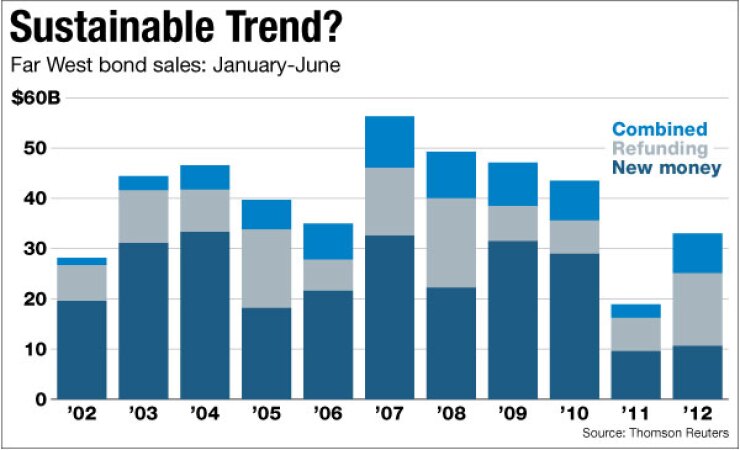

SAN FRANCISCO — California saw debt sales by municipal issuers almost double in the region in the first half of 2012 compared to a year earlier with the help of record low rates, driving Far West volume.

And looking ahead, experts are wary about whether that trend will be able continue in the second half.

The Golden State, as usual, was the main driver that helped Far West issuance rise 73% to $32.9 billion in the first six months of the year from the same period in 2011 as its sales volume rose 93% to $22.2 billion, according to Thomson Reuters.

"The favorable interest rate environment has allowed us to save taxpayers an impressive chunk of change," said Tom Dresslar, state Treasurer Bill Lockyer's spokesman. "This spring, we refunded $2.4 billion of GO bonds, and those deals reduced taxpayers' debt service tab by more than $300 million."

According to Treasurer's Office figures, long-term refundings throughout the state over the first six months totaled $13.6 billion compared to $4.47 billion during the same period in 2011, a 205% increase. Those refundings accounted for almost 60% of total issuances in California, Dresslar said.

Will this upturn continue in the state in the second half of the year? Market analysts are uncertain.

"The refundings that were done in the first half of the year cannot continue because, by and large, the deals that were able to be done quickly and easily have already been done," said Bud Byrnes, chief executive officer of Los Angeles-based RH Investment Corp., a broker-dealer specializing in California municipal bonds. "Traditionally, the second half of the year is where the volume is, but because of the substantial restructuring we are experiencing in the state of California, I am uncertain about how much volume we will be able to get in the second half of the year."

Byrnes said a lot of cities are scrambling to restructure their future bond plans amid tight budgets, partly due to the state shifting some of its own budget burdens onto local governments, which has included the dissolution of redevelopment agencies.

The second half could look more like last year, which had fewer refundings. By comparison, the Far West's sales last year, which was only $53 billion, were down 39% from the previous year, and represented the lowest amount since 2001.

California also drove that falloff as belt-tightening by Gov. Jerry Brown's administration led to fewer sales by the state, always the largest issuer in the region and typically in the country.

The state skipped its usual spring sale last year, but this year it could not resist taking advantage of the all-time low rates to refinance debt.

The state has sold more than $3.2 billion of GO debt in the first half of the year as it has doubled down on efforts to refund outstanding bonds while rates are so low. The treasurer sold $1.9 billion of GO refunding bonds in March and $1.3 billion in April.

Municipal bond yield indexes over the past year have hit record lows amid less supply and low Treasury bond rates.

Since early 2010, the spreads for states' GO yields have contracted against Municipal Market Data's generic triple-A municipal bond — from a high of 124 basis points for bonds maturing in five years and 163 basis points for 30-year debt, to 61 basis points and 101 basis points as of June 20, according to data from Thomson Reuters.

Investors have gobbled up the state's bonds because they pay higher yields compared to other states.

One reason is that every state, with the exception of Illinois, has a higher rating than California.

But California is still the lowest-rated state by Standard & Poor's and Fitch Ratings at A-minus. Moody's Investors Service rates it A1, one notch higher than Illinois.

Overall in California, refunding deals jumped 129% compared to the same period last year to $8.8 billion, which doesn't include the combined issuances of new money and refunding that skyrocketed by 411% to nearly $5.9 billion, according to Thomson Reuters.

The majority of California issuance in the first half was revenue bonds, $13.4 billion, a 73% increase in volume, followed by $8.8 billion GO bonds, a 133% rise compared to the first half of 2011.

The lion's share of the bonds in the first six months were sold in the state's education sector, $6.5 billion, a 63% jump, and for general purpose, $5 billion, up 1,498% from a year earlier, Thomson Reuters said.

Washington had the second-largest amount of bonds sold in the first half of the year with $6.6 billion of issuances, up 63% from the same period in 2011.

Like California, the Evergreen State boosted its debt sales mainly through refundings, which made up more than half of the all issuance in the state in the first six months with a volume of $3.5 billion, a 102% rise, according to the data.

"The main goal for any refunding is saving money for taxpayers. We use a savings threshold of 5% as part of our evaluation process. The current interest environment has provided a tremendous opportunity to save money and we have taken advantage of it," said Washington Treasurer Jim McIntire in a statement.

Washington officials have said the state attained more than $400 million in present-value savings by refunding more than $4 billion since June 2009.

Earlier this month, Washington refunded more than $700 million of GO bonds in two competitive sales. In July, the state refunded $560 million of bonds through four competitive sales.

Washington's GO bonds saw an upswing, rising 243% to $3.5 billion in the first half compared to the same time last year.

Revenue bond volume held steady at just above $3 billion and with only a 1% increase.

In total, according to Thomson Reuters, the state itself sold more than $2 billion, an increase of 337%, while state agencies sold $670 million, down 5%.

The state's transportation sector saw the largest increase in debt sales with a 1,185% increase to $1.6 billion.

Adding to that increase, the state sold more than $400 million in its first-ever Garvee sale in the spring to raise money to pay for a replacement floating bridge to help ease traffic in the Seattle region.

Following Washington with the next largest volume in the region, $1.84 billion, was Oregon. The state actually bucked the trend of increasing volume over the period compared to last year, with a drop of 2.8%.

The state did see refundings more than double over the period but new money deals slid 35% and combined deals dropped 23%. The state sold 31% less debt for a volume of only $388 million compared to a year earlier, while state agencies sold 15% less bonds for $397 million.

Alaska was the only other state in the region to see a falloff, as its debt issuance volume fell more than 11% to $595 million for the period compared to 2011. Bonds for utilities fell nearly 100% from $346 million of volume to just $5.8 million over the period. But state agencies more than double their bond sales with $267 million of volume over the six months.

Joining the majority of the region, Nevada saw bond issuance volume rise about 50% in the six months compared to the first half of 2011 to $558 million. An increase in refundings and utility sector bonds help push the rise.

The state also sold $189 million of bonds in the first half. It had issued nothing in the first six months of the previous year.

Idaho saw a major increase in bond sales, with $475 million of issuances over the six-month period compared to the previous year, a 257% increase. That was mainly built on a major increase in bonds sold for state agencies, education and refunding bonds.

Hawaii saw bond sales jump 154% to $243 million in the first half, mainly due to a 540% increase in refundings compared to the first six months of 2011.

Wyoming issuers sold $186 million in the first six months of the year compared to last, an 85% increase, but mostly due to new-money debt, half of which went towards the health care sector.

Montana's issuance rose 64% compared to last year to $129 million in the first six months, also on the back of $110 million of refundings, most of which were GO bonds sold by state agencies.

Helping manage all of the volume, Citi took the top spot as senior manager in the region with $4.7 million, followed by JPMorgan and then Bank of America Merrill Lynch, which had held the lead at the end of last year, according to Thomson Reuters.

Public Resources Advisory Group took the top the lead in the financial advisor category ahead of Seattle-Northwest Securities Corp.

Orrick Herrington & Sutcliffe continued its dominance as the top bond counsel in the region.