WASHINGTON - Could the District of Columbia's $350 million general obligation bond sale in late-August be the last time it sells GO debt?

That might be the case if the District Council approves a bill that would allow the issuance of bonds backed by income taxes, city finance officials said late last week.

"If the income tax bonds are approved, then we would plan to offer them in the fall, in lieu of general obligation bonds," Marcy Edwards, senior financial policy adviser for the office of the chief financial officer, said last week. "I think every time we need to raise money in the capital markets for things that we would otherwise do as a GO, we would sit down and say, 'OK, what is more advantageous to us?' If the ratings on the income tax bonds are higher than the GOs, it may behoove us to issue just the income tax bonds."

District Council member Jack Evans introduced the legislation, at CFO Natwar Gandhi's request, that would allow the district to issue income tax bonds as an alternative to general obligation bonds in an attempt to achieve higher bond ratings and a lower cost of borrowing.

The district's GOs are backed by real property taxes and are rated A1 by Moody's Investors Service and A-plus by both Standard & Poor's and Fitch Ratings.

Ruth Werner, legislative analyst for Evans, said the District Council's Finance Committee referred the bill on Thursday to be considered by the full council on July 1. Evans chairs the committee.

Edwards and other sources have indicated they expect it to pass.

When the bill was announced, district Treasurer Lasana Mack said that he thinks the city can achieve debt service savings and get higher ratings on the income tax bonds.

Other municipalities have issued bonds backed by income taxes, including New York City and New York State. The Empire State Development Corp. was able to obtain a AAA rating from Standard & Poor's for $310 million of personal income tax bonds it issued in October 2007.

Standard & Poor's analysts in mid-June said that depending on how the district's bonds would be structured that it could achieve that higher rating.

Moody'sanalyst Nick Samuels said whether the income tax-backed bonds would get higher ratings depends on the legal structure of the deal and the strength of the district's personal income taxes over a certain period of time.

Pauline Schneider, a partner at Orrick Herrington & Sutcliffe LLP, the district's bond counsel, earlier this month said that income tax bonds may be "a better source of security" for the district because a "substantial" portion of property is owned by the federal government or nonprofit organizations and therefore does not provide general property tax revenues for the local government.

The income tax bonds also would create a new District of Columbia credit for investors to consider for diversifying their portfolios.

Proceeds of the new-money GO deal set for late summer will finance library projects, government buildings, the district's subsidy to the Washington Metropolitan Area Transit Authority, known as Metro, and for various other economic development projects.

Edwards said the district is in the beginning phase of preparing for the $345 million to $350 million negotiated sale slated for late August.

"We expect it to be pretty plain vanilla - level debt service, 25-year bonds," she said. "That's subject to change, depending on investor demand."

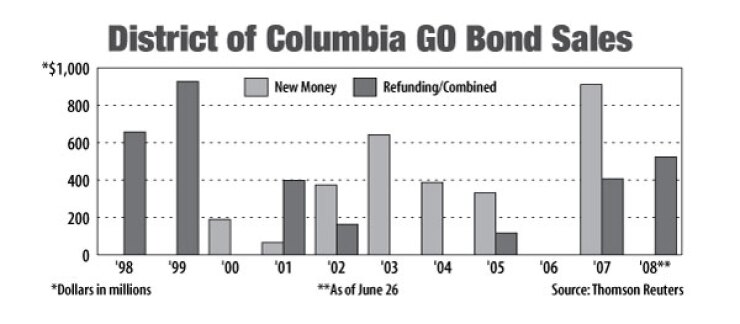

Edwards also said depending on market conditions that the district may also refund about $150 million of Series 1998 GOs.

"We always look for opportunities to refund bonds if it is economically advantageous," Edwards said. "Depending on market conditions, we would add another $150 million to this bond sale."

Public Resources Advisory Group and Phoenix Capital Partners are financial advisers on the deal.

The new-money portion of the sale will be led by Merrill Lynch & Co. Co-seniors underwriters will be Citi andSiebert Brandford Shank & Co. Co-managers on the deal will be Goldman, Sachs & Co., JPMorgan, Banc of America Securities LLC, and M.R. Beal & Co., Edwards said.

"Generally, our policy is to do things competitively whenever possible," Edwards said, but finance officials "looked at market conditions and given the uncertainty that's continued in the market since last year, we determined that it would probably be in our best interest to have the flexibility that you get when you do a negotiated sale."

Edwards said the fixed-rate bonds will be insured and that officials will be seeking bids from insurers in the coming weeks.

Edwards said the senior manager on the refunding bonds would be Siebert Brandford Shank and co-seniors would be Raymond James & Associates Inc. and Merrill Lynch. Co-managers on the deal would be Morgan Stanley, Wachovia NA and Loop Capital Markets LLC.

Squire, Sanders & Dempsey LLP will be bond counsel. Disclosure counsel is Hawkins, Delafield & Wood LLP. Underwriters counsel will be Orrick Herrington; Hogan & Hartson LLP; Lewis, Munday, Harrell & Chambliss; and MacKenzie & Associates.