LOS ANGELES — Spurred by fourth-quarter sales growth, Far West issuers sold $90.7 billion of municipal bonds in 2016, an 8.5% increase over the prior year.

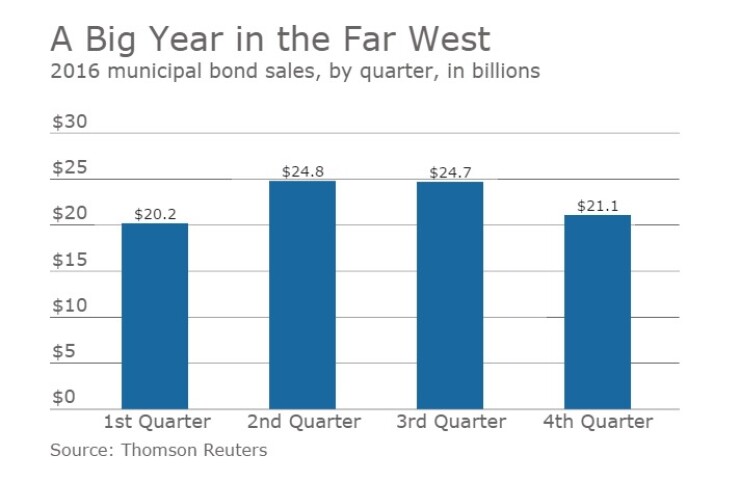

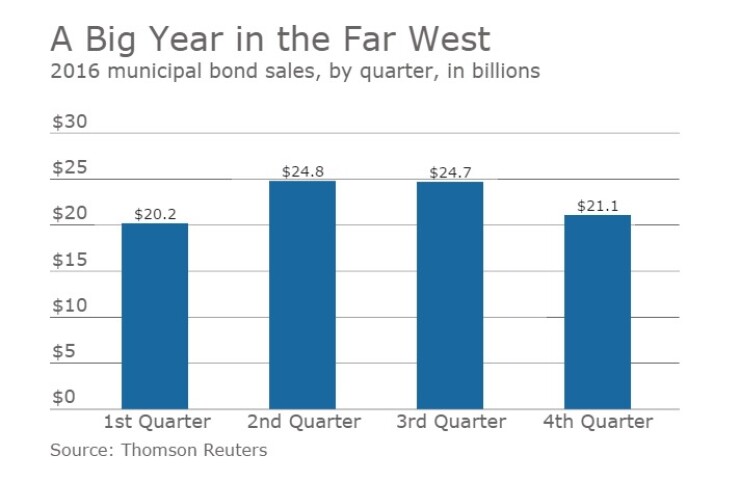

The volume of sales in the nine-state region was highest in the second and third quarters at $24.8 billion and $24.7 billion, respectively; but the fourth quarter experienced the greatest year-over-year growth of 38.8% to $21.1 billion, according to Thomson Reuters data.

"Some of the quarterly trends can be explained by issuers responding to the uncertainty generated by the November election and moving sales forward to Q4 that may have been originally scheduled for 2017," said Tom Schuette, partner and co-head of portfolio management at Gurtin Fixed Income Management.

As people grew more concerned about what Schuette called Trumpflation, he said "there may have been some aggressive issuers pulling refundings and other sales forward into the last two months of 2016."

Trump's campaign promises regarding pulling out of trade deals, potential trade tariffs, aggressive corporate/personal tax rate reductions and significant infrastructure spending would all have significant inflationary impacts, Schuette said.

Though inflationary fears have tempered considerably, he said, the media attention given to inflation and the potential impact on rates in the fourth quarter could have caused concern for issuers.

Refundings remained significant at $38.9 billion, but growth in the sector slowed to 2.3%. Growth in new money issuance rose 5.5% to $24.4 billion and deals Thomson Reuters defined as combined new money and refunding were up 22% $27.4 billion.

Far West volume of $90.7 billion trailed only the Northeast, where issuers sold $116.5 billion in 2016.

California, responsible for more than two-thirds of the region's issuance at $65 billion, was up 20%.

The state experienced an even larger fourth quarter boost than the region, with its volume up 63.4% compared to a year earlier, to $16 billion.

The state as a whole saw new money volume rise 23.5% to $16.8 billion while refundings grew 3.7% to $27.9 billion. Combined sales rose 48.1% to $20.2 billion.

California state government issuance was up 40% to $8.9 billion in 13 issuances. Of that, $6.3 billion was refunding and $2.5 billion was new money, said Tim Schaefer, California deputy treasurer for public finance.

Sales were split evenly with $4.4 billion in the spring and $4.5 billion in the fall, Schaefer said.

The deputy treasurer attributed part of the growth in sales volume to a $600 million to $700 million increase in new money requests during the second half.

The $2.5 billion in new money issuance is roughly the state's annual average, so refundings were again the biggest factor in the state's sales, Schaefer said.

The state government did primarily current refundings during the first half and advance refundings during the second half, he said.

"We are generally reluctant to do advance refundings and we try not to be market timers, but there were advance refundings that we saw we could take advantage of," Schaefer said.

While the state was mindful of anticipated interest rate increases promised by the Federal Reserve, he said, the election did not factor into Golden State officials' thinking.

"We make a conscious effort to try not to speculate about the outcome of things that are beyond our control or ability to forecast," Schaefer said.

In 2017, he said, the two 800-pound gorillas will be bond issuance for high speed rail and K-12 school bonds, after California voters in November approved a $9 billion state bond measure for schools. School bond sales are being postponed, however, until the State Allocation Board drafts better rules around tracking bond issuance.

The state expects to issue $1.5 billion during the first half of 2017 for high speed rail and $1.1 billion during the second half of the calendar year.

Schaefer described the 2016 bond market as choppier than the previous year.

"Volume had a lot to do with it," he said. "The market appeared to be more volume sensitive, because we had a big volume year."

Rates went down earlier in the year, faster than market participants expected; and when the market backed up in the fall, it backed up higher than expected, he said.

Refundings grew in five states, and fell in four.

Montana and Wyoming experienced the biggest growth with Montana refunding volume more than doubling to $286 million while Wyoming refundings rose 154% to $153 million.

Refunding volume fell 56.8% in Alaska to $284.3 million, 18.8% in Hawaii to $786 million, 13.6% in Idaho to $292 million and 14.2% in Washington to $4.3 billion.

California GOs snagged the four top spots for the region's largest sales with $2.95 billion pricing on March 8, $2.65 billion on Aug. 30, $1.65 billion on Oct. 18 and $1.47 billion on April 19.

In April, California State University trustees priced $1.38 billion.

Washington's state government had the Far West's largest deal outside of California with a $1.3 billion sale on June 28.

Citi bested Bank of America Merrill Lynch and JPMorgan for the title of top senior manager, credited by Thomson Reuters with $13.2 billion in volume. BAML trailed with $12.8 billion compared to $9.2 billion for JPMorgan.

Public Resources Advisory Group led the rankings of financial advisors , credited with $13.3 billion of volume. Public Financial Management, secured second with $13.2 billion. KNN Public Finance came in third with $8.1 billion.

Orrick Herrington & Sutcliffe continued its position atop the bond counsel rankings, credited with $31.1 billion. Stradling Yocca Carlson & Rauth came in second with $10.7 billion in volume. The third slot went to Hawkins Delafield with $6.2 billion.

The Far West region's education sector declined by 6.6%, but still represented the largest sector at $27.1 billion.

Utilities experienced 59% growth to $13.7 billion. Healthcare had $9.1 billion of volume, an 81% jump over the prior year.

Washington retained its slot as the state with the second largest muni volume in the region at $10.7 billion, despite a 25% drop in sales from 2015.

Issuance by state government rose 11% to $2.8 billion, however.

"In recent years Washington has been one of the largest issuers of competitive bond sales nationwide," said Washington Treasurer Duane Davidson. "We've consistently seen strong demand for Washington bonds, with usually five or six bidders on every series."

Davidson, who is new to the position after winning election to the office in November, noted that Washington enjoys GO bond ratings of AA-plus from Fitch Ratings, Aa1 from Moody's Investors Service, and AA-plus from S&P Global Ratings.

"With these strong bond ratings and a very vibrant state economy we'd expect continued robust demand for Washington's bonds," Davidson said.

The Washington education sector was off 17.5%, but still topped the other sectors at $2.8 billion. Transportation fell 40.1% to $1.6 billion.

Nevada edged out Oregon as the state with the third largest issuance growing 27% to just above $4.5 billion while Oregon volume fell 13.2% to just below $4.5 billion.

Montana, Nevada and California were the only states in the region to experience volume growth. Montana sales grew 142% to $771 million. Education volume in Montana reached $227 million from $87.7 million in 2015.

Hawaii volume dropped 9% to $2.9 billion.

The state government was Hawaii's top issuer at $1.85 billion, followed by Honolulu at $827 million.

Other states that saw volume declines were Alaska dropping 23.4% to $1.2 billion, Wyoming falling 29% to $197 million, and Idaho, down 13% to $868.8 million.