BRADENTON, Fla. - Growth in Florida's property insurance market will allow the Citizens Property Insurance Corp. to defease $418 million in debt, and terminate an assessment on policies securing the debt two years early.

In 2007, the nonprofit, state-run insurer assessed a 1.4% surcharge on all property insurance policies in the state to secure $1.38 billion in tax exempt bonds with a final maturity of March 1, 2017. Bond proceeds were used to pay claims related to Hurricane Wilma in 2005.

Citizens reduced the surcharge to 1% percent in 2011 in response to growth in the base from which the assessment is collected, the agency said. The assessment for the 2007A bonds remains at 1%.

"Citizens is expected to have sufficient resources in place by June 2015 to satisfy the bond's balance," said chief financial officer Jennifer Montero. "We recommend the emergency assessment be eliminated two years early, effective July 1, 2015."

About $418 million in debt service will be outstanding next year when Citizens defeases the bonds.

At that time, Citizens plans to place in escrow available emergency assessment collections, earnings on invested assessments, and a pro-rata amount of the 2007A debt service reserve fund to pay off the debt service on its regular schedule.

The legal defeasance will allow Citizens to eliminate the corresponding liability from the 2007A bonds from its balance sheet, Montero said.

Citizens' Board of Governors will be asked to approve defeasance documents in March 2015.

Montero said the cost to defease the bonds is not expected to exceed $80,000.

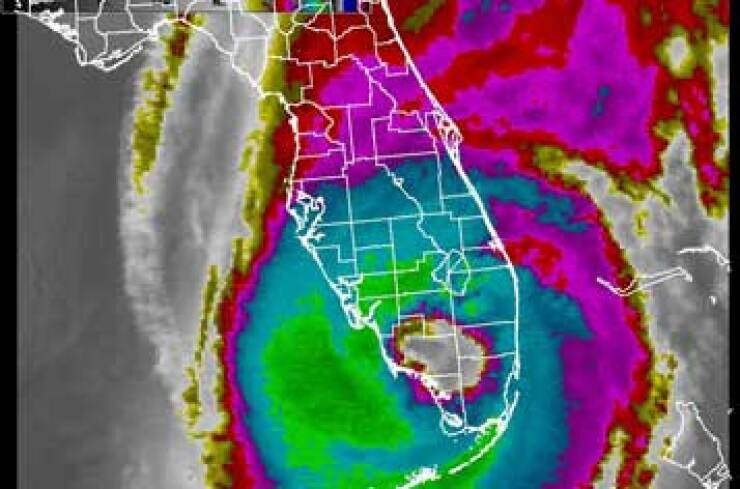

In 2004 and 2005, an unprecedented eight major hurricanes struck Florida, causing billions in damage. Wilma was the last major hurricane to hit the state.

Since Hurricane Wilma and the end of the recession, the state's economy has rebounded significantly.

The number of insurance policies has increased, as have the amount of premiums charged for insurance, officials say.

The increase in policies allowed the state-run Florida Hurricane Catastrophe Fund to defease $675.9 million of bonds in July that paid for hurricane claims submitted by private insurers and Citizens.

That defeasance allowed the Catastrophe Fund to remove a 1.3% assessment collected on all homeowners and auto insurance policies in the state after the debt was issued in 2010.

To accomplish the defeasance, the Cat Fund used revenues from the 1.3% assessment that were higher than expected because of an increase in the number of policies, as well as funds set aside for $500 million in claims that were anticipated but did not come to fruition.

Citizens and the Cat Fund were created by the Legislature after Hurricane Andrew slammed south Florida in 1993. The associated damage and claims left many private companies insolvent, or they either left the state or stopped writing property insurance.

Since then, Citizens has provided property insurance to those who cannot obtain coverage due to limited capacity in the private market. The Cat Fund was created as a low-cost reinsurer to help stabilize the property insurance market overall. Both were established as nonprofit entities with the power to issue municipal bonds.