A growing number of farm bankruptcies and a decline in land values add stress to rural economies in the midst of an international trade war.

China's recently announced

“Effects of this downturn are felt in state revenues, agricultural loan performance and corporate earnings,” said Fitch analyst Michael D’Arcy. “However, the extent to which this becomes a credit issue for states, lenders and agricultural companies will depend on multiple factors including the duration of the embargo, federal aid and the broader direction of the U.S.-China trade war.”

To ease the pain of his trade war, President Trump announced $16 billion of aid to farmers in May. After China retaliated with an embargo in response to another round of tariffs, Trump said more taxpayer support would be coming in 2020 if needed.

Trump also cleared a path to the bankruptcy court for more farmers last week when he signed the Family Farmer Relief Act of 2019, a measure that raises the Chapter 12 debt limit to $10 million from the previous $4.1 million.

“It will help family farmers reorganize after falling on hard times by increasing the debt limit for relief eligibility under the Chapter 12 bankruptcy code,” said Zippy Duvall, president of the American Farm Bureau Federation. “While this is a sobering reflection of the current state of the agricultural economy, we are grateful to Congress, the president and his administration for their prioritization of reforming our current bankruptcy laws.”

The American Bankers Association opposed the legislation, saying it would increase the burden on community and regional banks that were already starting to see weakness in their loan portfolios.

U.S. agricultural exports to China dropped to $9.1 billion in 2018 from $19.5 billion in 2017 as a result of Chinese tariffs on U.S. imports, according to the U.S. Department of Agriculture. Exports fell an additional 20% in the first half of 2019. The decline in exports comes in the midst of flooding and other weather that delayed planting this year.

“Things have been difficult for farmers long before this trade war rolled around,” said Roger Johnson, president of the National Farmers Union. “Farmers are making half of what they were in 2013, and they’ve taken on record levels of debt just to keep their doors open.”

Although Trump last week announced resolution of a trade conflict with Japan over tariffs on cars that also involved U.S. corn, Japanese Prime Minister Shinzo Abe said that the negotiations are still in the early stages.

States such as Kansas that are less populous and economically diverse face a greater long-term risk from the trade war, lending ammunition to Democratic candidates who have made inroads into statehouses and governor’s mansions. Although Republicans still control the Kansas Legislature, Gov. Laura Kelly is the first Democrat to hold that office in eight years.

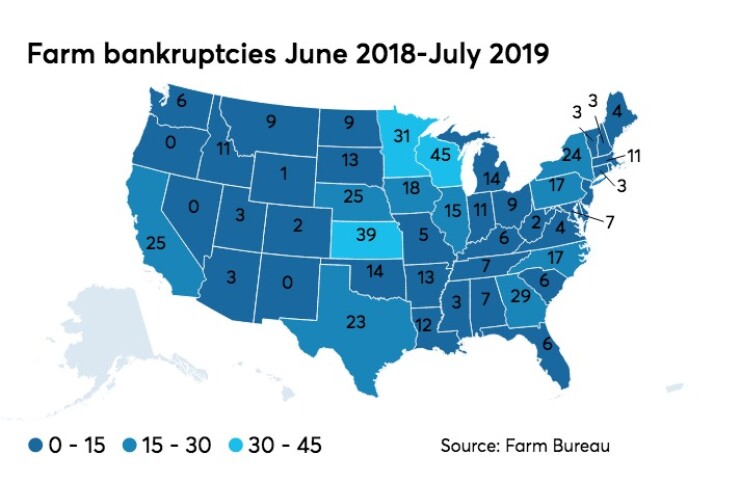

With 39 farm bankruptcies between June 2018 and July 2019, Kansas is second to Wisconsin, which recorded 45, according to the

"Filings in Kansas and Minnesota increased so significantly in the past year that they reached the highest levels of the past decade," Farm Bureau analysts said.

In 2017, Kansas could count 58,569 farms that generated more than $18.7 billion in agricultural output, according to the U.S. Department of Agriculture. Nearly 85% of Kansas farms are family owned.

Kansas’ population of 2.9 million makes it the 35th largest state. It has the 32nd largest economy based on a 2018 gross domestic product of $167 billion.

“Nebraska and Kansas, for which sales and income taxes accounted for 96% of general fund revenues in 2018, are more exposed to economic shocks than states such as Illinois and Minnesota that have greater trade exposure but less volatile revenue because exports account for a smaller portion of their economies,” D’Arcy noted.

According to the Federal Reserve Bank of St. Louis, agriculture loan and lease delinquencies are at the highest levels since the third quarter of 2010.

Land values pledged as collateral fell in concert with crop prices in key regions, declining 9.7% in northern plains states and 5.1% in Corn Belt states over the last five years, D’Arcy said.

North Dakota, Oklahoma and Texas, whose economies are built on oil and gas along with agriculture, could face a double whammy as weak oil prices send producers into bankruptcy alongside family farmers. Oklahoma had a significant rise in farm bankruptcies, with filings more than doubling from the previous year, per the Farm Bureau.

The declining rural economies are also showing up in the closure of hospitals, with 23 shuttered in Texas since 2010.

In California, Trump’s immigration crackdown has exacerbated a farm labor shortage.

The Farm Bureau's Duvall said the shortage is felt in all regions of the country.

“It has been estimated that anywhere from a third to half of farm workers are not authorized to be in the United States,” he said.

Duvall said the H-2A guest worker program filled just a fraction of the more than 2.4 million farm jobs because of cost and inefficiency.

U.S. Sen. Elizabeth Warren, D-Mass., a presidential candidate who grew up in Oklahoma and started her law career in Texas, has made rural revival a key element in her campaign for the Iowa caucuses against a crowded field. She proposes a $200 billion plan that would increase support for farm communities, including healthcare, and bring high-speed internet connections to rural areas.

Minnesota Sen. Amy Klobuchar, who serves on the Senate Agriculture Committee, has promoted more taxpayer support for crop insurance and expansion of existing programs as part of a plan to boost employment in rural economies.

Other Democratic presidential candidates, including former Vice President Joe Biden, Sen. Bernie Sanders, I-Vt., South Bend, Ind., Mayor Pete Buttigieg, and Sen. Cory Booker, D-N.J., have also announced comprehensive rural platforms that included agricultural and financial reforms.

In his battle for re-election, Trump can claim some policies favoring rural areas, starting with the billions of dollars in trade-war handouts, but also including $225 million in grants for bridge improvement projects, augmenting bonds in states with populations of less than 100 people per square mile. A $4 billion water development program is also designed with rural areas in mind.

With Democrats in control of the House, hopes for the Municipal Bond Market Support Act of 2019 by Rep. Terri Sewell, D-Ala., could rise. The bill,

“Expanding the availability of bank-qualified bonds will help local governments and nonprofits afford critical construction projects and stimulate their economies, all while providing significant savings for Alabama taxpayers,” Sewell said.