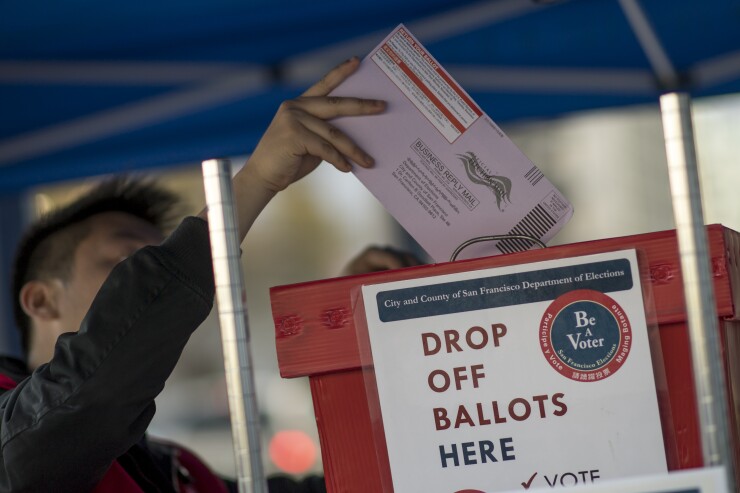

A San Francisco judge ruled against a lawsuit that challenged two tax measures city voters passed last year to fund early education and combat homelessness.

The anti-tax Howard Jarvis Taxpayers Association argued that under California law the measures needed to be approved by two-thirds of voters, not the simple majority achieved. An adverse ruling would have made it more difficult for voters to tax themselves to support programs.

San Francisco Superior Court Judge Ethan Schulman ruled Friday that Proposition C from the

“We’re pleased the court has confirmed that when voters act through the initiative process, a simple majority vote is required,” City Attorney Dennis Herrera said in a statement. “These cases have always been about upholding the will of San Francisco voters.”

Proposition C, a tax on commercial rents, was approved by 51% of voters in June 2018 and is expected to raise $145 million annually for childcare and early education services and salary increases for pre-school educators.

Business groups and anti-tax groups also challenged the “Our City, Our Home,” measure, passed in November to raise more than $300 million annually for housing and homelessness services. Both measures were designated Proposition C on the ballot.

Schulman issued two separate rulings validating the measures.

Herrera had filed a validation action to obtain a ruling on the measure for homelessness services, which imposes an additional tax on businesses with more than $50 million in gross receipts annually. That measure, opposed by business groups and Mayor London Breed, passed with 61% of the vote.

The city argued that because the measures were placed on the ballot through voter signatures, and not by city leaders, they needed only a simple majority to pass. Opponents contended that both measures constituted a “special tax” and should have required two-thirds voter approval.

Judge Schulman cited a similar ruling in the 2017 Supreme Court case California Cannabis Coalition v. City of Upland, which also considered whether voters’ ability to impose taxes via ballot initiatives was also limited. The judge ruled that limits placed on state and local governments’ ability to collect taxes through constitutional changes was not intended to limit voters’ rights.

“This decision to uphold the will of the voters will result in immediate relief for San Francisco’s homelessness crisis,” said the Our City Our Home Coalition in a statement.

State Assemblymember Phil Ting, D-San Francisco