-

Foothill-Eastern Transportation Corridor Agency, one of two toll systems operated by The Transportation Corridor Agencies, received a ratings boost to A3.

January 16 -

The Florida train is struggling to generate enough revenue to pay its debt.

January 16 -

"There are big credit differences between Chicago and New York City," said an investor.

January 16 -

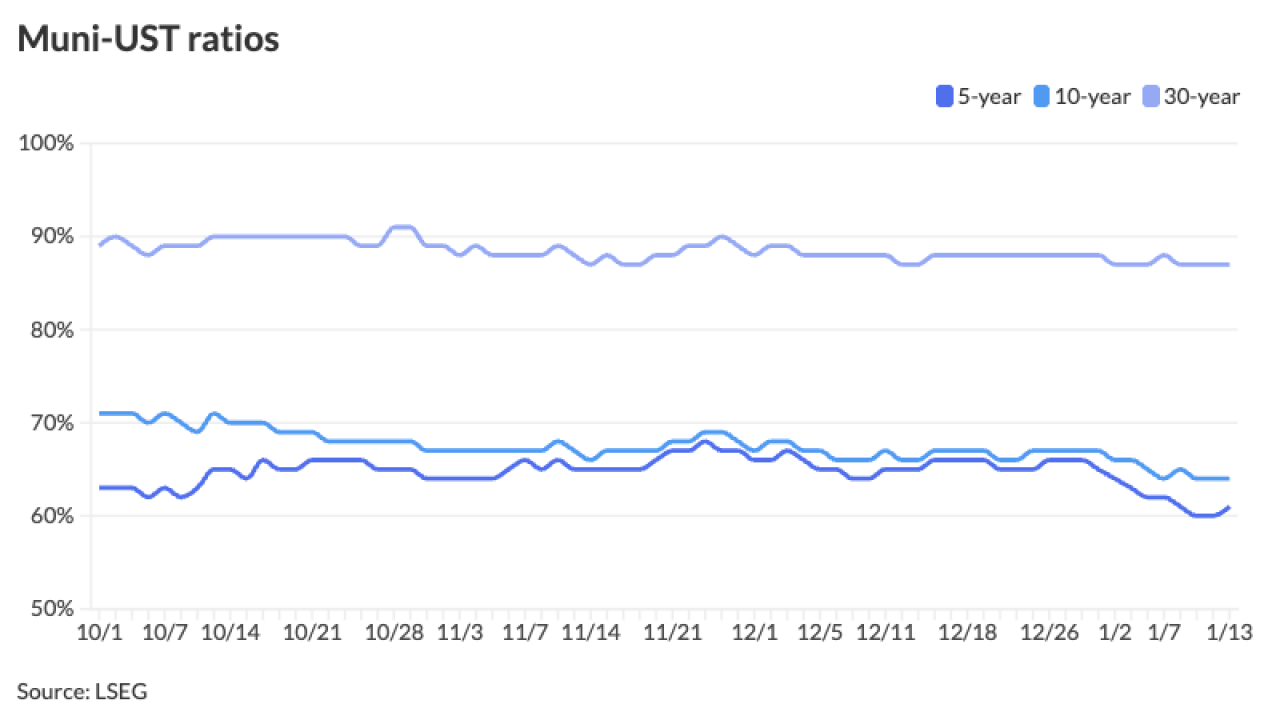

"We're starting off from a really high tax equivalent yield and that really starts the market from a position of strength," said Matt Norton, CIO for municipal bonds at AllianceBernstein.

January 15 -

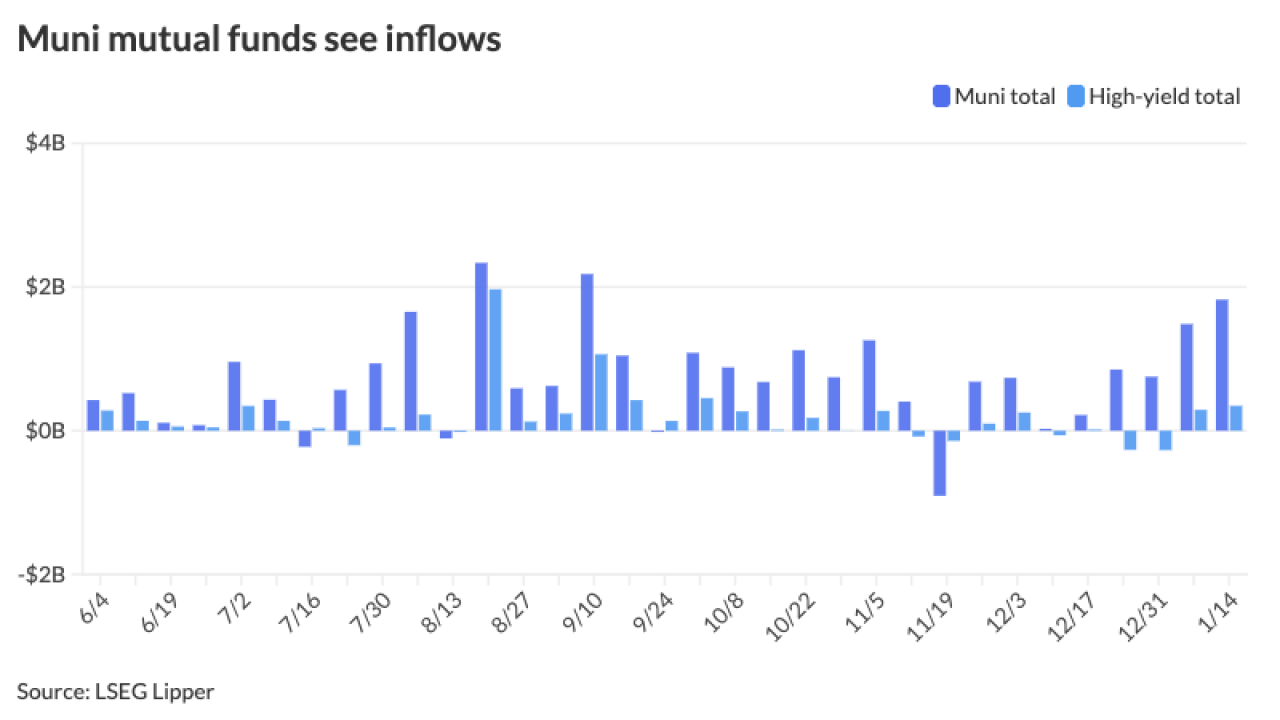

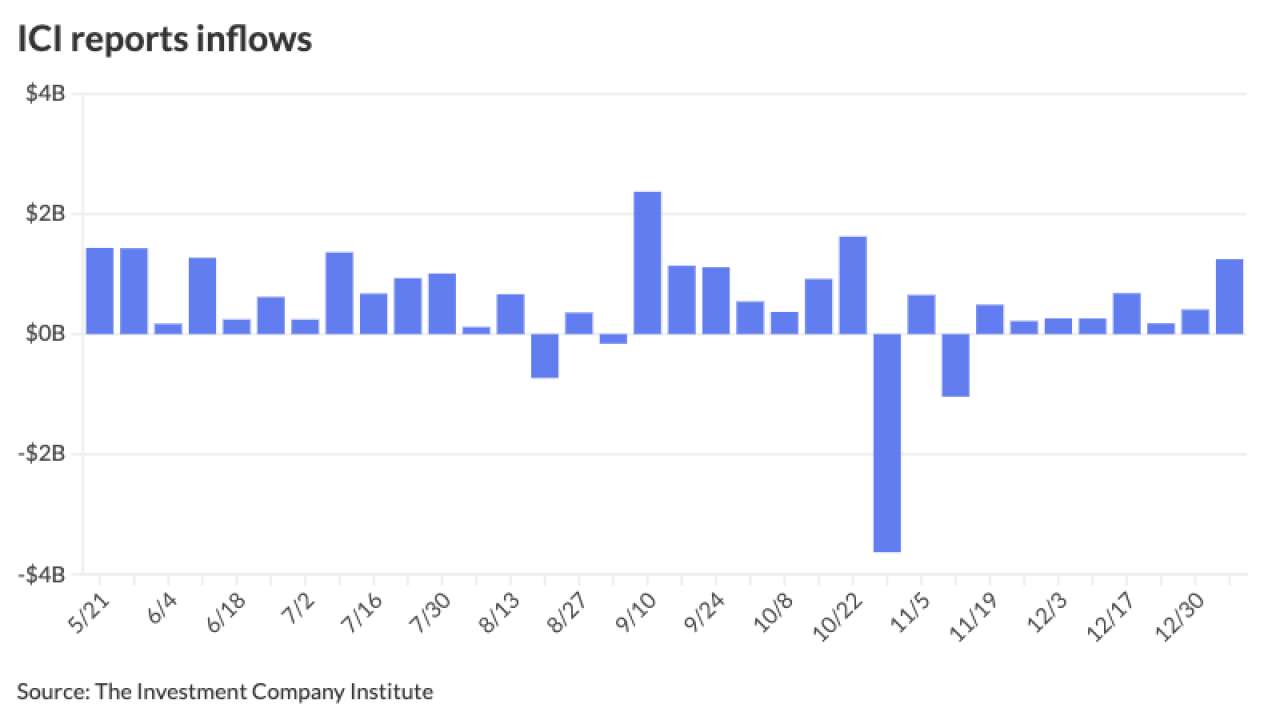

January got off to a good start, with muni yields rallying through Jan. 7. Since then, yields have been steady to slightly richer in spots, with muni yields seeing some strength in the front end and belly of the curve.

January 14 -

Eurostar veteran Nicolas Petrovic will oversee the Florida system while Mike Reininger will focus exclusively on Brightline West.

January 14 -

Moody's Ratings downgraded Fridley Independent School District three notches, to Ba3 from Baa3, and placed its bond ratings under review for downgrade.

January 14 -

"The bond market breathed a sigh of relief this morning as the CPI inflation numbers came in a tad weaker than expected," said John Kerschner, global head of securitised products and portfolio manager at Janus Henderson Investors.

January 13 -

The rating agency lifted the state's general obligation and other ratings by a notch, citing well-established and prudent governance practices.

January 13 -

Maryland is currently battling federal job losses and string of financial challenges but is starting the new year with a new triple-A rating on its general obligation bonds complete with a stable outlook.

January 13