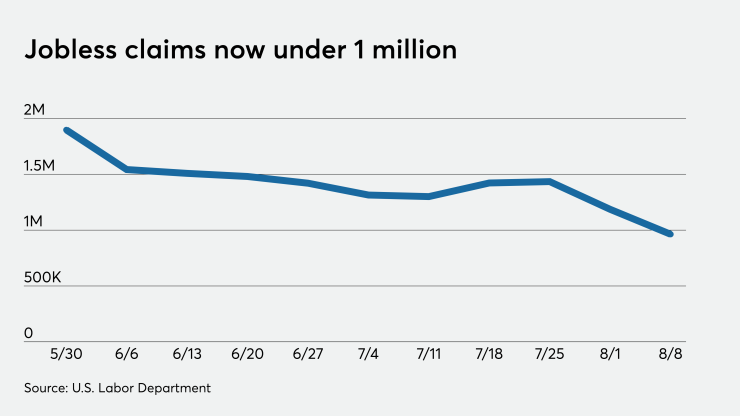

Initial jobless claims numbers beat expectations, coming in under one million for the first time in five months, but analysts see a “bleak” picture for the U.S. labor market.

Initial jobless claims declined to a seasonally adjusted 963,000, in the week ended Aug. 8, from the previous week’s upwardly revised level of 1.339 million, originally reported as 1.337 million, the Labor Department reported Thursday.

Economists polled by IFR Markets projected 1.140 million claims in the week.

Continuing claims fell to 15.486 million on the week ended Aug. 1 from a downwardly revised level of 16.624 million a week earlier, first reported as 16.628 million.

“Initial jobless and continuing claims both came better-than-expected, but still paint a bleak picture for the labor market,” said Ed Moya, senior market analyst at

Moya noted that the latest continuing claims number is the lowest since early April.

“The $600 benefit did go away and that might have disincentivized some people from filing claims,” Moya said. “The total number of people claiming benefits in all programs was 28.3 million Americans, an improvement of 3.06 million from the prior week.”

The states with the largest rise in claims for the week ending Aug. 1 were: Rhode Island (87), while the largest declines were: California (22,610), Virginia (19,048), Texas (14,095), Florida (13,176), and New Jersey (11,489).

“Being relieved that it was ‘only’ 963,000 shows how far the economy has to go before it’s fully healed as well as a stark reminder of how critical it is to extend unemployment benefits,” said Bryce Doty, senior vice president and senior portfolio manager at Sit Fixed Income Advisors.

Mark Hamrick, senior economic analyst at Bankrate has more of a glass half-full view.

"It is certainly welcome news to chalk up two straight weeks of declines in new claims, finally dropping below the one million level ending a devastating 20-week string and the total number of people on unemployment assistance is down to 28 million overall with continuing claims also dropping on the week, while many of the recent COVID-19 hot spot states saw declines in new claims,” Hamrick said.

But Hamrick has concerns about the length of recovery time.

"Thinking back to the early days of the pandemic and the imposition of restrictions, there’s no doubt that the severity of the outbreak has weighed on prospects for a more rapid economic recovery,” Hamrick said. “Even when effective vaccines become available, millions of Americans will still be struggling to put their financial lives back in order. But that time, in 2020 pandemic terms, remains a long way off."

Hamrick added that it is “quite stunning” that Congress has yet to agree on a fresh round of relief legislation with so many Americans hurting financially.

“Even after the president’s controversial and narrowly focused executive orders, the nation’s governors and business interests alike have urged all sides to redouble their efforts to pass meaningful and much needed legislation. That focus should not ease because of slight improvement in still extremely elevated new jobless claims."

Import/Export Prices

Import prices jumped 0.7% in July, after a 1.4% increase in June, the Labor Department reported Thursday.

Economists predicted imports to increase 0.5% month-over-month.

Export prices mover 0.8% higher in July after rising 1.4% the prior month.

Economists estimated exports to increase 0.4%.