BRADENTON, Fla. — A Florida Senate transportation committee is entertaining a proposal to merge four expressway and bridge authorities with outstanding debt into Florida’s Turnpike Enterprise.

The plan is part of the Republican Party’s strategy to consolidate state government and fill a budget deficit that could run more than $3.7 billion based on new revenue estimates released last week.

The consolidation includes the ailing Santa Rosa Bay Bridge Authority in northern Florida, which is close to a payment default on some of its $95 million of outstanding debt, sold to build the tolled Garcon Point Bridge. Those bonds are rated at junk levels.

However, officials say the proposal would not change the structure of any bridge agency’s outstanding bonds and preserves the existing indentures and revenues pledged to the outstanding debt.

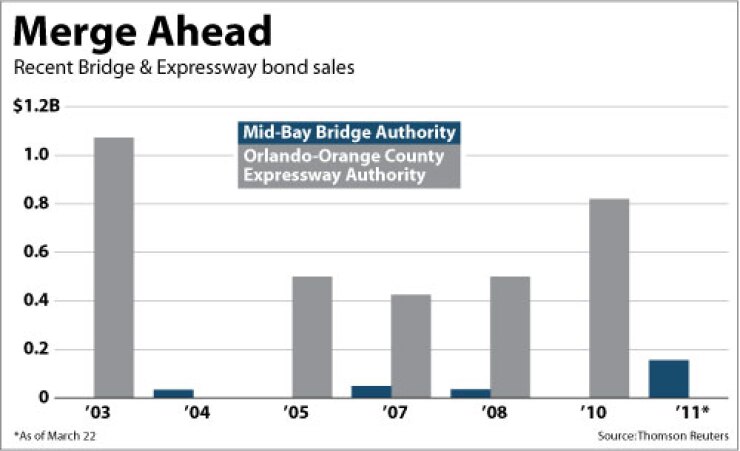

The draft bill also merges the Orlando-Orange County Expressway Authority, the Tampa-Hillsborough County Expressway Authority, and the Mid-Bay Bridge Authority with Florida’s Turnpike Enterprise, which is an agency of the Florida Department of Transportation.

As currently written, the bill would abolish all expressway authorities, except the Miami-Dade County Expressway Authority. It also eliminates a discount for people who use the state’s electronic toll collection device known as Sunpass.

The concept is aimed at reducing overhead and creating new bonding capacity for transportation projects since revenues are scarce, said Sen. Don Gaetz, R-Niceville, chairman of the committee reviewing the proposal.

The plan could save an estimated $24 million and create $3 billion of new bonding authority for the Turnpike Enterprise through 2021, said Gaetz, who represents northern Florida where the Garcon Point and Mid-Bay bridges are located.

“The Santa Rosa Bay Bridge Authority is sort of an anomaly because it is on the verge of default,” Gaetz said. “I would oppose using taxpayer funds or public funds to bail out bondholders.”

In addition to freeing up capacity to build new projects, the plan could ultimately result in better interest rates for future financings than entities such as the Mid-Bay Bridge Authority obtain now, he said.

In January, the Mid-Bay Bridge Authority sold $155 million of new and refunding springing-lien revenue bonds rated BBB-minus by Standard & Poor’s and BBB by Fitch Ratings. The $144 million of new-money bonds priced to yield 7.37% in 2034 and 7.5% in 2040. The authority’s senior-lien bonds are rated BBB-plus.

The authority’s executive director, Jim Vest, did not return a call seeking comment about the proposed bill.

The Turnpike Enterprise’s revenue bonds are rated Aa3 by Moody’s Investors Service and AA-minus by Fitch and Standard & Poor’s.

If the bill passes as currently structured, it’s not expected to affect the credit quality of the turnpike and it does not require that any bonds be refunded, said Ben Watkins, director of the Division of Bond Finance, which issues bonds for most state agencies including the turnpike.

“The way it’s intended to be is that the terms and conditions of the existing bondholders are preserved and protected,” he said. “The turnpike is just the operator of the facilities under same terms and conditions that existed for the bonds that are currently outstanding. It preserves existing credit structures.”

The Turnpike Enterprise would not assume financial liability for the debt, according to Watkins. “Existing indentures are in place,” he said. “The bonds will stay out there. It’s not like the state is taking [them] over. That’s not the reality.”

Gaetz said further details about the proposal have yet to be fleshed out, including the total amount of outstanding debt affected by the reorganization.

“We certainly would not violate any bond covenants that exist now,” he said. He added that the ailing Santa Rosa authority was not included in the proposed draft bill as a way of draining funds from other parts of the state to make Santa Rosa bondholders whole.

When asked what purpose it served to include the Santa Rosa agency in the bill, Gaetz said the details were provided by the Florida Department of Transportation.

However, FDOT assistant secretary Kevin Thibault said the agency was responding to a request from lawmakers and the proposed legislation was not an initiative of the department.

The framework for the draft bill and the entities to include were provided by Gaetz’ legislative committee, he said.

While there are no up-front plans to refinance any bonds placed under the Turnpike, Thibault said that could change in the future if the legislation is passed.

“In some period of time we probably could go out and refinance that debt to get a more favorable rate than what they are currently receiving as part of a bigger system with a higher bond rating,” he said.

Thibault acknowledged that FDOT recently opened negotiations with some expressways that have lease-purchase agreements with the department. Under those agreements, FDOT funds operations and maintenance on facilities as long as debt is outstanding. The draft bill under consideration would abolish those agreements.

The bill also exempts the Miami-Dade County Expressway Authority from consolidation with the turnpike. Thibault said he did not know why Miami-Dade was excluded and pointed out that Miami-Dade does not owe any long-term debt to FDOT nor does it have a lease-purchase agreement.

The legislative proposal comes as the Tampa-Hillsborough County Expressway Authority is preparing to sell new-money bonds, while the Orlando-Orange County Expressway Authority is analyzing ways to reduce its variable-rate bond and swap exposure. The bonds of both authorities are rated in the A category.

The Orlando expressway is considering several options for dealing with $249.5 million of variable-rate bonds and swaps for which letters of credit are due to expire May 14. The agebct did not respond to a request for a comment about the legislative proposal, though spokeswoman Lindsay Hodges said in an email that the authority was not consulted about it.

The Tampa expressway has $314.5 million of outstanding bond debt and most, if not all, was sold by the Division of Bond Finance. The expressway received legislative authority to issue its own bonds last year and is preparing to sell approximately $60 million of new revenue bonds in June for a widening project.

In a recent letter to the local legislative delegation, executive director Joe Waggoner stressed that his expressway operates as efficiently as the turnpike and ensures that tolls are used for local projects.

“The option being considered … would remove the only toll-financed expressway provider operating in the Tampa Bay area that collects local tolls, and reinvests 100% of those tolls locally to provide for our transportation needs,” he wrote.