Municipals were little changed Monday ahead of the week’s nearly $13 billion new-issue slate. Muni yields remained steady along all of the AAA GO scales.

“This week's total issuance is estimated at roughly $12.56 billion comprised of nearly $9 billion in tax-exempts and another $3.6 billion in taxable product. The year-to-date tax-exempt weekly average is approximately $5.84 billion,” said Peter Franks, senior market analyst at Refinitiv Municipal Market Data. “Secondary muni trading remains extremely quiet on the last day of summer and oh yeah, it’s Monday.”

Franks added that as equities plunged and Treasuries strengthened, munis held firm.

"Munis are still seeing very little in the way of a sympathetic move to lower yields as the concession-minded buyer waits for the negotiated flood gates to open," he said.

Volume is on the rise as the end of the third quarter looms, according to Kim Olsan, senior vice president at FHN Financial.

September supply will exceed $30 billion across all categories, with $22 billion priced month-to-date. “A rather diverse calendar should address most inquiry needs, but it does come as yields have stalled (near the lows) and any expectations the market had for fiscal relief to municipal issuers are fading,” she said.

Olsan noted there have been many prior periods of a stagnant curve such as the market is experiencing now, "but once broken it generally creates more dramatic changes, whether up or down in yield."

In early February and late June, two periods when yields were steady, saw a rally in rates, but the starting yields were higher than current levels.

"Two ongoing means to improve yield concessions are shorter-dated calls (reasonable volume in 10-15 year maturities/6-8 year calls) and down-in-coupon structures past 10 years," she said.

Olsan noted that both AA- and AAA-rated credits with 2026-2028 calls are trading with 30 basis-point or wider spreads to call dates and high relative value ratios. In 2% coupons, 15- to 20-year maturities offer discounts of 40 basis points or more to 5s depending on specific credit support, she said, adding that "away from those options, credit is a precarious choice without strong research capabilities."

She said there is no one state that will escape the ravage of shutdowns and lost revenues.

Market and political analysts see the presidential election heating up now, with a Supreme Court nomination likely leading to a bitter battle between the parties as November approaches. It now appears less and less likely that any sort of stimulus package, to help states and localities, will be passed anytime soon.

Primary market

A quiet Monday permeated the market as there were very few bonds out for the bid in the secondary market as all eyes were on the upcoming calendar, according to a New York trader.

“It’s very quiet and the market is just waiting for new issues,” he said Monday afternoon.

The trader said the arrival of three large New York deals will generate a hearty appetite from investors, including offerings from the New York Industrial Development Agency, the New York Municipal Water Finance Authority and the New York Housing Finance Authority.

On Tuesday, Goldman Sachs is set to price the NYC IDA’s (A2/AAA/NR/AA+) $924 million tax-exempt and taxable deal for Yankee Stadium. The bonds will be insured by Assured Guaranty Municipal Corp.

Raymond James & Associates will price the NYC MWFA’s $533 million of tax-exempt fixed-rate bonds on Tuesday for retail investors ahead of Wednesday’s institutional offering.

Morgan Stanley is expected to price the Texas Water Development Board’s (/AAA/AAA/) $600 million of Master Trust state water implementation revenue fund for Texas revenue bonds.

Also on Tuesday, Miami-Dade County is selling $531.715 million of special obligation bonds in three offerings. The deals consist of $340 million of Series 2020B taxable capital asset acquisition bonds, $114.96 million of Series 2020C exempt non-AMT capital asset acquisition bonds and $76.755 million of taxable capital asset acquisition refunding bonds.

On Wednesday, JPMorgan Securities is set to price the Portland International Airport, Ore.’s (NR/A+/NR/NR) $348.72 million of Series 27A AMT and Series 27B taxable revenue bonds.

On Thursday, Jefferies is expected to price Chicago’s (NR/A/A/A+) $1.2 billion of general airport senior lien bonds for O’Hare International Airport.

Secondary market

Some notable trades Monday:

Laredo, Texas ISD 5s of 2024 traded at 0.26%-0.25%. Utah GOs, 5s of 2026, traded at 0.36%. Sycamore, Ohio community school district 4s of 2026, traded at 0.51%-0.46%.

Fairfax County, Virginia GOs, 5s of 2029 at 0.77%-0.76% while the issuers 5s of 2037 traded at 1.32%-1.31%.

Harris County, Texas flood 3s of 2038 at 1.68%-1.56%. Houston airports 3s of 2039 at 1.75%-1.74%. Texas waters (set to sell this week) 3s of 2039, traded at 1.65%.

New York City TFAs, 4s of 2040 at 2.12% after originally pricing at 2.18%.

Washington GOs, 5s of 2045 traded at 1.64%-1.55%.

Last week, the most traded muni sector was industrial development followed by education and utilities, IHS Markit said.

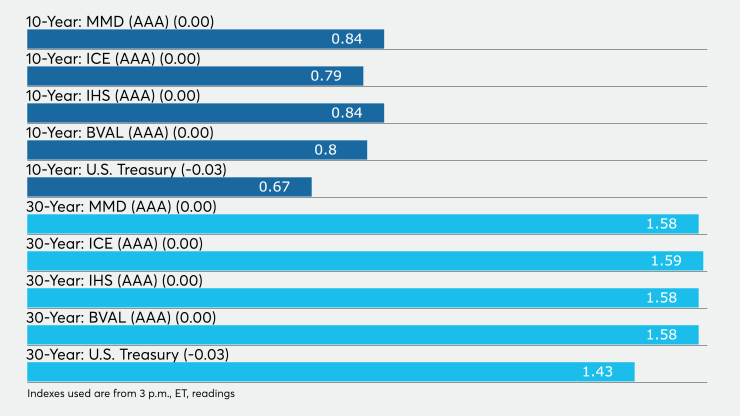

High-grade municipals were little changed on Monday, according to final readings on Refinitiv MMD’s AAA benchmark scale. Yields were flat in 2021 and 2022 at 0.12% and 0.13%, respectively. The yield on the 10-year muni was steady at 0.84% while the 30-year yield remained at 1.58%.

The 10-year muni-to-Treasury ratio was calculated at 124.3% while the 30-year muni-to-Treasury ratio stood at 110.4%, according to MMD.

The ICE AAA municipal yield curve showed the 2021 maturity steady at 0.12% and the 2022 maturity flat at 0.12%. The 10-year maturity was unchanged at 0.79% and the 30-year was flat at 1.59%.

The 10-year muni-to-Treasury ratio was calculated at 123% while the 30-year muni-to-Treasury ratio stood at 109%, according to ICE.

The IHS Markit municipal analytics AAA curve showed prices unchanged with the 2021 maturity yielding 0.13%, the 2022 maturity at 0.14%, the 10-year muni at 0.84% and the 30-year at 1.58%.

The BVAL AAA curve showed the yield on the 2021 maturity unchanged at 0.11%, the 2022 maturity down one basis point to 0.13%, the 10-year down one basis point to 0.80% and the 30-year unchanged at 1.58%.

Treasuries were stronger as stock prices traded lower.

The three-month Treasury note was yielding 0.10%, the 10-year Treasury was yielding 0.67% and the 30-year Treasury was yielding 1.43%.

The Dow fell 2.60%, the S&P 500 declined 2.00% and the Nasdaq lost 1.20%.