The Connecticut Education Association is suing the state over Gov. Dannel Malloy’s executive-order budgeting that cuts $557 million in school funding from 139 municipalities.

Connecticut’s largest teachers union filed the

The state has operated without a fiscal 2018 budget since July 1. The lawsuit contends that without a state budget, Malloy lacks the authority to cut education funding.

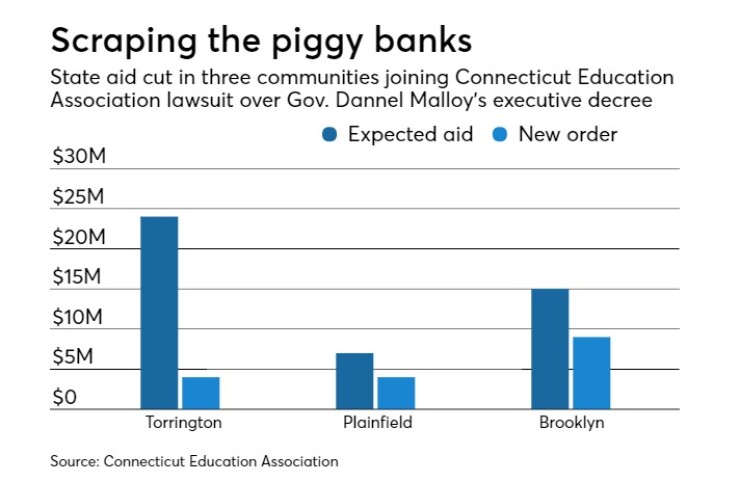

Torrington, Plainfield and Brooklyn joined the initial filing.

“We can’t sit by and watch our public schools dismantled and students and teachers stripped of essential resources," said association president Sheila Cohen. "This injunction is the first step toward ensuring that our state lives up to its commitment and constitutional obligations to adequately fund public education.”

Separately, Connecticut Attorney General George Jepsen has questioned the legality of the governor's executive order.

“I think the governor’s order is in very serious legal trouble,” said Senate Republican Leader Len Fasano, R-North Haven.

The executive orders pose risks for issuers dependent upon state aid, according to Gurtin Municipal Bond Management.

"Connecticut's current situation does make it imperative to understand the credit cushion of any state-dependent obligors, given the implementation of dramatic state aid cuts," Gurtin said in a commentary. "We continue to only hold those state-dependent obligors that can withstand ongoing state cuts."

Aid to Torrington dropped to $4 million from $24 million; Brooklyn went to $4 million from $7 million, and Plainfield to $9 million from $15 million.

Speaking to reporters at the state capitol, Malloy accused the CEA of acting prematurely.

“Under normal circumstances, those checks don’t go out until the end of October,” he said. “Secondarily, they’ll have to handle the issue of the fact that we have a lot less money to spend without a budget than we do with a budget.

“Their stronger argument might be that we can’t make any payments to communities in the absence of a budget. That one I would be afraid of.”

Lawmakers debated behind closed doors Wednesday for the third straight day, trying to work out a compromise budget one month after Democrat Malloy vetoed a Republican-crafted $40.7 billion biennial spending plan.

“Whatever is in that document should be free of gimmicks, pension steals and the like,” said Malloy. He also opposes deep cuts to the University of Connecticut.

A handful of moderate Democrats broke from party leadership to pass the Republican budget. The Senate is split 18-18 while Democrats hold a slim 79-72 advantage in the House of Representatives.

Bond rating agencies have hit Connecticut with several general obligation downgrades over the past 18 months, citing late and imbalanced budgets, and high debt.

S&P Global Ratings and Fitch Ratings rate Connecticut GOs A-plus. Moody’s Investors Service rates them A1 while Kroll Bond Rating Agency assigns AA-minus.

Gurtin said Connecticut's situation "differs drastically" from Illinois' record-setting impasse.

"Even absent a budget agreement, Connecticut is making cuts that are keeping its budget in approximate balance -- thus avoiding the Illinois example of running up massive unpaid bills until agreeing upon a budget," said Gurtin. "We believe the state's credit quality remains solid, and the state has a framework that allows for pragmatic fiscal solutions."

Hanging in the balance is capital city and bankruptcy candidate Hartford. Mayor Luke Bronin has asked the state for $40 million in additional aid, which he said is but one prerequisite to avoiding bankruptcy.

Bond insurers Assured Guaranty and Build America Mutual, who combined wrap about 80% of Hartford’s GO bonds, recently hired Robert Lamb, founder and president of Lamont Financial Services Corp., to work with Hartford’s debt.

The city reported $683 million in its most recent comprehensive annual financial report, for fiscal 2016.