Illinois will offer more than $2 billion of cash flow notes and bonds in May, state budget officials said Tuesday.

The state is targeting May 5 for the competitive sale of $1.2 billion of general obligation certificates and May 12 for the negotiated sale of $1 billion of bonds, including $700 million of tax-exempt paper and $300 million of taxable debt.

“We will definitely be flexible to move the date out (or to day-to-day) as the market conditions warrant our entering,” state finance spokeswoman Carole Knowles said in an email providing details on the planned transactions. “The size, timing, and structure of the anticipated transactions remain subject to market conditions.”

Proceeds of the note issue will provide a cash-flow infusion and help the state “bridge through the unprecedented COVID-19 crisis and the resulting delay in final income tax payments and maintain strong liquidity,” the administration said.

Gov. J.B. Pritzker announced the state would sell notes in May when he released revised revenue estimates earlier this month that projected a $2.7 billion revenue gap in the fiscal year that runs through June 30 and a $4.6 billion shortage in fiscal 2021. The notes will cover the delay in income tax revenue expected from extending the April filing deadline to July to coincide with the federal filing extension.

With the state’s bill backlog tab at $7.3 billion and warnings that it will grow as vouchers pile up and revenues slow, the infusion of cash will help temper its growth. Rating agencies watch the number closely to gage the state's liquidity.

The certificates, which must be repaid in the next fiscal year, are allowed under the state’s Short-Term Borrowing Act when revenues fall short of formal estimates and only the state treasurer and comptroller must join the governor’s Office of Management and Budget in approving the issuance. State borrowing rules would have complicated use of the Federal Reserve's new short-term borrowing tool.

The state will tap a portion of $1 billion in previously approved pension-buyout bonding authority for the taxable piece of the bond sale. The tax-exempt paper “will fund the summer construction season and keep priority facility maintenance projects moving forward,” the administration said.

BofA Securities will serve as bookrunning senior manager, with Goldman Sachs, Loop Capital Markets, Ramirez & Co., and RBC Capital Markets serving as co-senior managers. The syndicate is rounded out with co-managers Academy Securities, Estrada Hinojosa & Co., Huntington HSE, Melvin Securities, and Stern Brothers & Co.

Chapman and Cutler LLP and Charity & Associates PC are co-bond counsel on the bond sale. Mayer Brown LLP is serving as underwriters' counsel. Acacia Financial Group and Swap Financial Group are advising the state.

Chapman and Burke Burns & Pinelli are co-bond counsel for the certificates and Public Resources Advisory Group is advising on that sale.

Moody’s Investors Service affirmed the state’s Baa3 rating and negative outlook Monday and S&P Global Ratings affirmed the state’s BBB-minus rating and negative outlook Tuesday. Fitch Ratings also affirmed the state's BBB-minus rating and negative outlook Tuesday. Fitch recently downgraded the state one notch to BBB-minus from BBB and assigned a negative outlook. Moody’s and S&P moved the state’s outlook to negative from stable over the last month due to strains of managing through the COVID-19 pandemic.

Pritzker issued a stay-at-home order closing all non-essential business last month and recently extended it through May. The state announced 2,219 new cases Tuesday bringing the total positive cases to 48,102. That includes 2,125 deaths.

The state is heading into the market with headwinds from both its rating hits and comments from Senate Majority Leader Mitch McConnell that bankruptcy should be an option for states, like Illinois, grappling with big pension burdens. President Trump has offered mixed messages on further relief for cities and states. The Coronavirus Aid, Relief, and Economic Security package, signed March 27, provides funds to states to cover costs related to the coronavirus, but not tax revenue losses.

While the cash flow borrowing and other one-time measures will address the 2020 gap, Pritzker is lobbying for further federal aid and has said he’s working with lawmakers on plans to address the gap in the proposed fiscal 2021 budget.

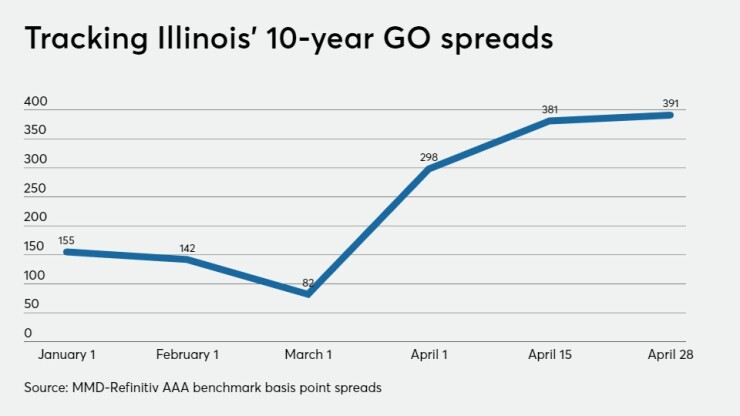

The state’s 10-year bond remains at the peak level of a 391 basis point spread to the Municipal Market Data’s AAA benchmark at 1.28%. It hit the peak last Thursday when it rose from a 381 bp spread.

The yield of 5.19% on the 10-year represents a 249 basis point spread to the BBB benchmark of 2.49% where Illinois is rated, underscoring the market’s position that the state is now entrenched in high-yield territory.

Some trades have topped a 400 bp spread, said Ed Lee, strategist at IHS Markit. A 2026 bond traded late last week at a 404 bp spread compared to a prior trade of 346 bps and a 2027 bond traded at a 409 bp spread compared to a prior spread of 350. Even the higher-rated state sales tax bonds are trading in high-yield territory with recent trades at spreads of between 272 basis points and 297 bps.