WASHINGTON – Two Senators have introduced a bipartisan bill that would allow tax-exempt private-activity bonds to be used to help power plants and industrial facilities finance projects to capture and store carbon dioxide.

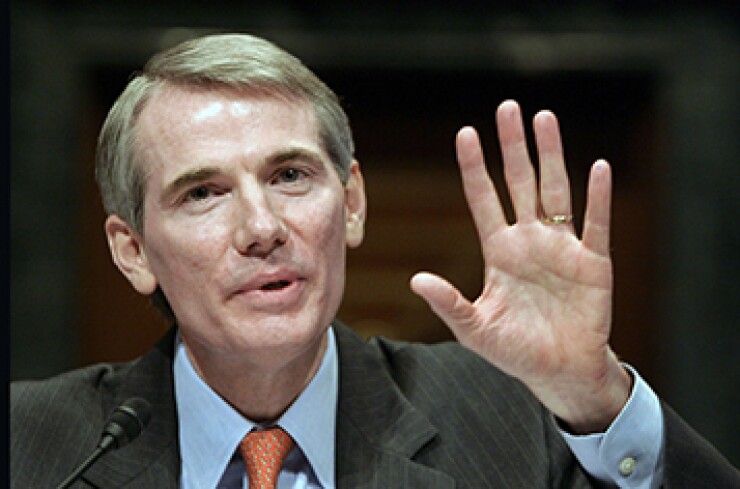

The Carbon Capture Improvement Act of 2015 was introduced on Thursday by Sens. Michael Bennet, D-Colo., and Rob Portman, R-Ohio.

Carbon capture and storage (CCS) facilities are designed to siphon off CO2 from power plants emissions and industrial facilities and either store it underground or sell it for other uses, such as oil companies that inject it underground to recover more oil.

"This bill would reduce upfront costs, one of the largest impediments to carbon capture technology," Bennet said in a release. "It is good for the economy and good for the environment."

"This is a commonsense idea and that's why it's supported by business groups, energy groups and environmental groups alike," said Portman. "This is something that people on both sides of the aisle can get behind and I urge my colleagues to support this bill."

CCS technology is still being developed and the costs of CCS facilities are high. The only full scale power plant CCS project operating in North America is Boundary Dam Unit 3 near Estevan, Saskatchewan, according to Fred Eames, a lawyer with Hunton & Williams, who recently authored a white paper on CCS technologies for the National Coal Council. The project was designed to capture 90% of the CO2 produced from a 120 megawatt coal-fired unit, but its CO2 capture rate has been less than 65%, he said.

Other projects are underway such as a clean coal power plant being built by Southern Co.'s Mississippi Power in Kemper County, Miss. The 582 megawatt generating facility will convert lignite to gas and send it through a gasifer to create synthetic gas. The plant is expected to capture at least 65% of the CO2 produced, which will be transported along a 61-mile pipeline to Denbury Resources and Treetop Midstream Services and used for enhanced oil recovery.

But proponents say CCS facilities will help coal-fired power plants and other facilities reduce their CO2 output, meet environmental requirements and help avoid climate change. They say tax-exempt financing will help spread out the costs over a longer period of time.

Supporters also note that Congress allowed tax-exempt private activity bonds to be used to finance pollution control facilities from 1968 through part of 1986. But the Tax Reform Act of 1986 eliminated these financings, primarily because of Congress' concern about the revenue losses, as many tax-exempt bonds were issued for these facilities.

The Bennet/Portman bill would create a new category of exempt-facility bonds, which are tax-exempt private-activity bonds. The bonds could be used to entirely finance CCS facilities that capture and store at least 65% of the CO2 produced. If the capture and storage rate for a CCS facility is less than 65%, then bonds could be issued in an amount equal to the percentage of CO2 that would be captured and stored.

The legislation is written so that if a power plant has four units that each produce a ton of CO2 and the operator wants to build a $60 million CCS facility that will capture and store 80% of the CO2 from the first unit, the entire $60 million cost of the CCS facility can be financed with the new exempt facility bonds, without having to take into account the other three units.

The bonds could be issued with only a quarter of the amount of volume cap to minimize competition with other projects for PAB cap. For example, if a borrower wants to issue $400 million of bonds to finance a CCS facility, it would need to only obtain $100 million of volume cap from the state.

Most PABs are issued under state volume caps, which for 2016 will be the greater of $100 per capita or $302.88 million, according to the Internal Revenue Service. Each state has a limited amount of volume cap. Unused cap can be carried over three years.

In addition, the bill will ensure that if a governmentally-owned power plant or other facility finances a CCS facility and then contracts with a private company to take the CO2, this will not give rise to private use and payments that would make the governmental owner's tax-exempt bonds taxable.