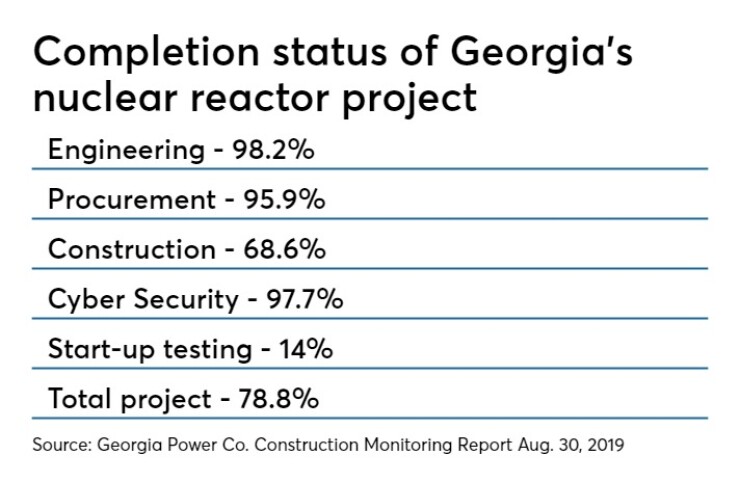

Georgia Power Co. says construction of two nuclear reactors at Plant Vogtle has met all milestones over the last year and a half, and that the project is nearly 79% complete.

That’s timely news for MEAG Power, which could issue $725 million of bonds as early as next week to fund a portion of its ownership stake in the project.

Georgia Power, which owns 45.7% of the project and is heading up construction, updated its status in a

“The target in-service dates remain unchanged, with approved commercial operation dates of November 2021 for Unit 3 and November 2022 for Unit 4,” the report said. “There were no changes to the cost forecast.”

MEAG, also known as the Municipal Electric Authority of Georgia, also notified its bondholders of the latest construction report

Delays and soaring costs almost derailed the project's development in September 2018 because of a $2.2 billion jump over eight months in the estimated cost to complete the reactors. Similar problems led to the abandonment of a nuclear reactor project across the border in South Carolina using the same technology.

In Georgia, the three municipal power agencies with ownership stakes voted to continue work on the reactors after reaching a deal in which Georgia Power agreed to take on more financial responsibility for construction costs.

In 2018 and in the first half of 2019, the project met all major milestones, and the first nuclear fuel load was ordered for Unit 3, marking the first nuclear fuel order to be placed in more than 30 years for a newly designed reactor in the U.S., Georgia Power officials said in a release.

Georgia’s reactors are using Westinghouse’s new AP1000 reactor design. Unlike reactors that are primarily dependent on electricity to power water cooling facilities, AP1000 technology relies on passive safety systems such as gravity, natural circulation, convection, compressed gas, and condensation to maintain safe operations and shut down procedures.

The same reactor design was being built in South Carolina at the V.C. Summer Nuclear Generating Station. Both projects

In Friday’s construction report, Georgia Power said that some of its projections for the new Vogtle units are dependent on “potential lessons learned from the Chinese AP1000 projects.”

The fourth Chinese AP1000 reactor entered commercial operation in January.

Dan Aschenbach, a partner at the public finance and clean energy investment consulting firm AGVP Advisory, said

“Since the last report no changes were made to the completion schedule with the commercial dates of November 2021 and November 2022 for Unit 3 and Unit 4, respectively,” he wrote. “The project remains in the green status in the Nuclear Regulatory Commission Construction Reactor Oversight Process.”

Aschenbach also said the objective of the project’s owners was the development of the nuclear generation to diversify their resource mix providing a hedge against the impact of carbon costs and fossil fuel cost volatility. “Whether the progress here sets the stage for other new nuclear projects remains to be seen,” he added.

Completing Units 3 and 4, Georgia Power said in its report, is critical to its “energy mix and remains in the best interests” of its customers, enabling the utility to deliver reliable and economical power in the decades ahead.

“Upon completion, Vogtle Units 3 and 4 will be an asset to Georgia Power, its customers, the state, and the nation for 60 or more years,” the report said. “The project remains the most important infrastructure project currently underway in Georgia, providing over 8,000 construction jobs and approximately 800 permanent careers once complete.”

The Public Service Commission will post a schedule for the upcoming review process in which the commission will hear from Georgia Power and staff will make recommendations regarding its review of the Vogtle Construction Monitoring (VCM) report, said commission spokesman Tom Krause.

“The commissioners will review staff’s recommendations and must ultimately approve a VCM in a public hearing,” he said.

Plant Vogtle is in Waynesboro, Georgia, about 130 miles west of Charleston, South Carolina. On Wednesday the eastern Atlantic coast from north Florida to North Carolina was under a warning for Hurricane Dorian, whose maximum sustained winds were 105 miles per hour — down from 185 mph when it pummeled the low-lying Bahamas over Labor Day weekend.

Although Dorian was projected to skirt Georgia’s coast, its hurricane-force winds extended outward up to 60 miles and tropical-storm-force winds extended out to 175 miles, according to the National Hurricane Center, raising questions about whether the new nuclear plant could withstand winds from a large storm such as Dorian.

Georgia Power said that the Vogtle work site is operating on a normal schedule this week.

"Storm impacts at the site, which is more than 100 miles from the coast, are expected to be minimal, with winds expected to be less than 25 mph over the next couple of days," the company said in a statement to The Bond Buyer Wednesday. "Teams have conducted walk downs of the construction site to identify and secure potential hazards that could result from any high winds that may occur."

Krause, the PSC spokesman, said he recently visited the Vogtle site.

“The containment unit is built to specifications that would allow a 737 jet to hit it without causing a breach,” Krause said he was told. “A hurricane, even a strong one, isn’t going to do damage to the units.”

Krause also said that Georgia Power has storm readiness procedures in place that are monitored by the PSC.

Georgia Power’s cost to build the two new reactors at Vogtle is projected at $8.4 billion, although the company said it is “not seeking approval of costs above the previously approved $7.3 billion.” The estimated remaining capital spending to complete the project is about $2.8 billion.

Those estimates don’t include costs to be paid by the nonprofit Oglethorpe Power Corp., which has a 30% ownership share, MEAG with 22.7%, and the city of Dalton, Georgia, with 1.6%.

Next week, MEAG is expected to enter the bond market to finance a portion of its costs for two special-purpose, limited liability companies it organized as special financing vehicles to transfer various percentages of its ownership interest in the project.

MEAG will issue about $450 million of bonds for Project M, in which 29 of its members have court-validated take-or-pay contracts for 33.9% of MEAG’s ownership interest.

Another $275 million of Plant Vogtle bonds will be issued for Project P in which MEAG has a take-or-pay contract for 41.2% of its ownership interest with PowerSouth Energy Cooperative in Andalusia, Alabama. PowerSouth provides wholesale power to 16 electric cooperatives and four municipal electric systems in Alabama and northwest Florida.

Fitch Ratings assigned a BBB-plus rating with a negative outlook to both the Project M and P bonds; Moody's Investors Service has given the Project M bonds an A2 rating and the Project P bonds a Baa2 rating, both with stable outlooks; and S&P Global Ratings assigned an A rating to the Project M bonds and BBB-plus to the Project P bonds, both with negative outlooks.

In July, MEAG closed on the limited offering of tax-exempt serial and term bonds that raised $619 million, including $48.14 million in premiums, to finance a portion of the reactors’ cost related to its Project J contract.

The court-validated contract debt will be paid through a power purchase agreement between MEAG and northeast Florida’s JEA, formerly the Jacksonville Electric Authority. JEA and the city have filed a lawsuit challenging the legality of the agreement.

“We thought given the complexity of this situation we’d take this route with investors who knew the situation best rather than have a full open [bond] market process,” Edward E. Easterlin, MEAG’s senior vice president and chief financial officer, said in July after the limited offering had closed.

Easterlin said the bond proceeds are expected to conclude financing for Project J, in which 22.7% of its ownership interest in the reactor was transferred to JEA.

The unrated 40-year bond issue, sold in the par amount of $571 million, was purchased by sophisticated institutional buyers familiar with the legal dispute between the two public power agencies, according to Easterlin.

On Aug. 28, Fitch gave the Project J debt a BBB-plus rating and kept the special purpose vehicle on rating watch negative; Moody’s assigned a Baa3 rating and negative outlook; and S&P gave the Project J bonds an A rating and negative outlook.

While JEA is still pursuing litigation, both utilities said settlement discussions are underway.

JEA has also begun a process to determine if there are buyers interested in purchasing the Jacksonville-based municipal utility.