-

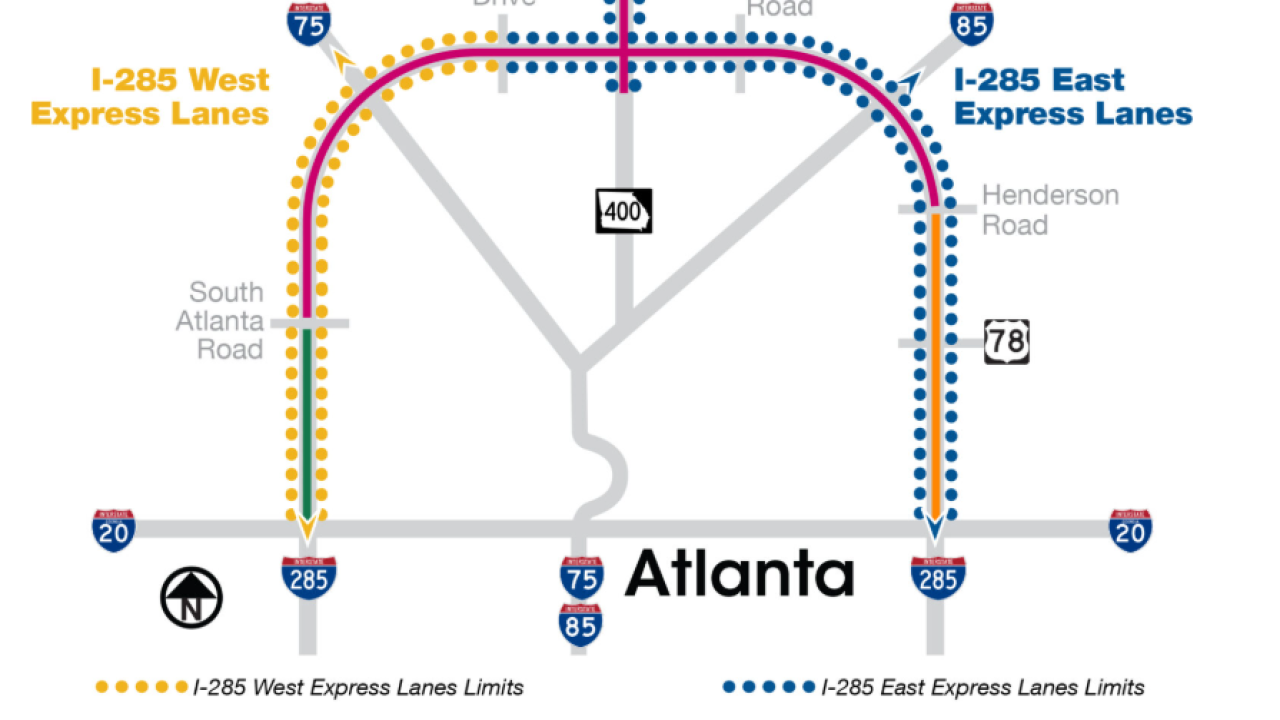

The project was the Georgia's first revenue-risk P3 and lays the groundwork for future express lane P3s.

November 20 -

The market is in a bit of a lull right now as it braces for a deluge of economic data, which could spark volatility, said Jeff Timlin, a partner at Sage Advisory.

November 19 -

The rating agency lowered the outlook to stable on its A-plus rating, saying Pennsylvania didn't do itself many favors in its fiscal 2026 budget season.

November 18 -

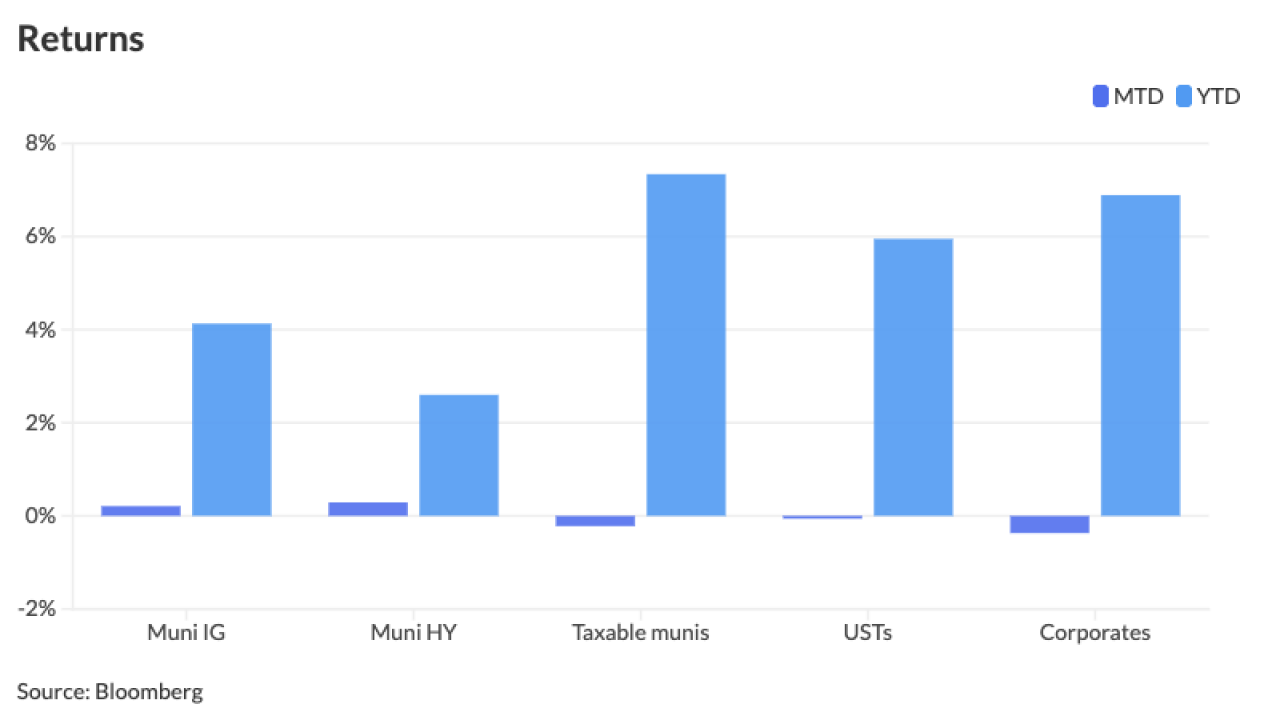

The muni market has "demonstrated more conviction with steady demand and appealing relative yields weighing on the long-end while shifting dynamics on the short-end have led to municipals selling-off," said Tim Iltz, fixed income credit and market analyst at HJ Sims.

November 18 -

Chicago Mayor Brandon Johnson is seeking City Council approval of $1.8 billion in new money general obligation bonds and $2 billion in refunding authority.

November 18 -

The massive I-285 East express lanes project in metro Atlanta will be procured in two phases.

November 18 -

Moody's placed a negative outlook on the higher education earlier this year. 2026 looks even more uncertain, according to a new report from the rating agency.

November 18 -

The "data dumps" over the next several weeks could lead to market volatility, said Abdulla Begai, director and fixed income portfolio management at A&M Private Wealth Partners.

November 17 -

Moody's cited the airport's "significant improvement in liquidity" and "continued enplanement recovery" in its decision to upgrade the rating to Aa3.

November 17 -

Ten winners across five regions and five additional categories will be celebrated Dec. 2 in New York City, where one will be crowned the overall Deal of the Year.

November 17