The overall economy grew for the 108th straight time, the Institute for Supply Management reported Tuesday.

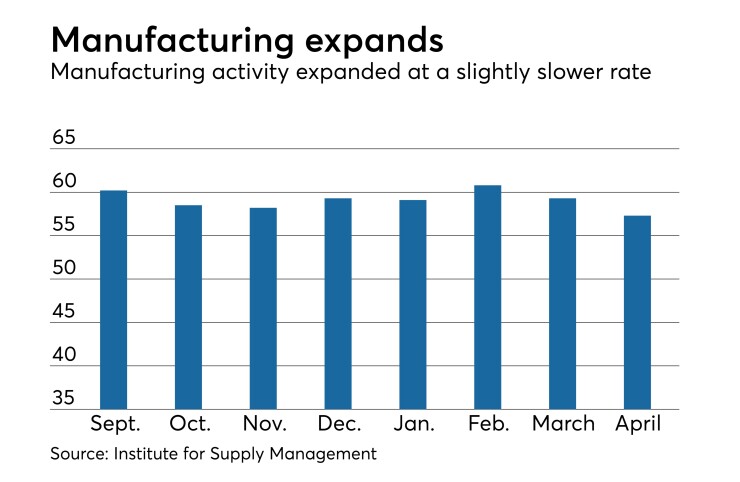

According to the ISM's monthly report on business, the ISM index decreased to 57.3 in April from 59.3 in March.

Economists polled by IFR Markets predicted the index would be 58.4.

An index reading below 50 signals a slowing economy, while a level above 50 suggests expansion. A reading of 50 shows the sector was unchanged in the month.

The prices paid index increased to 79.3 from 78.1, indicating higher raw materials prices for the 26th consecutive month. The employment index fell to 54.2 from 57.3.

The production index slipped to 57.2 from 61.0, the new orders index declined to 61.2 from 61.9; the supplier deliveries index gained to 61.16 from 60.6; the export orders index slid to 57.7 from 58.7; and the imports index dropped to 57.8 from 59.7.

The inventories index fell to 52.9 from 55.5; the customers' inventories index increased to 44.3 from 42.0; and backlog of orders rose to 62.0 from 59.8.

Respondents' comments included:

- “We are seeing strong sales in the U.S., Europe and Asia.” (Chemical Products)

- “Business is off the charts. This is causing many collateral issues: a tightening supply chain market and longer lead times. Subcontractors are trading capacity up, leading to a bidding war for the marginal capacity. Labor remains tight and getting tighter.” (Transportation Equipment)

- “Shortages of trucks and drivers has impacted delivery times.” (Food, Beverage & Tobacco Products)

- “The recent steel tariffs have made it difficult to source material, and we have had to eliminate two products due to availability and cost of raw material.” (Fabricated Metal Products)

- “Demand is up for products. Commodity pricing for steel and other materials increased due to the proposed tariffs. We are seeing commodity futures coming down. A lot of suppliers are asking for increases, and the team is battling those requests.” (Machinery)

- "[The] 232 and 301 tariffs are very concerning. Business planning is at a standstill until they are resolved. Significant amount of manpower [on planning and the like] being expended on these issues.” (Miscellaneous Manufacturing)

- “Production orders at this time are still strong and being driven partially by construction factors and customers purchasing ahead to avoid potential price increases.” (Plastics & Rubber Products)

- “The general outlook for 2018 remains positive and upbeat as we see continued signs of a growing economy and investment in housing and infrastructure.” (Nonmetallic Mineral Products)

- “Business conditions have been good; order book is full and running around 98 percent capacity.” (Primary Metals)

- “Backorders remain strong. New order rate exceeds shipment rate.” (Computer & Electronic Products)