CHICAGO — The Art Institute of Chicago received final approval from the Illinois Finance Authority board yesterday for a debt refunding this spring of up to $245 million that will allow the prestigious museum to shed its floating-rate risks.

The Art Institute plans to current refund its existing variable-rate demand bonds, eliminating its current credit enhancement, in favor of a fixed-rate structure and an intermediate term bond structure.

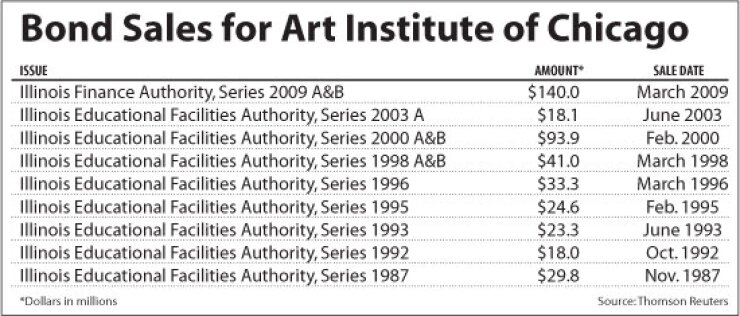

The bonds being refunded were sold in 1992, 1995, 1996, 1998, 2000, and 2009. The 2009 variable-rate bonds will be converted to annual put bonds.

The debt will be secured solely by a general pledge of the institute and not by a pledge of any real assets, a lien, or a security interest in the institute’s collection, according to IFA documents. The museum carries current ratings of A1 from Moody’s Investors Service and A-plus from Standard & Poor’s.

JPMorgan is the senior manager and Loop Capital Markets LLC is co-senior manager on the fixed-rate bonds. Morgan Stanley is senior manager on a term bond series. The institute is working with Prager Sealy & Co. as financial adviser. Orrick Herrington & Sutcliffe LLP is bond counsel.

The original bonds financed various museum and school building renovations, gallery renovations, equipment and art object purchases, the acquisition and renovation of a school facility, and the renovation of the museum’s Ryerson/Burnham Libraries.

Its 2009 bonds financed the acquisition, construction, furnishing, and equipping of the new modern wing and gallery reinstallation renovations.

The downtown Chicago museum’s permanent collection contains 260,000 works of art, including paintings, sculpture, prints, drawings, photographs, decorative arts, and textiles. It claims to hold one of the finest collections of French Impressionism outside of Paris, one of the best collections of 19th century prints and drawings, and a leading collection of Chinese bronzes and jades.

The museum had more than 1.5 million visitors last year, up from 1.4 million in 2008, and has a membership of 88,810. It also operates a prestigious art school with 3,000 students.

Meanwhile, the National Opinion Research Center received final approval for its private placement this spring of up to $4.4 million of five-year bonds to finance upgrades and renovations at its facilities, including improvements in its computing equipment.

NORC operates facilities in downtown Chicago, on the University of Chicago campus, and in the District of Columbia. The organization has been affiliated with the university for more than five decades. The nonprofit has pioneered studies in health, education, labor, mental health, housing, and alcohol and drug abuse. Its clients include government agencies, educational institutions, foundations, and private corporations.

JPMorgan Chase Bank will purchase the bonds. Chapman and Cutler LLP is bond counsel.

The Poetry Foundation — which received final approval to sell up to $25 million from the IFA board last month — received a first-time rating of A1 from Moody’s. The fixed-rate borrowing scheduled for next week will finance the foundation’s acquisition and renovation of a new downtown administrative headquarters that will have performance space and also house its archives and collections, which are currently on display at the Newberry Library in Chicago.

William Blair & Co. is the underwriter. Perkins Coie LLP is bond counsel.

The foundation benefits from a strong financial cushion of $169 million in total resources, including $132 million that is unrestricted, and its niche position as publisher of Poetry magazine. The foundation received five trusts totaling $118 million through last December, and expects to receive another $56 million from the estate of deceased benefactor Ruth Lilly.

Its challenges include its reliance on investment income to support operations and the expected increase in operational expenses with the opening of its new building.

The foundation was established in 1912 with the founding of the magazine, the oldest monthly magazine “devoted to verse in the English-speaking world, with a high-quality reputation reinforced by its noted publications of first important poems of now-classic poets,” Moody’s wrote.