-

Public pensions that relied on equity growth to ease unfunded liabilities could face a harsher reality, experts told The Bond Buyer's Texas Public Finance Conference.

February 26 -

Moody's calls the missed payments an administrative default given the district's willingness and ability to pay.

February 25 -

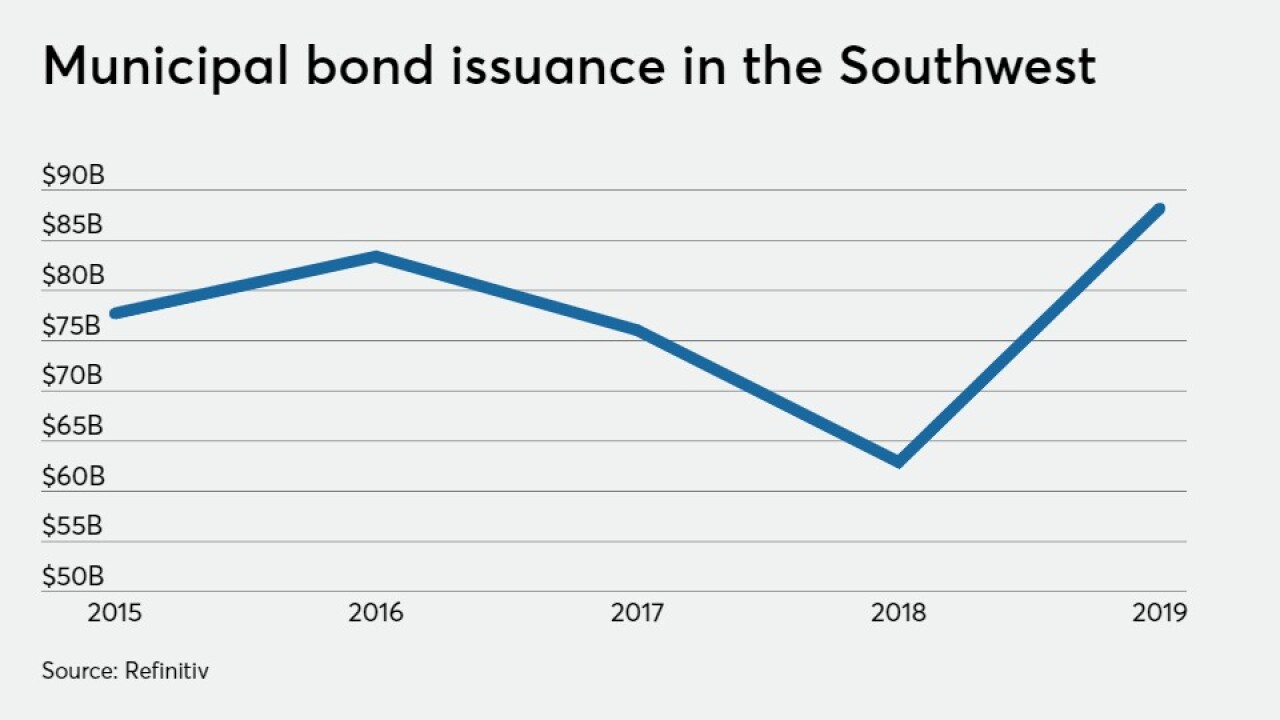

Issuers in the region sold $78.2 billion of bonds in 2019, a 24% year-over-year gain driven by growth in Texas and Colorado.

February 24 -

A nonprofit corporation will use the taxable and tax-exempt bonds to buy or refinance 28 skilled nursing facilities in Oklahoma and Texas.

February 14 -

Amarillo city officials are asking voters to go to the polls in May to decide the fate of a $275 million bond issue to help fund a proposed $319 million Civic Center expansion and renovation project.

February 12 -

After a record year of sales tax revenue, Texas continued to grow collections in the first month of 2020.

February 5 -

After two recounts produced different results, the Midland Independent School District's $569 million measure bond fell 26 votes short.

January 27 -

The proceeds of the bonds were used for the construction of a 232,100 square foot residential facility with 108 living units located on the main campus of an existing facility in Dallas known as The Overlook.

January 16 -

The first hard evidence of how this is affecting ratings in the public finance sector came from a downgrade two months ago involving Princeton Community Hospital in West Virginia.

January 14 -

The last-ditch attempt to settle Preston Hollow Capital's lawsuit against Nuveen failed this week.

January 10