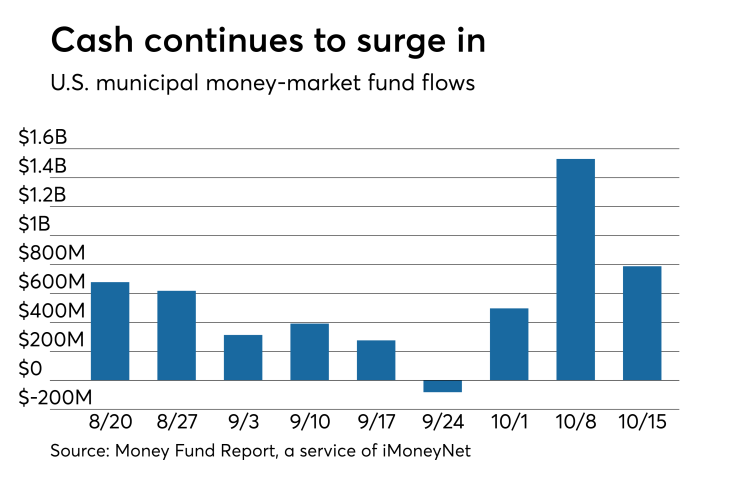

Muni money market funds see inflow

Tax-free municipal money market fund assets increased $788.3 million, raising their total net assets to $133.83 billion in the week ended Oct. 15, according to the Money Fund Report, a service of iMoneyNet.com.

The average seven-day simple yield for the 197 tax-free and municipal money-market funds rose to 1.10% from 1.08% last week.

Taxable money-fund assets decreased $21.63 billion in the week ended Oct. 16, raising total net assets to $2.696 trillion.

The average, seven-day simple yield for the 830 taxable reporting funds increased to 1.77% from 1.75% last week.

Overall, the combined total net assets of the 1,029 reporting money funds fell $20.84 billion to $2.830 trillion in the week ended Oct. 16.

Treasury announces auction details

The Treasury Department announced these auctions:

- $31 billion of seven-year notes selling on Oct. 25;

- $39 billion of five-year notes selling on Oct. 24;

- $38 billion of two-year notes selling on Oct. 23;

- $19 billion of two-year floating rate notes selling on Oct. 24;

- $39 billion of 182-day bills selling on Oct. 22; and

- $45 billion of 91-day bills selling on Oct. 22.

Treasury sells $5B of reopened 30-year TIPS

The Treasury Department Thursday sold $5 billion of inflation-indexed 29-year 4-month bonds at a 1.2354% high yield, an adjusted price of 96.357546, with a 1% coupon. The bid-to-cover ratio was 2.32.

Tenders at the market-clearing yield were allotted 47.98%. Among competitive tenders, the median yield was 1.170% and the low yield was 0.888%, Treasury said.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.