SAN FRANCISCO — Chevron Corp., the second-largest integrated oil company in the United States, will benefit from a record amount of tax-exempt recovery zone facility bonds next month to upgrade the biggest refinery in the lucrative California energy market.

The $250 million private-activity bond sale will help pay for a major upgrade of the Chevron El Segundo Refinery. The conduit issuer is the California Municipal Finance Authority.

The company, which is based in San Ramon, Calif., said the project will result in incremental employment growth for the greater Los Angeles area, according to the California Debt Limit Allocation Committee, which approved the reallocation in September.

The energy company said the offering qualifies under the American Recovery and Reinvestment Act because the refinery is in Los Angeles County, which was recently designated as a recovery zone. However, according to a CDLAC staff report, the public benefit of recovery zone facility bonds may be less than intended as fewer projects than expected have been proposed.

“I am in no position to quote total headcounts, but certainly there will be a good number of construction jobs created, and then we would expect some amount of permanent jobs created once the facilities are up and running,” said Roger Haley, an analyst in Chevron’s treasury department. “This is something [Chevron] needs to do to keep the refinery competitive.”

The debt is sponsored by the city of El Segundo.

“It seemed to be the path of least resistance,” Haley said of going through the CFMA.

Bill Crowe, assistant city manager in El Segundo, said the authority approached the city about issuing the bonds for Chevron.

The agency needed the city to hold a Tax Equity and Fiscal Responsibility Act, or TEFRA, hearing, which requires bond issue approval by an elected official or body of elected officials after a public hearing.

El Segundo has a population of around 17,000 and is sandwiched between the Los Angeles airport, Interstate 405, and the ocean.

It is roughly five square miles, and the refinery takes up about a quarter of the area. The city was named after the second refinery Standard Oil built in the early 20th century. It is also home to several other Fortune 500 companies.

During a June 15 meeting, the City Council designated El Segundo a recovery zone based on the county’s designation as a recovery zone due to economic distress, according to a copy of the city’s resolution.

“The county has the qualifiers,” Crowe said. “A community like ours, with our unemployment rate [being] significantly less than the state, probably half, [doesn’t] have enterprise zones or other depressed sections.”

Los Angeles County’s unemployment rate hit 12.6% last month, slightly higher than the state average of 12.4%. El Segundo’s unemployment rate was 6.5% as of August, according to the local Daily Breeze newspaper.

Even though the project will promote job growth and passed the required criteria, it did not score well during its evaluation by the CDLAC.

The staff report gave the bond reallocation a score of seven out of 100 and noted no new jobs would be created or retained within two years of completion of the project.

“It is important to note that the Chevron U.S.A. will provide public benefit that cannot be captured according to the CDLAC evaluation criteria,” the report said.

The report also pointed out the upgrade would cost-effectively bolster the state’s fuel supply. California has high fuel standards, and prices, and that formulation makes it hard to bring in fuel from out-of-state refineries during times of peak demand.

Joe DeAnda, press secretary for the state treasurer’s office, which oversees CDLAC, said the application met all criteria but noted there is little competition now for recovery zone bond allocations.

“Without sufficient demand, we are not able to impose the point scale to try and drive the most public benefit out of these projects,” DeAnda said. “Under the federal guidelines, there is not much we can do in the absence of sufficient demand.”

The basic federal guidelines for recovery zone facility bonds are to support trades or businesses in areas suffering from economic distress, and 95% of the proceeds must be used for recovery zone property, according to the law firm Orrick, Herrington & Sutcliffe LLP.

The government allocated California $1.2 billion of RZFB authority, with a sub-allocation of $271 million to Los Angeles County.

Since many cities and counties did not use their allocations, the state reallocated some of the bond authority.

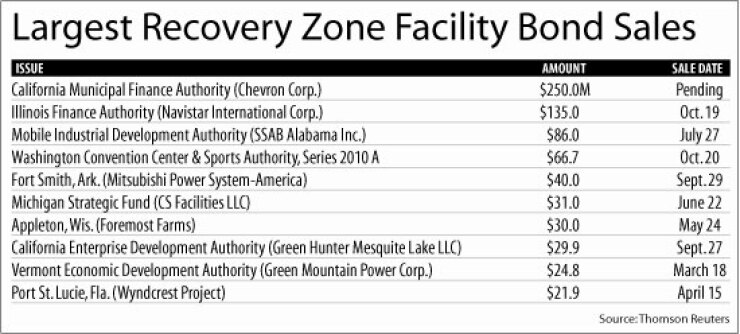

The bond deal will be the biggest sale yet, surpassing the Illinois Finance Authority’s offering last week of $135 million on behalf of Navistar International, the current record-holder.

The debt for Chevron is expected to price in the first two weeks of November with the offered bonds maturing in 2030. Bank of America Merrill Lynch will lead the sale. Fulbright & Jaworski LLP will be bond counsel.