WASHINGTON - The downward financial spiral of Fannie Mae and Freddie Mac Friday led economists and financial experts to warn about possible dire consequences for the U.S. economy. However, housing analysts said the two secondary mortgage market titans had their greatest impact on the muni market beginning two years ago when they either halted or severely reduced their purchases of muni housing bonds after being the biggest buyers in the market. Click to see the

The resulting lack of demand pushed housing bond interest rates up from five to 25 basis points, according to John Craford, executive vice president of finance and administration for the Connecticut Housing Finance Authority in Rocky Hill, Conn.

"They haven't been active buyers in the muni bond market during the last couple of years," said a housing expert who did not want to be identified. "They're not really in the market now, they're not supporting it. But their absence has contributed to spreads that are the widest they've every been over most peoples' careers in housing bonds vis-a-vis other munis."

"We haven't relied on Fannie or Freddie to buy muni bonds in a long time," since 2006, said Matt Fabian, managing director of Municipal Market Advisors, Inc. in Concord, Mass. "Their holding of muni bonds has been pretty flat since then."

"If they needed to sell bonds to raise cash it could be an issue" for the muni market, said Fabian, but he added, "They do own a lot of housing bonds that no one wants to buy right now." Fannie and Freddie have customized bond structures, and typically buy whole housing bond issues from dealers, he said.

According to housing market experts, Fannie Mae and Freddie Mac were the biggest buyers of single and multi-family housing bonds over a ten-year period, from about 1996 to 2006.

Federal Reserve Flow of Funds statistics for 2008 show that muni holdings of the government-sponsored enterprises shot up to $12.1 billion in 1996 from $7.8 billion the year before and continued to soar to $44.6 billion in 2004. The GSEs held $39.7 billion of munis in 2005, then $36.1 billion in 2006, falling to $33.3 billion in 2005 and $32.4 billion in 2008. The statistics represent the holdings of seven GSEs, including the Federal Home Loan Banks, the Federal Agricultural Mortgage Corp., the Farm Credit System, and Resolution Funding Corp., but sources said that the lion's share of those muni bonds are held by Fannie Mae and Freddie Mac.

Fannie Mae completely halted its purchases of muni bonds in May 2005 after it bumped up against the 2% de minimis tax rule. The rule is a "safe harbor" provision, under which corporations must have no more than two percent of their assets in tax-exempt bonds in order to be able to avoid having to prove to the Treasury that they are not trying to write off their cost of borrowing to buy tax-exempt bonds.

Fannie Mae's mortgage portfolio assets were then frozen at the end of December 2005 after it was accused of overstating its reported income and capital by an estimated $10.6 billion. The mortgage finance company was sanctioned by federal regulators in May 2006 and ordered to pay a $400 million civil penalty to settle charges that it manipulated accounting rules to erroneously portray steadily improving earnings that triggered maximum bonuses for senior executives over a six-year period. It did not resume purchases of muni bonds until April 2007. Freddie Mac also faced financial and regulatory issues, and its purchases also were curtailed. For the past two years, both mortgage finance companies have bought few muni bonds.

When Fannie Mae and Freddie Mac stopped or severely cut their purchases of muni bonds, bond funds "stepped into the breach to fill that void," said Craford. But then the subprime mortgage crisis hit and generally tainted housing bonds.

In addition, a number of state housing finance authorities had entered into interest rate swaps to create synthetic fixed rate bonds and many of those deals were insured by bond insurers whose ratings were downgraded.

These events also have hurt the muni housing bond market since the departure of the two secondary market mortgage titans, according to Craford.

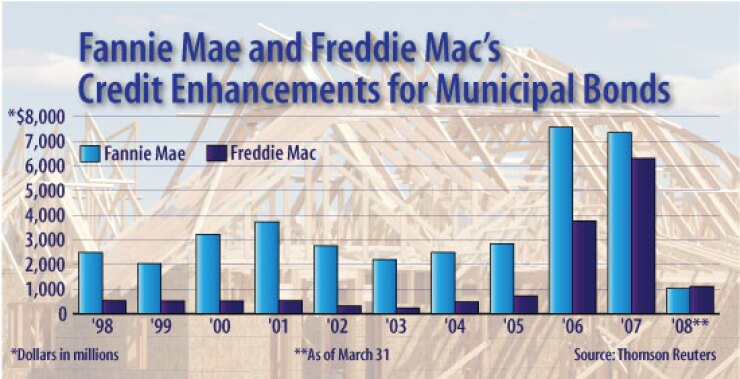

Fannie Mae and Freddie Mac also provide credit enhancement for munis - mostly multi-family housing bonds - but have done less and less of that this year, housing experts said.

Fannie Mae provided credit enhancement for $1.0 billion of muni bonds in 2008, through July 10, compared to $7.4 billion of bonds in 2007, $7.6 billion in 2006 and $2.8 billion in 2005, according to statistics from Thomson Reuters. Freddie Mac credit enhanced $1.1 billion of bonds in 2008 as of July 10, down from $6.3 billion in 2007, $3.8 billion in 2006 and $733 million in 2005.

In the wake of all of the turmoil, one big boost to the housing market would be if Congress approves housing stimulus legislation pending in the Senate that would exempt all housing bonds from the alternative minimum tax, Craford said. Exempting housing bonds from the AMT could cause interest rates on housing bonds to drop 60 to 75 basis points, he said.

Meanwhile, the markets reacted favorably to a news report by Reuters Friday that Federal Reserve Chairman Ben Benanke provided some relief to Fannie Mae and Freddie Mac by opening the Federal Reserve Bank of New York's emergency discount window. However, a news report by Bloomberg said Benanke had not taken any such action.