Bank of America Corp.’s agreement to pay Assured Guaranty Ltd. $1.1 billion in mortgage put-backs sent bond insurer share prices up more than 20% on Friday.

Bond insurers have been battling some of the world’s biggest financial institutions, claiming that many of the mortgages packaged as asset-backed securities they guaranteed failed to meet underwriting standards.

That alleged failure violated the insurance contracts, the insurers say, causing them catastrophic losses. They want the banks to reimburse them and are seeking recoveries known as “put-backs.”

The Bank of America-Assured dispute, resolved without litigation, is the biggest such settlement so far for the battered bond insurance industry.

“It’s a major transaction,” said Sabra Purtill, managing director of investor relations at Assured. “This completely settles our reps and warranties dispute with them. It also provides us with substantial protection in the future on any deterioration in our first-lien portfolio that they securitized.”

Assured’s stock price jumped roughly 30% to as high as $18.40 on the news — a three-month high. It closed at $17.40.

Total repurchase claims against mortgage lenders totaled between $11 billion and $20 billion as of June 2010, according to a Moody’s Investors Service research note from September. Most of the claims are from Fannie Mae, Freddie Mac, and the Federal Home Loan Banks.

The largest bond guarantors — Ambac Financial Group, Assured, and MBIA Inc. — expect to recover more than $6 billion, according to Moody’s, which notes the figure is about one-third of the insurers’ lifetime residential mortgage-backed securities claims.

“Should guarantors succeed in putting back material amounts of non-performing loans, their claims-paying resources would be significantly strengthened, which is credit positive,” the Moody’s report said.

Bank of America sent Assured $850 million in cash Thursday to settle the case, which covers 29 transactions. The balance is due by March 31, 2012.

In addition to the $1.1 billion settlement, B of A agreed to a reinsurance arrangement that will reimburse Assured for 80% of all paid losses on 21 other residential MBS transactions until their aggregate collateral losses exceed $6.6 billion.

“This settlement significantly strengthens our balance sheet, allowing us to more effectively assist municipal issuers,” Dominic Frederico, Assured’s chief executive, said in a press release.

Assured’s total “recovery assumption” from breaches of contract totaled $1.7 billion, as of year-end 2010. That number could rise as Assured gains more access to loan files, though this transaction concludes any dispute with Bank of America.

“We and Assured are basically done,” Brian Moynihan, the bank’s chief executive, told investors in Friday’s first-quarter earnings call. “We have basically resolved virtually all of the controversies between our various companies and Assured.”

The various companies include Countrywide — which Bank of America acquired during the financial crisis.

While this settlement was outside of court, Assured is pursuing at least eight other mortgage-servicers to recover more putbacks. It has already sued three banks — JPMorgan Chase, Deutsche Bank and Flagstar Bank — to meet most of its other claims.

“They have refused to reimburse us under the terms of our contract for reps and warranty putbacks,” Purtill said of the other banks. “They are breach-of-contract claims, not fraud claims.”

Frederico said he hoped the settlement would encourage other representations and warranties providers to accelerate the claims-settlement process.

“We still have a substantial amount to collect from others,” Purtill added.

Chuck Noski, Bank of America’s chief financial officer, told investors that Assured “was the only one of the [six] monolines not suing us,” implying that out-of-court litigation is the way to produce results.

But insurers that are suing the bank for recoveries were equally pleased by the news.

MBIA chief financial officer Chuck Chaplin called the deal “yet another affirmation of the validity of both our claims and expected recoveries related to improperly originated mortgage loans in insured securitizations.”

MBIA was the biggest insurer before the financial crisis and is now the most active in pursuing putbacks through the courts. It expects to recover between $2.5 billion and $4.4 billion in putbacks, according to its year-end 2010 financial statements.

Its stock jumped 17% Friday to $10.48 on the news.

One hedge fund manager, who didn’t want to be identified, said the case was a possible game-changer for MBIA.

“All these deals are the same,” he said, referring to the insured MBS. “It’s the exact same stuff.”

Ambac Financial Group, the bankrupt parent of the second-biggest insurer prior to the crisis, also saw its shares climb 5% to $0.147.

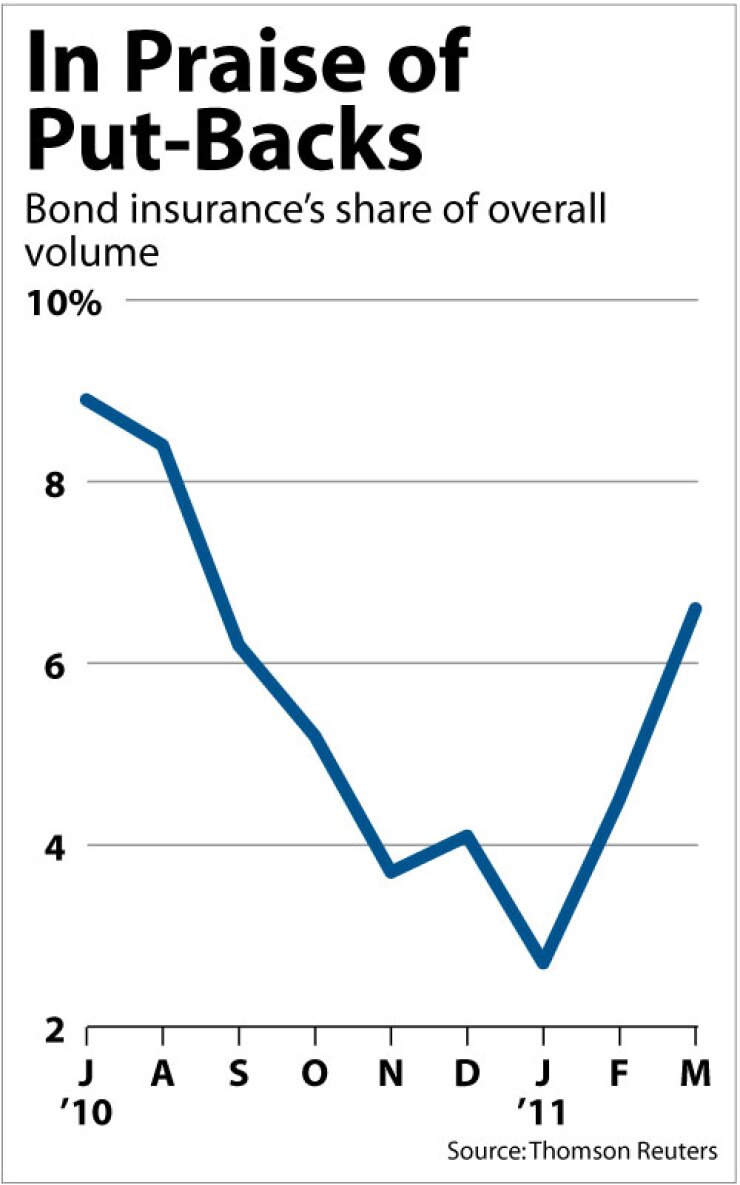

The Bank of America settlement comes at a precarious time for Assured. Its two platforms wrapped 201 issues for a total of $2.29 billion from January to March, or just less than 5% of total issuance, according to Thomson Reuters.

“It was clearly a very difficult period for the market overall and our production reflects that as well,” Purtill said.

However, looking at the quarter by month, Assured wrapped 2.7% of all bonds in January, 4.5% in February, and 6.6% in March — its best month since September. Not only did things progress in the first quarter, they did so after Standard & Poor’s proposed new ratings criteria that, if implemented, could turn Assured into a single-A-rated insurer.

“Despite the S&P announcement, the municipal market has shown great faith in our balance sheet and our financial strength,” Purtill said. “To us that is a strong statement that despite the limited issuance in the municipal market and despite the challenges that Assured is facing down with the rating agencies, there is still a core segment of the market that values and depends on bond insurance for credit protection.”