LOS ANGELES — Municipal bond issuers in the Far West sold $69.4 billion of debt in 2018, according to Refinitiv data, a 27.7% drop from the previous year.

A slight uptick in new money bond sales, up 2% year-over-year to $44.4 billion, was nowhere near enough to make up for a sharp decline in refunding activity.

Refundings fell 57% to $13.3 billion. Deals classified as combining new money and refundings were off 45.9% to $11.6 billion.

The 2017 federal Tax Cuts and Jobs Act gets the blame, after it eliminated a widely used refinancing tool.

“I think a significant amount of it is the loss of advance refundings,” said Tim Schaefer, California’s deputy treasurer for public finance. “That clearly had an impact of unknown dimensions on our volume and I suspect for other large issuers in the state. Large issuers drive volume. I don’t think it affected smaller issuers as much, because they engage in advance refundings less.”

The drop in volume came as no surprise to Raul Amezcua, a managing director with Stifel, Nicolaus & Co.

“Everyone pushed advanced refundings into 2017,” Amezcua said. “Everyone knew 2017 was stealing volume from 2018. It was the busiest December in history.”

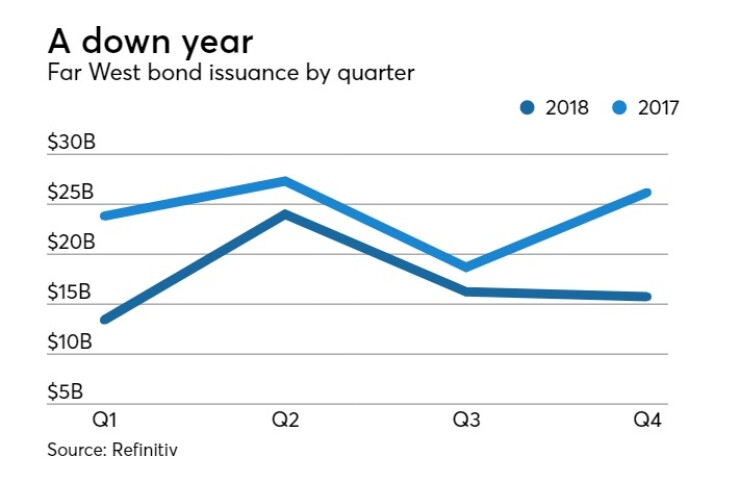

Volume was down year-over-year in every quarter, but the first quarter saw the steepest decline, with a 43.7% drop to $13.4 billion. First-quarter issuance was siphoned into fourth quarter 2017 amid fears that the tax bill would eliminate private activity bonds and advance refundings. PABs ultimately survived.

Amezcua anticipates that new money sales will see slight increases this year and next year as the economy remains on solid footing and economists keep pushing out the timeline for a recession.

Taxable bond sales dropped 34.4% across the region to 128 deals totaling $6.7 billion.

Though Amezcua knows some issuers conducted advance refundings through taxable sales, Amezcua said that Stifel only did a few.

Volume in the Far West trailed only the Northeast, where issuers sold $95.5 billion.

California was responsible for nearly two-thirds of the region’s issuance at $47.9 billion, down 30.1% from 2017.

New money issuance in the Golden State fell 2% to $28.2 billion and refundings dropped 56% to $10.1 billion. Combined sales fell 42.6% to $9.5 billion.

For California state government, new money sales ticked up 2% to $6.8 billion from $6.6 billion in 2017 while refundings fell 58% to $5.6 billion from $8.8 billion, Schaefer said.

“I know the buyside people who read your paper say ‘Interest rates are still low, so why don’t you load the boat and sell lots of debt?’” Schaefer said. “That is not the way we operate in Sacramento. We sell bonds when we need money to back our capital outlay. If a project is delayed, we don’t sell debt, even if interest rates are attractive.”

Of the $2.3 billion the state plans to price next week, $2.01 billion will refund bonds issued in March 2009 after the American Recovery and Reinvestment Act was passed, Schaefer said. The remainder will be new money for water quality supply and infrastructure projects.

Though a raft of Build America Bonds were issued under ARRA that are hitting their 10-year call date, Schaefer doesn’t know how much of a boost that will give to refundings this year.

The bulk of California's $2.2 billion April 11 GO pricing will also be a refunding. The state also had planned to issue $800 million in taxable general obligation bonds in a competitive deal on March 26, primarily for high speed rail. The amounts are preliminary, said Schaefer, who couldn’t give the exact percentage going for the rail project. He also said there is a possibility the bonds could be sold in a negotiated deal, rather than competitively.

Given the state has $4.8 billion in spring sales planned, and fall issuance is expected to be similar, Schaefer said the state government’s bond sales will likely be north of $8 billion this year.

Deals classified as being for education fell 35.8% from the prior year in the Golden State, but were still the largest category with $13.7 billion. Transportation sales fell 33.2% to $6.9 billion after nearly doubling in from 2016 to 2017.

Refundings fell in every state except Idaho where, such volume more than doubled to a still-modest $413.5 million, even as the state’s overall volume slipped 13.8% to $1.1 billion.

Every Far West state experienced declines in overall volume, but Alaska and Oregon experienced the most dramatic drops at 45% to $547.8 million and 47% to $3.8 billion, respectively.

Washington had the biggest jump in new money issuance growing 63% to $7.2 billion while refundings dropped 57.1% and combined sales declined 80% to $456 million.

Washington remained the Far West state with the second-most municipal bond volume at $9.2 billion for 2018, a 10.5% decrease from 2017. The state’s new money sales jumped 62.6% to $7.2 billion while refundings dropped 57.1% and combined deals declined 80%.

Washington’s state government issued $1.1 billion in new money in 2018, but executed no refundings, said Jason Richter, Washington’s deputy treasurer of debt.

State government bond sales throughout the Far West were down 35.6% to $9 billion, according to Refinitiv’s data.

Washington followed the national trend with a burst of refundings occurring in November and December 2017 ahead of the federal tax law, Richter said.

He attributed the drop in new money issuance for state government to the fact that the capital budget for the 2017-2019 biennium wasn’t approved until February 2018, nearly a year later than normal. The budget got hung up while the Legislature hammered out a compromise on funding to drill residential water wells after a state Supreme Court decision increased counties' responsibility for drilling the wells.

“It was an unusual blip in the normal course of business in the state,” Richter said. “It also reduced the amount of debt that normally would have been issued.”

The state conceivably could be playing catch-up with debt issuance in the next few years, but both Richter and Treasurer Duane Davidson are advising caution. Davidson, elected treasurer in 2016, has been recommending the state reduce the amount of debt it issues and to work at operating more on a pay-as-you-go basis.

Currently, 68% of the capital budget is to be funded with bond proceeds for the biennium that ends June 30, Davidson said.

Washington and Nevada both saw jumps in bond sales for public facilities construction.

A $1 billion Washington Convention Center Public Facilities District deal was largely responsible for the state’s jump in public facilities debt to $1.4 billion from $38 million the year before. The deal, priced in August by joint lead managers Citi and Goldman Sachs, was the largest deal outside of California for the region. Nevada’s public facilities sales more than sextupled to $1.6 billion.

Two California GO deals were the region’s largest with a $2.2 billion deal in March and a $2.1 billion taxable GO deal in April. The Golden State Tobacco Securitization Corp. came in third with a $1.7 billion refunding on June 20.

Education remained the Far West region’s biggest sector, though volume fell 34.8% to $19.3 billion. Bonds classified as "general purpose" were down 19.9% to $13.8 billion. Transportation followed with $9.2 billion after a 33.5% decline and utilities fell 25.6% to $6.8 billion.

The top three rankings for senior manager, financial advisor and bond counsel remained the same as in 2017, albeit with smaller deal volume.

Bank of America topped the regional senior manager table, credited by Refinitiv with $10.7 billion on 76 deals. Citi trailed with $8.8 billion on 67 issues, followed by $8.4 billion on 77 issues for Morgan Stanley.

Public Resources Advisory Group led the rankings of financial advisors with $11.7 billion on 41 issues. PFM came in second with $10.1 billion in 120 issues. KNN Public Finance came in third with $4.6billion on 65 issues.

Orrick Herrington & Sutcliffe retained its position atop the bond counsel rankings, credited with $25.6 billion. Stradling Yocca Carlson & Rauth came in second with $5.9 billion on 143 issues. Hawkins Delafield secured the third slot with $5.4 billion.