Municipal bonds were largely unchanged Wednesday, the first session in a week in which benchmark yield curves were not cut, while the primary provided more guidance for a supply-starved market. U.S. Treasuries were flat 10-years and in, but softer on the long bond and equities ended in the black.

Municipal to UST ratios rose slightly on the day's moves. The five-year was at 54%, 69% in 10 and 79% in 30, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the five at 51%, the 10 at 71% and the 30 at 79%.

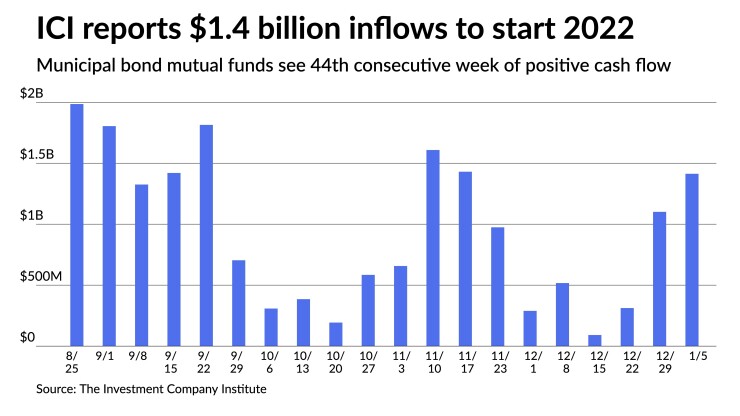

The Investment Company Institute reported $1.413 billion of inflows into municipal bond mutual funds in the week ending Jan. 5, up from $1.101 billion in the previous week.

It marked the 44th straight week of positive flows into the long-term funds. Exchange-traded funds saw inflows at $268 million after $588 million of inflows the previous week.

Over the last week, munis somewhat trailed the Treasury selloff due to tax-exempt supply constraints, said Matt Fabian, Partner at Municipal Market Analytics.

He said the sector has been repricing itself slowly — and perhaps begrudgingly — to keep pace with the movements in Treasuries.

“The yield increases have been more a function of housekeeping than they are weakness,” he said. “Weakness would follow selling, and there's still minimal selling pressure because there just aren't enough bonds available for people to own. So things that are scarce are valuable and rarely sold."

Supply is beginning to roll in and the primary action on Wednesday provided more direction.

In the negotiated market, RBC Capital Markets priced and repriced for Tomball Independent School District, Texas (Aaa/AAA///) $141.92 million of unlimited tax school building bonds, Series 2022 with up to one basis point bump. Bonds in 2/2023 with a 5% coupon yields 0.37%, 5s of 2027 at 0.94% (-1), 5s of 2032 at 1.39% (-1), 2.1s of 2037 on par, 2.4s of 2042 on par and 2.65s of 2047 on par, callable 2/15/2032.

In the competitive market, the Las Vegas Valley Water District (Aa1/AA//) sold $288.49 million of general obligation limited tax water improvement bonds to BofA Securities at a 2.678% true interest cost. Bonds in 6/2023 with a 5% coupon yield 0.39%, 5s of 2027 at 0.97%, 5s of 2032 at 1.35%, 4s of 2037 at 1.63%, 4s of 2042 at 1.82%, 4s of 2046 at 1.95% and 4s of 2051 at 2.04%, callable in 12/1/2031.

Stoneham, Massachusetts (/AA+//) sold $135.16 million of general obligation municipal purpose loan to J.P. Morgan Securities LLC at a 2.23% true interest cost. Bonds in 1/2023 with a 5% coupon yield 0.33%, 5s of 2027 at 0.84%, 5s of 2032 at 1.24%, 2.125s of 2037 at 2.125%, 3s of 2042 at 2.08%, 2.625s of 2047 at 2.60% and 2.5s of 2052 at 2.65%, callable in 1/15/2031.

Tomorrow will see the Chicago Board of Education's $862.65 million of GOs price as well as a Florida Board of Education competitive loan.

NYS, NYC to sell $6.9B bonds in Q1

New York State on Wednesday released its calendar of planned bond sales in the first quarter for New York State, New York City and their major public authorities.

Comptroller Thomas P. DiNapoli said the sales of $6.91 billion include $6.28 billion of new money and $630 million of refundings and reofferings.

About $2.33 billion is scheduled for sale in January, $2.15 billion of which is new money and $179 million of which is for refundings or reofferings.

Around $1.61 billion is scheduled for sale in February, $1.15 billion of which is new money and $451 million of which is refundings.

About $2.97 billion scheduled for sale in March, all of which is new money.

The anticipated sales in the first quarter compare to past planned sales of $5.05 billion in the fourth quarter of 2021 and $6.92 billion in the first quarter of 2021.

The calendar includes expected sales by the Dormitory Authority of the State of New York, the Metropolitan Transportation Authority, the New York City Municipal Water Finance Authority, the New York City Transitional Finance Authority, the New York Liberty Development Corp., the New York State Housing Finance Agency, the New York Transportation Development Corp. and the Triborough Bridge and Tunnel Authority.

Informa: Money market muni funds fall

Tax-exempt municipal money market fund assets reduced their total by $630.3 million, bringing their total to $87.32 billion for the week ending Jan. 10, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 150 tax-free and municipal money-market funds remained at 0.01%.

Taxable money-fund assets lost $21.2 billion, bringing total net assets to $4.538 trillion in the week ended Jan. 4. The average seven-day simple yield for the 777 taxable reporting funds was steady at 0.01% from a week prior.

Secondary trading

Puerto Rico general obligation bonds traded up again on Wednesday following news

Energy Northwest in Washington 5s of 2023 at 0.38%. Ohio 5s of 2023 at 0.39%. California 5s of 2024 at 0.63%. Delaware 5s of 2024 at 0.54% versus 0.48% Friday. Oregon 5s of 2024 at 0.55%.

New Hampshire Municipal Bond Bank 5s of 2026 at 0.67%. Indiana Finance Authority Parkview healthcare 5s of 2026 at 0.98%. Ohio 5s of 2026 at 0.85%.

San Antonio, Texas 5s of 2027 at 1.08%-1.04% versus 0.98% Monday. New York City TFA 5s of 2028 at 1.10%-1.08%. Charleston County, South Carolina 5s of 2029 at 1.11% versus 1.12% Tuesday.

New York City waters 5s of 2031 at 1.24%.

University of California 5s of 2034 at 1.48%. New York City 5s of 2036 at 1.61%.

Triborough Bridge and Tunnel Authority 5s of 2041 at 1.67%-1.65%. California 5s of 2041 at 1.63% versus 1.67%-1.65% Tuesday and 1.56%-1.55% Monday.

AAA scales

Refinitiv MMD's scale saw unchanged on bonds in 2023-2024, a one-basis point cut on bonds in 2025-2026 and unchanged thereafter at the 3 p.m. read: the one-year at 0.33% and 0.46% in two years. The 10-year at 1.19% and the 30-year at 1.65%.

The ICE municipal yield curve showed yields were unchanged: 0.31% in 2023 and 0.50% in 2024. The 10-year was 1.22% and the 30-year yield was 1.65% in a 4 p.m. read.

The IHS Markit municipal analytics curve was unchanged: 0.34% in 2023 and 0.47% in 2024. The 10-year at 1.19% and the 30-year at 1.67% as of a 4 p.m. read.

Bloomberg BVAL was unchanged: 0.33% in 2023 and 0.47% in 2024. The 10-year at 1.22% and the 30-year at 1.66% at a 4 p.m. read.

Treasuries were flat 10-years and in and weaker by two basis points on the 20- and 30-year while equities ended in the black.

The five-year UST was yielding 1.502%, the 10-year yielding 1.737%, the 20-year at 2.139% and the 30-year Treasury was yielding 2.084% at the close. The Dow Jones Industrial Average gained 38 points or 0.11%, the S&P was up 0.28% while the Nasdaq was up 0.23% at the close.

Inflation

The economy and Federal Reserve policy are in transition and policymakers are trying to curb inflation that until recently they termed transitory, analysts said.

“The surge and broadening of inflation has been a red flag for the Federal Reserve,” said Grant Thornton Chief Economist Diane Swonk. “They have pivoted from being patient to panicking on inflation in record time.” She expects a March liftoff and balance sheet reduction “soon after” despite the impact of the Omicron variant.

Another change, Swonk said, is variants are now viewed by policymakers as inflationary, not “disinflationary given the havoc they reap on supply chains.” Yet Omicron is forcing some low-wage earners to tap savings and business to close temporarily as a result of ill workers, she said.

“This is the first time the Fed has chased instead of trying to preempt a nonexistent inflation since the 1980s,” Swonk said. “Brace yourselves.”

Indeed, the consumer price index gained 0.5% in December, while the core rate rose 0.6% in the month, both a tick higher than projected, while CPI jumped 7.0%, as expected, on an annual basis, the fast pace since 1982, and the core climbed 5.5% year-over-year.

“If CPI inflation is still around 7% heading into the March FOMC meeting, as we expect it to be, it will be hard for the Fed to stand by idly,” said Wells Fargo Securities Senior Economist Sarah House.

“Inflation has thus far outpaced nominal wage increases and reduced real wages for broad swathes of the labor force,” said Berenberg Capital Markets Chief Economist for the U.S. Americas and Asia Mickey Levy. “Amid a tight labor market in which the balance of power is shifting toward workers, nominal wages are expected to accelerate partly to catch-up to inflation.”

With Wednesday’s CPI and “a fast-tightening labor market,” JPMorgan Funds Chief Global Strategist David Kelly and market insights research analyst Stephanie Aliaga said, “the Federal Reserve could increase the fed funds rate four times this year (once more than in its December projections), with liftoff beginning in March.”

But the economy and monetary policy are transitioning, said Scott Wren senior global market strategist Wells Fargo Investment Institute. “Worries of potential Fed mistakes and higher interest rates often unnerve investors at this point in the cycle,” he noted. “Economic and earnings growth concerns come to the forefront. COVID-19 headwinds also come into play.”

Investors should prepare for a more bumpy road than they’ve traveled in the past 20 months, he said, but opportunities exist.

“Persistent high inflation rates together with the recent strong labor market data reinforce the hawkish narrative provided by the Fed,” said DWS Group U.S. Economist Christian Scherrmann. He expects liftoff as early as March although Omicron will “dictate the fate of the economy in January and maybe in February.”

Omicron, he said, could prevent progress toward maximum employment, but “it also has the potential to push inflation and therefore inflation expectations up further, possibly implying even more rate hikes down the road than the three to four which are currently anticipated by market participants.”

Inflation will remain elevated into next year, said Jim Smigiel, chief investment officer at SEI. “Many investors would have benefited from having a measure of inflation protection in their portfolios in 2021,” he said. “We always believe some exposure to inflation-sensitive assets is useful and suspect that may be even more so in the year ahead.”

But 2022 will bring volatility to the markets, based on “rising interest rates and uncertainty about the path of the pandemic.”

But, Smigiel doesn’t “see signs of an impending recession on the horizon” and remains optimistic “global growth will re-accelerate as this latest COVID wave fades.”

While inflation has persisted longer than originally expected, it should moderate in the next 12 months, said Nick Hayes, head of fixed income allocation & total return at AXA Investment Managers. “Unfortunately, that fuels probably equal amount of hawkish and dovish rhetoric which probably means that we live in a world of heightened rates volatility for the seeable future.”

While the situation has been termed “persistently transitory,” he said, that phrase “amusingly probably doesn’t add much clarity.”

The question of will the Fed liftoff has been replaced by how many rate hikes will come, Hayes said. “With rate volatility should come risk asset volatility and with it comes opportunities to add risk to create better returns in 2022 than many fixed income investors saw in 2021.”

But not everyone sees inflation continuing into 2023. “The Fed is in a real conundrum,” said Ron Temple, head of U.S. Equities at Lazard Asset Management. “Inflation is likely to recede during the first quarter, but the pressure on households from broader inflation metrics is real and intense. The Fed is walking a tightrope where it might begin tightening just as inflation is falling and economic growth is decelerating.”

Although he supports tapering and liftoff, he sees inflation falling “materially as episodic factors like used cars subside, raising questions on the need for further tapering and additional rate hikes. The Fed should move ahead, but cautiously as the outlook is not as clear as it might appear.”

While inflation should decelerate later in the year, wage pressure provides an upside risk, according to Wilmington Trust economists. “Key components to watch will be disruption related sectors (used and new cars, furniture, apparel) and rent related measures.”

Turning to the composition of the Fed Board, Luke Tilley, chief economist at Wilmington Trust, sees the Powell renomination as providing continuity, but the departure of Vice Chair Richard Clarida removes “one of only two career economists, along with Chris Waller, on the Board.”

The Board will likely tilt “slightly dovish” this year, and with Clarida leaving, it “probably elevates the voices of Waller, the Board staff, and Reserve Bank presidents on the FOMC.”

Separately, the Beige Book, released Wednesday, reported “modest” economic growth, with supply chain issues and labor shortages holding back further gains.

Modest gains in employment were seen, and prices gained with some deceleration, but the outlook has softened. “Although optimism remained high generally, several districts cited reports from businesses that expectations for growth over the next several months cooled somewhat during the last few weeks,” the report said.

Primary to come

Louisiana (Aa2/AA-//) is set to price Thursday $651.035 million of taxable gasoline and fuels tax revenue refunding bonds, 2022 Series A. Wells Fargo Bank.

Comal Independent School District in Texas (Aaa//AAA/) is set to price Thursday $445.825 million of unlimited tax school building bonds, Series 2022, serials 2023-2047, insured by Permanent School Fund Guarantee Program. Raymond James & Associates.

The

Coast Community College District in Orange County, California, (Aa1/AA+//) is set to price Thursday $206.73 million of federally taxable 2022 general obligation refunding bonds, serials 2022-2037, term 2039. RBC Capital Markets.

The Rhode Island Housing and Mortgage Finance Corp. (Aa1/AA+///) is set to price Thursday $138.145 million of homeownership opportunity bonds, consisting of $124.345 million of non-alternative minimum tax social bonds, Series 76A and $13.8 million of federally taxable social bonds, Series 76-T. J.P. Morgan Securities.

Cuyahoga County, Ohio, (/AAA//) is set to price Thursday $123.39 million of tax-exempt Sales tax revenue bonds, Series 2022A, for the Ballpark Improvement Project. KeyBanc Capital Markets.

New Mexico Mortgage Finance Authority (Aaa///) is set to price Thursday $100 million of tax-exempt, non-alternative minimum tax single family mortgage program Class I bonds, 2022 Series A, serials 2023-2034, terms 2037, 2042, 2047, 2052 and 2053. RBC Capital Markets.

Competitive:

The Port of Seattle (Aaa/AA-/AA-/) is set sell $94.645 million of taxable, limited tax general obligation and refunding bonds, Series 2022B at 11:30 a.m. Thursday. This issuer is also set sell $15.73 million of alternative minimum tax, limited tax general obligation bonds, Series 2022A at 11 a.m. eastern Thursday.

Chip Barnett contributed to this report.