CHICAGO - The Indianapolis Public Improvement Bond Bank this week enters the market with its long-planned restructuring of auction-rate and insured variable-rate water works revenue debt in a $569 million transaction.

The deal - that will end an 18-month-long period of higher market-driven interest costs that drained water department coffers and damaged its credit - could price as soon as Tuesday, but is tentatively set for Wednesday, said bond bank deputy director and general counsel Deron Kintner.

The refunding bonds will mature serially between 2011 and 2024 with term bonds in 2029 and 2038. Morgan Stanley is the senior manager. Crowe Horwath LLP is financial adviser and Ice Miller LLP is bond counsel.

Ahead of the sale, Fitch Ratings downgraded the credit two notches to A-minus and assigned a negative outlook. Moody's Investors Service also lowered the credit two notches to A3 and assigned a negative outlook, while Standard & Poor's affirmed its AA-minus but revised the outlook to negative from stable.

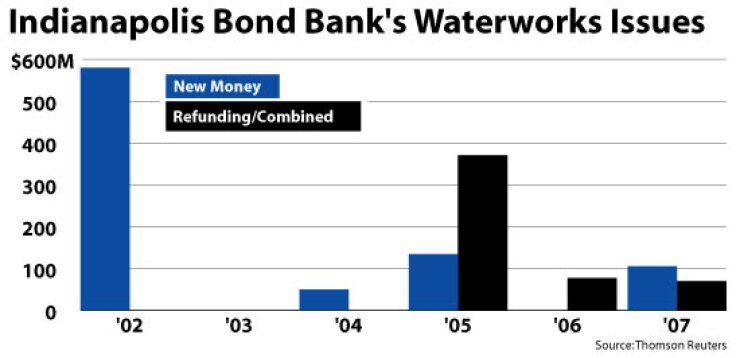

The financing will restructure three previous debt series, which total roughly $488 million, from 2004 and 2005. The final maturity will remain the same as the original debt. The district has a total of $920 million of rated debt outstanding.

Downgrades aside, officials said they were looking forward to resolving the floating-rate mess. "This will provide more stability and certainty for the waterworks department and ratepayers," Kintner said.

The Indianapolis Department of Waterworks covers both Indianapolis and nearly all of Marion County, as well as portions of seven surrounding counties. The utility serves about one million customers. It was created to manage the city's purchase in 2002 of the water system from private operators.

The system's floating-rate problems mirror those other issuers have been grappling with since early last year as the credit crunch disrupted the auction-rate market and insurance downgrades prompted failed remarketings of variable-rate demand bonds.

Skyrocketing liquidity costs and an exodus of providers complicated its restructuring plans, and negative swap valuations, which would lead to costly termination payments, dampened the appeal of converting the debt to a fixed rate.

As the cost of its variable-rate debt rose, the department could not meet required debt service coverage levels and officials were forced to petition Indiana for an emergency rate increase in February.

The system, in an order at the end of June from the rate-setting commission, won a 12.3% increase, short of the 17.6% it requested. At that level, the department's debt service coverage for 2009 is expected to remain below a 1.1 times rate covenant requirement - a key credit issue for analysts.

Earlier this year, the finance team had settled on a refunding plan that involved refinancing each of the three series - all which carried insurance from MBIA Insurance Corp. - individually.

The team intended to leave its $48 million VRDOs in a floating-rate mode, shedding the MBIA insurance and a standby bond purchase agreement with Depfa plc, in favor a letter of credit from Harris Bank NA. That original plan would have allowed the district to leave in place a swap with JPMorgan.

The finance team also planned to refund its $50 million of auction-rate securities series into a fixed-rate mode. The final piece involved refunding a $388 million variable-rate series, shedding Depfa and MBIA, and moving the debt into fixed rate. The bond proceeds were also to be used to cover a swap termination payment.

The bond bank scrapped that plan after Harris withdrew its LOC offer because of a change in company policy regarding the bank's backing of revenue bond deals.

"Ideally, we wanted to avoid the termination payment on the $48 million series, but liquidity just became too expensive and we didn't have a choice," Kintner said. "At the same time, the swap termination costs came down. It was still a tough decision to make but about six weeks ago we decided this was the best course of action."

The bond bank's current estimates put the swap termination payment at about $45 million. The waterworks system has incurred an additional $15 million in interest costs in 2008 and 2009 due to the spike in floating-rate borrowing costs, but Kintner said some of the expense is offset by $6 million in savings achieved in 2005 and 2006 by using the variable-rate structure over a fixed-rate one.

The bond bank is under the gun to act as it faces, early next month, a $22 million payment under an accelerated repayment schedule required by one of its liquidity contracts. The bond bank took out a commercial bank loan to post $14 million in collateral needed as part of an agreement with Depfa to put off the accelerated payment that was set to start early this year.

Standard & Poor's revised its outlook on the credit to negative due to the increased uncertainty as to whether future allowed rate increases will be sufficient to address future costs and maintain debt service coverage ratios commensurate with the current rating level.

Analyst Justin Formas wrote: "Reduced liquidity resulting from rate levels that fail to produce recurring revenues sufficient to cover recurring expenses could also pressure the rating."

Fitch attributed the double-notch downgrade to the "system's severely weakened financial capacity."

Moody's and Fitch analysts also raised concerns over future rate requests, noting that the Indiana Utility Regulatory Commission's order was highly critical of the department's management agreement with Veolia Water Indianapolis LLC, which operates the system under a 20-year agreement struck in 2002. The commission halted a pending payment due to Veolia for past unexpected costs until it can review whether the payment is reasonable.