-

The Office of Tax-Exempt Bonds has been staffing up, IRS officials said at the National Association of Bond Lawyers conference in Chicago.

September 19 -

The ratio of local government municipal debt to GDP in aggregate has fallen to around 10% from 20% in 2010.

September 19 -

"We, the city of Philadelphia proper, we can't do it alone," Parker said in a keynote address at The Bond Buyer Infrastructure conference Tuesday. "We are grateful to our state and our federal partners, as well as the bond market."

September 18 -

The Republican presidential nominee reverses course on his own policy

September 18 -

"It's great people are thinking about creative solutions, but don't forget the rules still apply," said the SEC's Dave Sanchez.

September 18 -

The Financial Industry Regulatory Authority found that the firm had not included the non-transaction-based compensation indicator on 23,000 municipal securities transactions.

September 18 -

The commission charged the municipal advisors $1.3 million in penalties due to recordkeeping failures stemming from use of unmonitored communications, such as text messages, to conduct business.

September 17 -

Current FHWA deputy administrator Kristin White will serve as acting administrator until a successor is named.

September 13 -

NAFOA is supporting passage of the Tribal Tax & Investment Reform Act, which would free up tribal bond issuance.

September 13 -

President Joe Biden's so-called billionaire tax supported by Vice President Kamala Harris, which would tax unrealized gains from assets including bonds, would raise $500 billion over 10 years, according to Sen. Elizabeth Warren, D-Mass.

September 13 -

The agencies are overstepping their statutory authority in trying to force the market to adopt a new securities identifier, says the American Bankers Association.

September 12 -

A report by the Securities Industry and Financial Markets Association shows that the move to a T+1 settlement cycle has struck the right balance between increasing efficiencies and mitigating risk.

September 12 -

House Republicans are once again careening towards a government shutdown

September 12 -

The candidates touched on muni-adjacent issues like energy policy, housing and tariffs but offered little new information on infrastructure proposals or tax policies.

September 11 -

The House Financial Services Committee held a hearing Tuesday examining the practices of proxy advisors and their relationship with ESG investing.

September 11 -

Issuance as of Wednesday is at $345.327 billion, a 32.7% increase over 2023. The Bond Buyer 30-day visible calendar on Monday was at $20.02 billion, the largest in nearly four years.

September 11 -

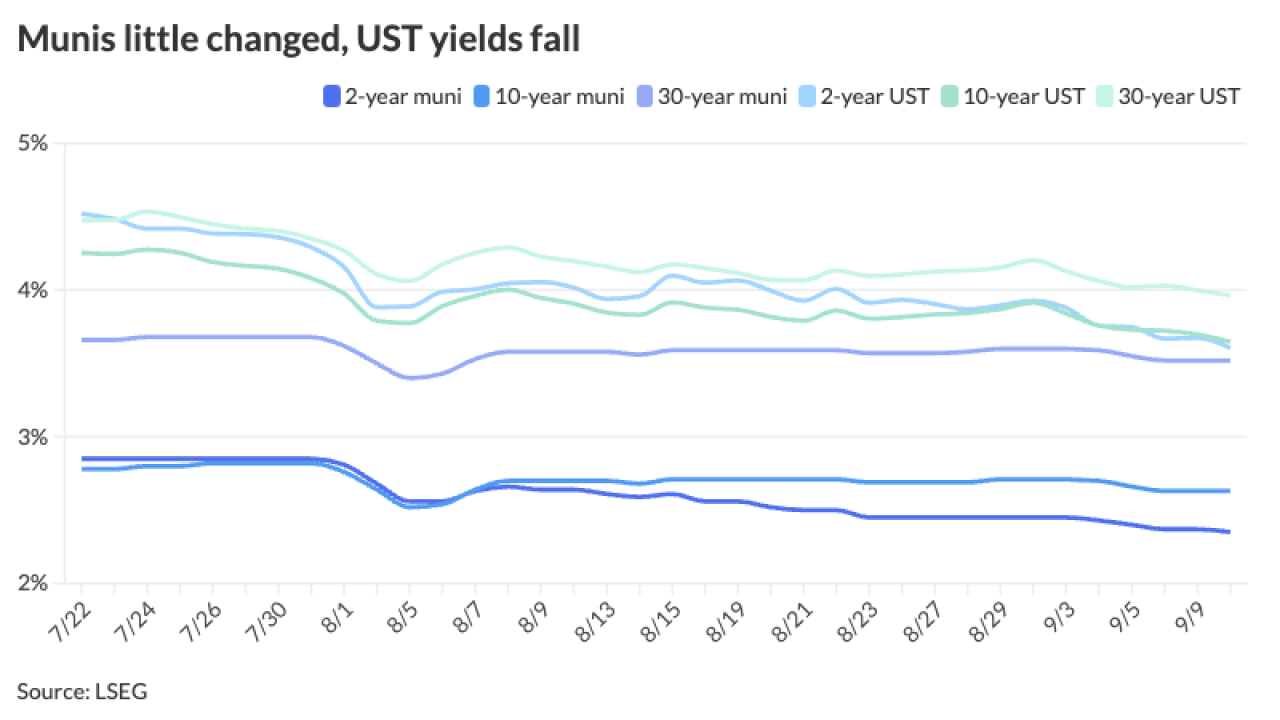

Municipals lagged the UST moves again, cheapening ratios and creating a valuable entry point for investors looking for compelling taxable equivalent yields, particularly 10-years and out.

September 10 -

Environmental regulations under fire in California.

September 9 -

The high-grade issue is expected to be well received by the market. D.C. joins a growing list of issuers refunding outstanding BABs amid lower rates.

September 9 -

It's the latest proposal for a type of national infrastructure financing structure in lieu of the municipal bond market.

September 6