SAN RAFAEL, Calif. — The Sonoma Marin Area Rail Transit District in California remains on track to debut in the bond market this spring, but the limits of the sales tax it relies on for funding will limit the scope of the rail transit line it plans to build, its board of directors learned here last week at a workshop.

The district’s financing capacity remains about $100 million short of the estimated cost to build what is already a truncated version of the transit line promised to voters, its staff told the board Thursday.

In 2008, voters in both Sonoma and Marin counties, which are north of the Golden Gate Bridge, by a two-thirds supermajority vote approved a quarter-cent, 20-year sales tax to build and operate a passenger train line along a disused freight-train corridor bisecting the counties.

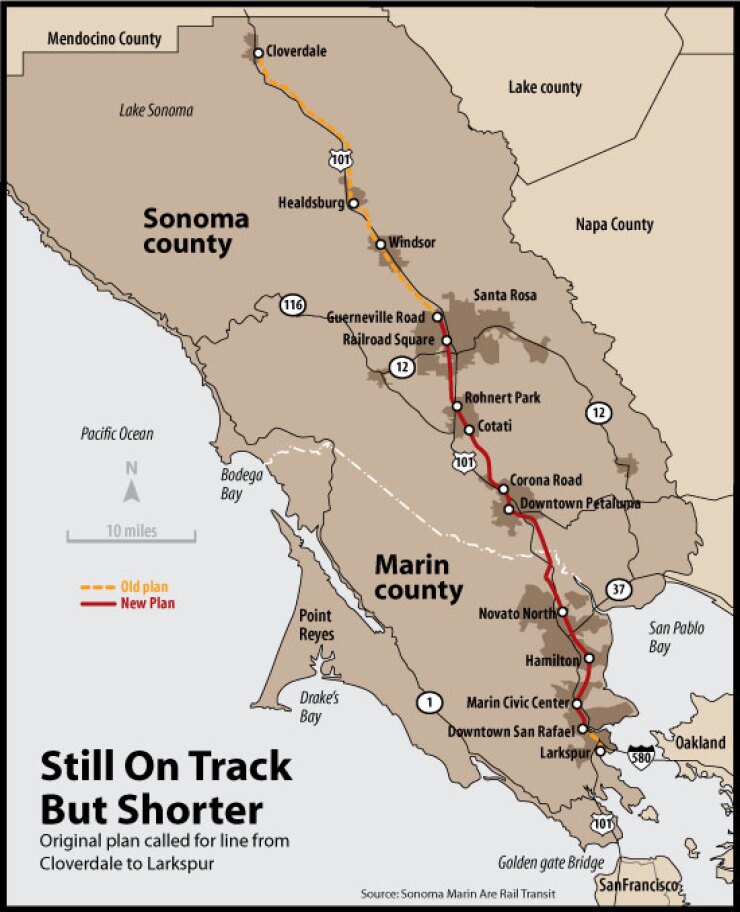

The original vision called for a 70-mile line between Larkspur in Marin County north to Cloverdale in Sonoma County, with a parallel bicycle path.

Limits to funding capacity of the sales tax led the agency to focus on building a 37-mile segment between the county seats, San Rafael in Marin and Santa Rosa in Sonoma, to open in 2014.

At last week’s workshop, board members discussed, without making final decisions, the options for reducing the funding shortfall. Proposals included the omission of planned passenger stations and portions of the bicycle path, and trying to get by with refurbishing one of the line’s bridges instead of building a replacement.

The district will be able to sell about $161 million of sales tax revenue bonds this spring, said Sarah Hollenbeck, senior managing consultant for Public Financial Management Inc., the district’s financial adviser.

The agency’s ability to leverage its sales tax revenue stream is limited by what rating agencies and investors are willing to accept, she told the board.

Even though sales tax revenue will rise over time, raters and bond buyers like to see such revenue bonds structured so that the peak debt service cost will not exceed current sales tax revenue, she said. The district will also need to fund a debt service reserve from the proceeds.

“We think this is a bit more conservative and makes the bonds more easily sold to investors,” she said.

The district is constrained by the scheduled 2029 expiration of its sales tax. That will be the final maturity for the bond issue.

The district’s board is on track to authorize the bond issuance as soon as its scheduled April 6 meeting, which would allow for a bond sale in June.

SMART has already selected a financing team. In addition to PFM, it includes senior managers Barclays Capital and co-managers Citi, Morgan Stanley, Jeffries & Co., and Wedbush. Orrick, Herrington & Sutcliffe LLP is bond counsel, Fulbright & Jaworski LLP is disclosure counsel, and Nixon Peabody is underwriters’ counsel.

Though the SMART line is being constructed on a freight corridor where tracks are in place, it will have to start from scratch to build a line safe and fast enough for passengers, its senior rail engineer, Bill Gamlen, told the board. “We’ll have to take it back down to subgrade and build it back up,” he said.