Illinois' $700 million general obligation issue drew healthy interest from bidders Wednesday but the state saw spreads widen as

The competitive deal came in three series, each bid separately, with a taxable series for $175 million maturing in 2029 won by BofA Securities from among nine bids with a final true interest cost of 5.78%.

A second series for $245 million of tax-exempt paper maturing in 2037 received nine bids with BofA Securities submitting the low bid with a true interest cost of 5.01%. Wells Fargo Bank NA offered the low bid among eight received with a TIC of 5.44% for a third series of $280 million of tax-exempt paper maturing in 2047.

"Amid the backdrop of global market volatility, the state of Illinois appreciates receiving many aggressive and relatively tight competitive bids to support our Rebuild Illinois capital and pension acceleration programs," Paul Chatalas, state capital markets director, said in a statement.

State law requires 25% of all issuance during the year be sold competitive, which in practice the first deal of the fiscal year is sold at auction. Most major firms participate to stay in favor when the state compiles teams for its negotiated sales.

About $138 million of the taxable series will fund the state's ongoing pension buyout programs aimed at reducing unfunded liabilities. State lawmakers earlier this year raised the original authorization to $2 billion from $1 billion and extended the program through 2026. About $850 million remains after Wednesday's sale.

The remainder of this week's bond proceeds will finance capital work.

The 10-year in the deal offered a yield of 4.80%, a 152 basis point spread to Municipal Market Data's AAA benchmark, while the long, 25-year maturity paid a 5.50% yield, a 168 bp spread. The maturities had 5% coupons.

BBB benchmark rates Wednesday were at 4.17% and 4.81% on the 10 and 25-year, respectively. Illinois carries ratings of BBB-plus from Fitch Ratings and S&P Global Ratings and Baa1 from Moody's Investors Service, with stable outlooks.

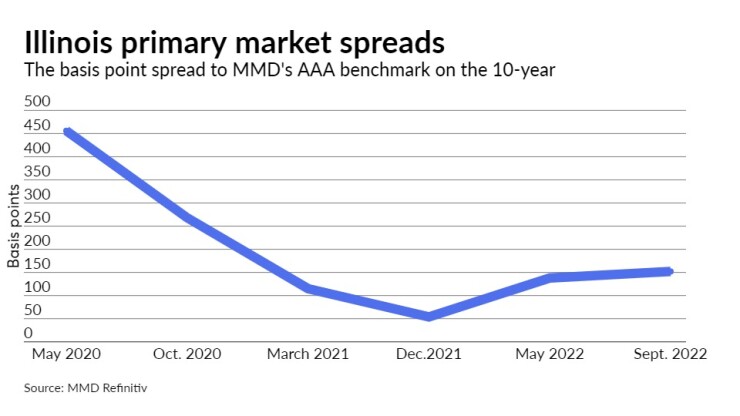

The state spreads also landed wide compared to a May sale and sales in 2021, as other borrowers also have seen, but remained far narrower than those seen early in the pandemic and during the state's two-year budget impasse that ended in 2017.

Market participants said the spreads were in line with expectations given ongoing market volatility and rising rates, healthier supply levels this week, the deal's size, and concessions offered on other deals. The state's spring upgrades also were viewed as holding the spread penalties from even further widening.

"I thought the deal was bid well and didn't offer too much concession from recent trading," and that's "because the gross yields have backed up so much in 2022 with four and five percent handles in yield" that are attractive for buyers, said Peter Franks, director of market analysis at Refinitiv. "There's so much uncertainty. None of the news is that good."

Some concession could be expected due to the deal's size and the Illinois name which, despite a

The 10-year and 25-year with 5% coupons in the

Before this year's long run of big municipal

A prior March 2021 deal saw a 115/110 bp spread on the 10 and 25 year bonds.

The state's spreads hit a high of 456/400 on 10 and 25 year maturities with coupons of 5.5% and 5.75% in a May 2020 deal as investors worried that the COVID-19 pandemic could sink the state's then BBB-minus/Baa3 ratings into junk territory.

The state saw some recovery in a sale late in October 2020 with spreads at 268 bps on the 10-year and 271 bps, with a 4.25% coupon, on the 25-year.

The state headed into market Wednesday with its 10-year previously set based on secondary market trading at a 133 bp spread, up from 63 bps at the start of the year.

Wednesday saw

"On the news the rates markets rallied and the stock market saw green for the first time in a long while. Munis in typical muni fashion slightly firmed up but did not follow and the new issue markets priced to clear, not stock," Refinitiv said in its market close commentary.

Illinois' top fiscal managers last week

The state paid billions off in overdue bills, bolstered its barren rainy day fund