CHICAGO -Indiana Gov. Mitch Daniels is expected to sign into law today a sweeping overhaul of the state's property tax system - including a new rule requiring voter approval of most local bond issues as well as new limitations on how bonds can be structured.

Lawmakers approved the massive bill last Friday, on the last day of a three-month session that was dominated by debates over property tax and local spending reforms. The new statute follows closely the original proposal put forth by Daniels in mid-2007 after rising protests from homeowners whose tax bills doubled and sometimes tripled in one year.

Under one key amendment to the original bill, lawmakers agreed to take over all cities and towns' pre-1977 police and fire pension obligations - a move that comes just as several larger cities were moving to increase their levies to pay for the obligations. That measure also means that Indianapolis' long-planned $450 million pension obligation bonds will no longer be necessary.

"This is at least injecting some certainty into the market," said Michael Claytor, an executive with Crowe Chizek & Co., which acts as financial adviser to several cities in the state, including Indianapolis and Fort Wayne. "With the proposed changes that were flying around back and forth, there was an awful lot of uncertainty in the Indiana bond market. It's taken a little more work to market bond issues in Indiana because of those issues. Even if this does change the game and make it more difficult or limit [issuance] for local units, there's also more certainty in the market now."

At the center of the new law is a series of so-called circuit breakers, or property tax caps. They cap a homeowner's tax bill at no more than 1.5% of the assessed value of the house through 2009 and 1% after 2010, rental property bills at 2.5% through 2009 and 2% after 2010, and commercial bills at 3.5% through 2009 and 3% after 2010.

Those circuit-breakers will lead to an estimated decrease in property tax revenue of $1 billion annually across the state.

To replace the loss in revenue, Indiana will raise its sales tax beginning in April to 7% from 6% - generating an estimated $620 million in 2008 - and impose new casino licensing fees at the state's two horse tracks, estimated to raise $250 million this year.

To offset the loss in revenue for governments - which have emerged as the most vocal opponents to the new legislation, warning of future devastating revenue drops and an inability to issue new debt - the new law allows local governments to raise their income taxes by 1.25% to compensate for the loss in property tax revenue.

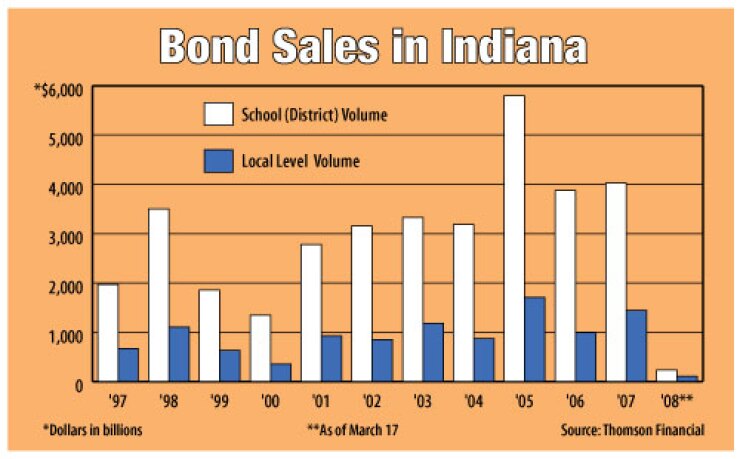

The biggest impact of the new law on the bond market likely will be the measure requiring voter approval on most new bond issues. Under the law, the state's current petition remonstrance process for new bond projects will be replaced with a referendum for all government capital projects that will cost more than $12 million, or more than 1% of the unit's total assessed value, as well as for all high school projects that will cost more than $20 million, or for elementary and middle school projects that will cost more than $10 million.

"It does certainly changes the dynamic," Claytor said, adding that it's too early to predict whether the referendum will mean a direct hit to issuance volume. "The knee-jerk reaction is to believe there will be less issuance, but that remains to be seen."

The impact is likely to vary from region to region, depending in part on an area's economy and population growth.

"The referendum is certainly a more formal process than [the current petition remonstrance process]," said James Merten of City Securities Corp. "I'm sure some communities will clearly support projects because they're growing, but for others it's going to be a hard sell."

Other important measures include a 20-year cap on final maturities - 25 years for bonds linked to tax increment financing revenue - and a requirement that debt service include regular and level principal and interest payments over the life of the bonds. The law makes an exception for bonds that are linked to a growing revenue stream.

Merten said the 20-year maturity cap "is going to affect everyone. When you have a 20-year limit on maturity, if you build a high school and it takes 30 or 36 months, then you only have 17 years left for payments, and that means higher payments and more of a tax impact because of the higher payments."

The new law also includes some advantages for bondholders, including a new requirement that a local government facing revenue loss must first make its bond payments. As well, the so-called intercept mechanism that currently allows schools to turn to the state treasurer to make debt service payments if the district is unable to do so is now expanded to include local units of government.

"The state can't guarantee the debt, but [the treasurer] is standing right there willing to help," Merten said. "That I believe will have a very favorable impact on the ratings of cities and towns."

Meanwhile, the law restricts debt refinancing, mandating that bonds can only be refunded if there is a savings, and not for restructuring purposes where final maturities are pushed out. Savings from refundings must be used to repay those bonds or reduce levies instead of being used to launch new projects. In addition, all bond issues - not just those greater than $3 million, as under current law - will be subject to approval by the jurisdiction's local legislative body.

While local governments and schools face significant revenue decline under the new law, proponents say that the legislation includes several tools to help financially troubled municipalities. In addition to the ability to raise local income taxes, local governments can appeal for relief to a newly created Distressed Unit Appeal Board if they have lost more than 5% of their budget under the new law.

"This has been one of the toughest problems I've seen in my years in the General Assembly," Rep. Jeff Espich said Friday as the House prepared to vote on the measure. "I expect local community leaders to take tough leadership roles to find solutions to problems, and we've given them tools in this bill to find the solutions to those problems."

Indiana also agreed to take over several local levies under the new law, including the local schools general and transportation funds, child welfare funds, and indigent health care. The state, which currently pays 50% of pre-1977 police and fire pensions, agreed to take over the full remaining liability to provide relief for local municipalities, many of which were gearing up to increase taxes or bond out the growing liabilities.

Local counties' pension liabilities total $90 million a year, while school pension payments come to around $130 million, according to the Legislative Services Agency. The state pension obligation takeover was claimed as a victory by new Indianapolis Mayor Greg Ballard, who had delayed issuing a long-planned $450 million pension obligation bond issue while he lobbied state lawmakers to take over the obligation. However, city officials said recently the new law would in a revenue loss of $11 million in 2009 and $39 million in 2010.