-

Wilshire Consulting said the aggregate funded ratio for U.S. state pension plans remained unchanged between and first and second quarters of 2018 at 70.8%, up 0.7 percentage points from the previous 12 months.

August 27 -

The proposed Treasury rules would limit states' use of charitable deductions as workarounds for the $10,000 cap on the federal deduction for state and local taxes.

August 23 -

A report on cyber-related risks released Wednesday by S&P Global warned that “a successful attack on an entity with limited resources could have a credit impact.”

August 22 -

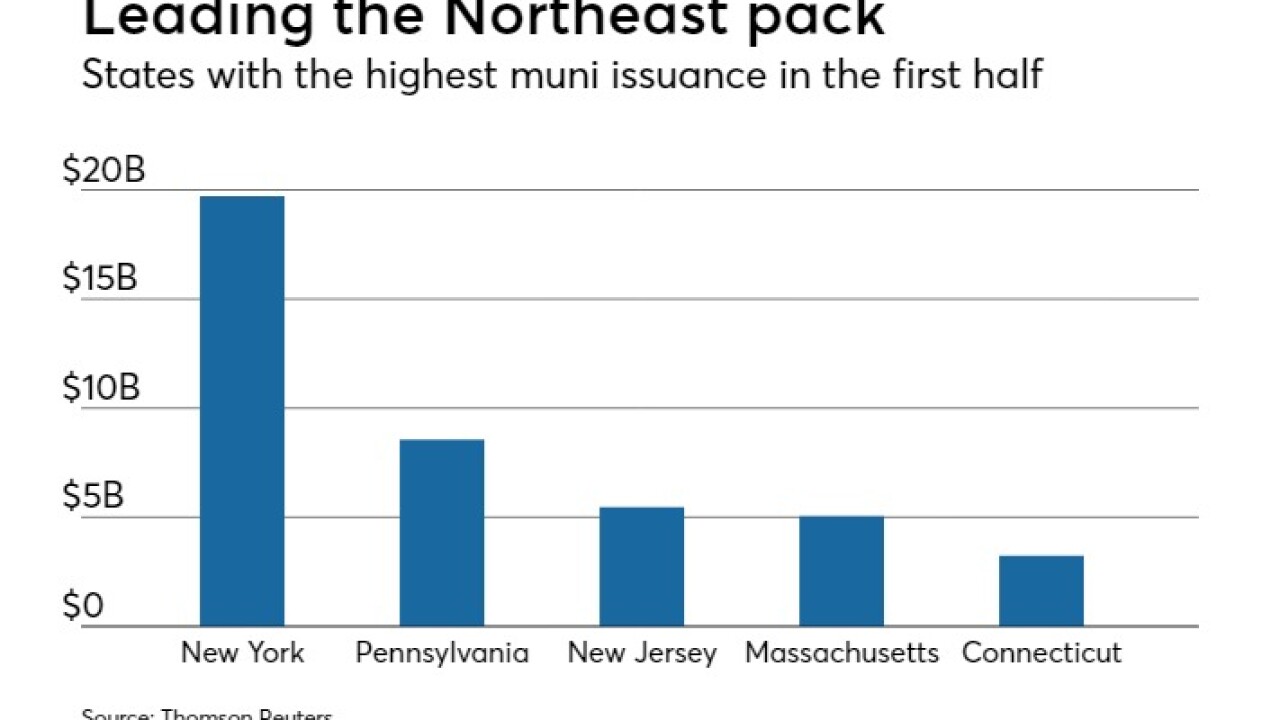

Northeast municipal bond issuance sank 11.7% in the first half of 2018 compared to a year earlier, reflecting a national trend driven by federal tax changes.

August 17 -

The Trump administration’s effort to publish a proposed rule comes just over two months after the IRS announced May 23 it was working on the regulations to enforce the $10,000 cap on what previously was an unlimited personal deduction of state and local taxes, also known as SALT.

August 6 -

Tax Reform 2.0 would make permanent the lower individual tax rates in last year’s Tax Cuts and Jobs Act that are scheduled to expire in 2025.

July 26 -

A Civil War-era revenue measure is the centerpiece of the arguments in the lawsuit filed by four northeastern states.

July 18 -

The University of Maryland at Baltimore County told the legions who became instant fans Friday night: Come to our new municipal-bond financed events center.

March 20 -

Northeast municipal bond issuance was up 4% from 2016 to $121.3 billion.

February 23 -

The merger would create the fifth-largest Catholic health system in the country.

February 22