-

Voters in three states approved Medicaid expansion, highlighting dozens of ballot measures around the country that will impact budgets and credit.

November 7 -

Gage County had consulted a bankruptcy attorney, who told officials it wouldn't qualify for Chapter 9.

October 22 -

Agencies across the country said the case filed by a Florida utility could expose them to "unprecedented" federal oversight of public power contracts.

October 12 -

The three states are in the bottom of a ranking of state fiscal conditions by the Mercatus Center at George Mason University.

October 10 -

Volume was off in eight of the region's 11 states in the wake of tax reform and the end of advance refundings.

August 21 -

Iowa, Kansas, Nebraska and North Dakota are vulnerable to a trade war, Moody's Investors Service says.

August 7 -

Voters approved Omaha Public Schools' $410 million bond referendum and another district's $510 million measure.

May 16 -

Failure at the ballot may require Omaha Public Schools to lean more on its general fund dollars for repairs needed to keep schools fully operational.

April 10 -

Employers in New York also are allowed to implement a 5% payroll tax as a way of paying some of their employees’ state income taxes.

April 6 -

Issuers in the Midwest sold $82.98 billion of debt last year, a 5% drop from 2016.

February 27 -

The governor wants to neutralize the effects of the new law to make it revenue-neutral for the state government.

January 29 -

Columbus Public Library Director Drew Brookhart has a lot to think about over the days, weeks and months ahead.

April 17 -

The Omaha City council is considering several revenue streams to support borrowing that would help finance a proposed $156 million streetcar system.

March 6 - Nebraska

Lagging Nebraska tax revenue resulted in a new cut to the states revenue forecast.

February 28 - Michigan

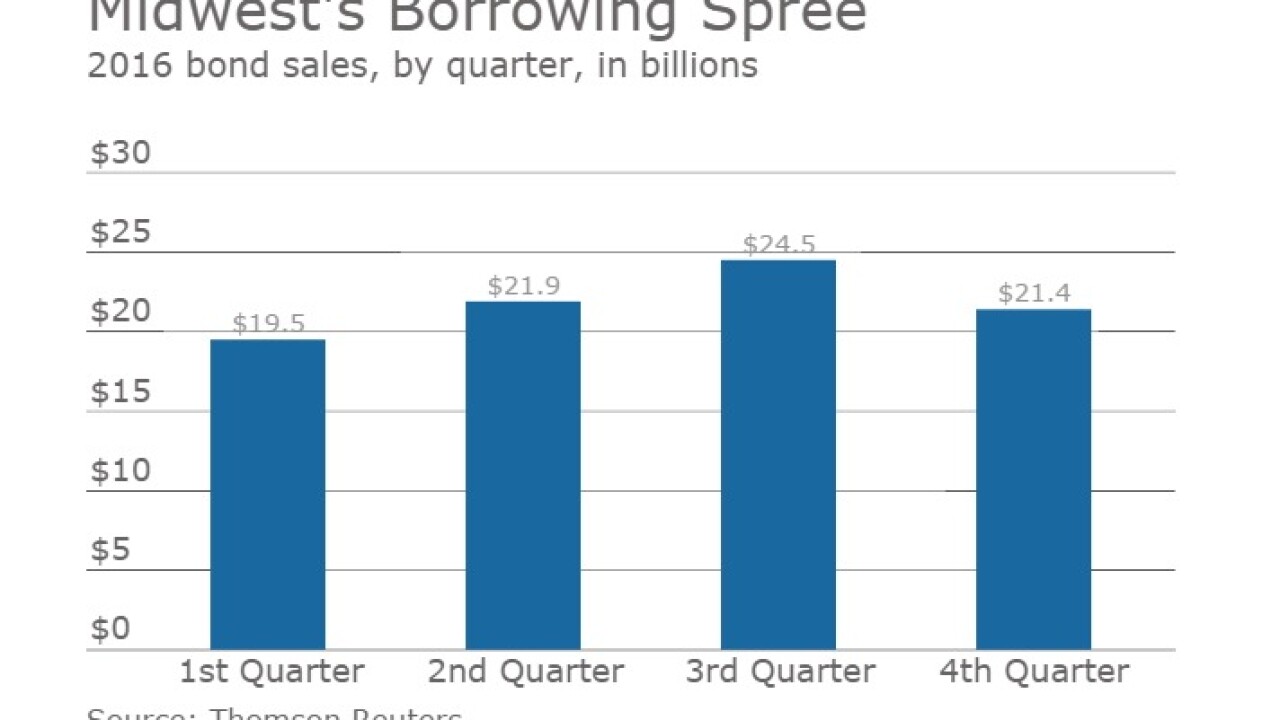

Issuers in the Midwest sold $87.2 billion of municipal bonds in 2016, a 23.4% year-over-year increase that was the biggest of any region.

February 14 - Nebraska

Most Nebraskans could see an income tax cut beginning in 2020 under a tax overhaul proposal Gov. Pete Ricketts announced Thursday.

January 12 - Nebraska

Nebraska Gov. Pete Ricketts will deliver his State of the State address Thursday, which will focus on the release of a new two-year budget and his plan to deal with a $276 million deficit in the current budget.

January 9 - Oregon

Tax and bond measures found success in California and Washington on Election Day.

November 9 -

The Nebraska Farm Bureau says a community colleges $369 million bond question on the November ballot would lead to a massive property tax increase on farmers, business, and homeowners in southeast Nebraska.

September 28 - Nebraska

Ralston, Nebraskas general obligation arena bonds were dropped seven notches to junk by S&P Global Ratings after the project has struggled to produce the revenue needed to repay the debt.

September 21