The Florida House of Representatives says a lawsuit challenging a bill the chamber passed to dissolve a state toll road agency threatens its exclusive authority to enact legislation.

For that reason, the House said in a motion June 4 that a judge should allow the chamber to intervene in the May 5 suit filed by the Miami-Dade County Expressway Authority. The litigation is pending in Leon County Circuit Court.

The authority, also known as MDX, sought declaratory and injunctive relief after the Senate passed

MDX said HB 385 would unconstitutionally divest it of “all governance, control, property, assets, rights and powers” it has over five local expressways. Judge John Cooper denied MDX’s request for a preliminary injunction because the bill hadn’t been signed into law.

“The House has a direct and immediate interest in these proceedings because the plaintiff’s request for declaratory and injunctive relief seeks to diminish the legislative authority vested exclusively in the Florida Legislature,” the chamber’s June 4 motion said, adding that its immediate interest is “in preserving its core legislative functions and the constitutionality of its actions.”

On Tuesday, Cooper set a hearing on the House’s motion for Aug. 8 — a date that would be after the July 1 effective date of the bill if Gov. Ron DeSantis signs it into law before then.

DeSantis, a Republican who won the governor’s office last fall after being backed by President Trump, also filed a motion May 9 to dismiss the MDX lawsuit.

“This case strikes at the core of a bedrock principle of our Republic — the explicit separation of powers,” DeSantis’ motion said. “MDX is asking the judiciary to violate this principle and issue an extraordinary injunction prohibiting the executive branch from exercising a constitutionally prescribed power — the decision to sign or veto a piece of legislation.”

Although the injunction was denied, DeSantis also argued that the suit wasn’t appropriate for a ruling since he hadn’t seen the bill.

“While MDX may have a valid claim to seek declaratory relief if and when the Transportation Act becomes law, at this current moment their claims are not ripe,” the governor’s filing said. “MDX’s attempt to circumvent separation of powers, exert their will and bypass deliberate briefing on this issue is wholly inappropriate.”

The Legislature hasn’t yet sent the bill to DeSantis for his approval or veto.

If he signs the bill, it would dissolve the MDX on July 1 and fire the current governing board members, which may be why the agency filed a lawsuit so quickly after HB 385 was passed by the Legislature.

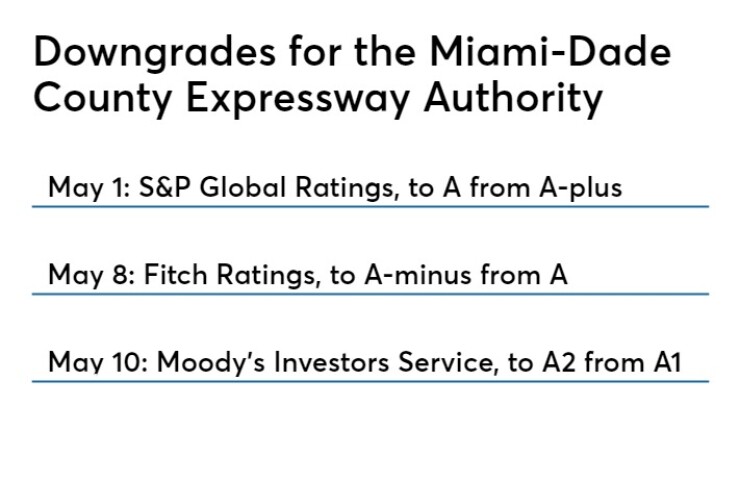

During May, as lawmakers considered and ultimately passed the bill, three rating agencies cited unprecedented and persistent “political interference” into the operations of a local toll road agency when they downgraded MDX’s $1.53 billion of outstanding revenue bonds.

S&P Global Ratings lowered its rating to A from A-plus and changed the outlook to negative; Fitch Ratings lowered its rating to A-minus from A and placed the rating on watch negative; and Moody's Investors Service cut its rating to A2 from A1, keeping it under review for further downgrade.

Analysts said the Legislature’s actions would prevent MDX from operating independently, and they said the successor agency, the Greater Miami Expressway Agency, would experience reduced flexibility under HB 385. They also said the new entity would be reluctant to increase toll rates that might be necessary to fund capital plans.

That’s partly because the law requires the new agency to have a goal of rebating 25% of the tolls paid each month by Miami-Dade County residents who use SunPass transponders and incur a minimum of $12.50 in tolls.

Under this rebate scenario, the new toll road agency could lose up to $26.4 million in revenue during its first year, according to projections from a May 6

“On average, the impact of the 25% SunPass toll rebate for Miami-Dade County residents, in combination with a minimum monthly toll requirement of $12.50, represents a reduction of just over 11% to systemwide collected toll revenue,” the report said.

Toll revenue losses could amount to as much as $37.3 million by 2044, said the CDM report signed by senior vice president Ed Regan and project manager David Aron.

HB 385 also would ban toll increases until 2029, except by a vote of two-thirds of the governing board — instead of the current majority vote — and only to comply with bond covenants. Yet another requirement is that proposed bond issuances must be approved by the Legislative Budget Commission.

Current MDX board members have questioned whether local drivers will actually experience much toll relief because 60% of the tolls collected in the county are charged on non-MDX highways by the Florida Department of Transportation and the Florida Turnpike Enterprise. Neither of those agencies are bound by the restrictions in HB 385.

After the bill passed, a bondholder asked questions about the legislation in an email to MDX’s attorney, Carlos M. Zaldivar, on May 8.

“We are bondholders in the MDX and would like to get an update on the latest legislation regarding the dissolution of the agency,” wrote Duane McAllister, a managing director with Robert W. Baird & Co. The email was obtained through a public records request.

Zaldivar responded by emailing a copy of the final bill to McAllister, and told him that MDX filed a lawsuit “in order to protect our assets,” as well as the interests of bondholders.

“From a bondholder’s perspective, the legislation is wrong and you are right to fight against it,” McAllister wrote. “We bought bonds believing MDX had independence as well as rate-setting authority and now they are seeking to change the rules after the fact.”

McAllister also said the Legislature’s action “brings into question other toll authorities within the state and their own independence.

“The state is setting a very concerning precedent for bondholders by taking this action,” he wrote.

This year’s effort to reduce drivers’ costs has also raised concern among Florida’s seven other expressway agencies and four transit authorities, all members of a statewide organization called TEAMFL who believe they may be the subject of similar bills in the future.

CDM Smith’s Regan, who is also a TEAMFL board member, said in an interview Tuesday that he tried to “dispel the notion” that the MDX bill only pertained to a local issue, which is why it’s believed that some legislators voted for it.

Regan said he told some lawmakers that if the Legislature voted for the bill that it could be construed as interfering with bond covenants, and that rating analysts might question agencies across the state about the matter when they plan to issue bonds.

“While I’m not a rating analyst,” he said, “I figure that’s going to be a risk factor.”

In Florida, the third-most populous state, Regan said transportation funding needs to be able to rely on user fees such as toll revenues because other sources of funding are “drying up” as gas tax revenues decline and drivers shift to electric and hybrid vehicles.

“The last thing in the world the Legislature needed was to create uncertainty for bonding against user fees,” he said. “It just seems to me that this is a risk at a time when you don’t need risks given the pending decline in funding sources.”

During the legislative session earlier this year, some lawmakers speaking in support of the MDX bill also said they thought, before the measure passed, that it wouldn’t impact bond ratings because the Legislature had restructured the former Orlando-Orange County Expressway Authority in 2014, and its bond ratings weren’t downgraded.

Gov. Rick Scott signed the bill dissolving the OOCEA and creating the Central Florida Expressway Authority on June 20, 2014. It expanded the agency’s jurisdiction from a single county to one that included Orange, Lake, Osceola, and Seminole counties, and imposed stronger ethics compliance rules on board members.

At the time, Moody’s analysts said they expected there would be no negative credit impact on the agency’s A2 bond rating as a result of the legislation’s approval.

“The bill includes specific non-impairment language for the benefit of OOCEA bondholders,” Moody’s said, adding that the new agency’s tighter governance and its “limited ability to divert funds from core activities” were also positives from bondholders’ perspective.

The Orlando-Orange County agency’s restructuring was a “completely different situation” than what’s proposed with the MDX bill, said Regan, who is based in the Orlando area and recalled the Legislature’s work on the 2014 bill.

“What the [2014] legislation did is create a regional toll authority to take the place of the Orlando-Orange County Expressway Authority,” he said. “It did absolutely nothing to set any limitation on rate setting. It did nothing to change or set any limits whatsoever on the ability to issue debt, or force rebates.”

The bill may present operational problems for the new Greater Miami Expressway Agency.

If the law takes effect July 1, it would immediately dissolve the MDX. Its current board members would be fired.

Although the measure creates a new toll road agency to assume MDX’s debt and operations, no board would be in place immediately to operate Miami-Dade County’s local expressway system because the bill doesn’t create a transition plan for the transfer of power.

The bill states that new governing board appointments “shall be made by July 31, 2019,” and that they must meet within 15 days after all board members are appointed.