-

The whistleblower responsible for federal investigations and lawsuits accusing banks and broker-dealers of fraud and collusion in the remarketing of variable rate demand obligations will likely be forced to go public because of a recent ruling by Massachusetts’ highest court.

October 5 -

The not-for-profit university closed on a $195 million privately placed refunding that eases debt service demands.

October 3 -

Illinois-based OSF Healthcare System will refund $470 of debt this week and next.

October 1 -

Moody's boosted its outlook for the University of Illinois to stable from negative ahead of the deal.

September 28 -

The state Supreme Court upheld a law that safeguards local property tax exemptions for the hospitals.

September 26 -

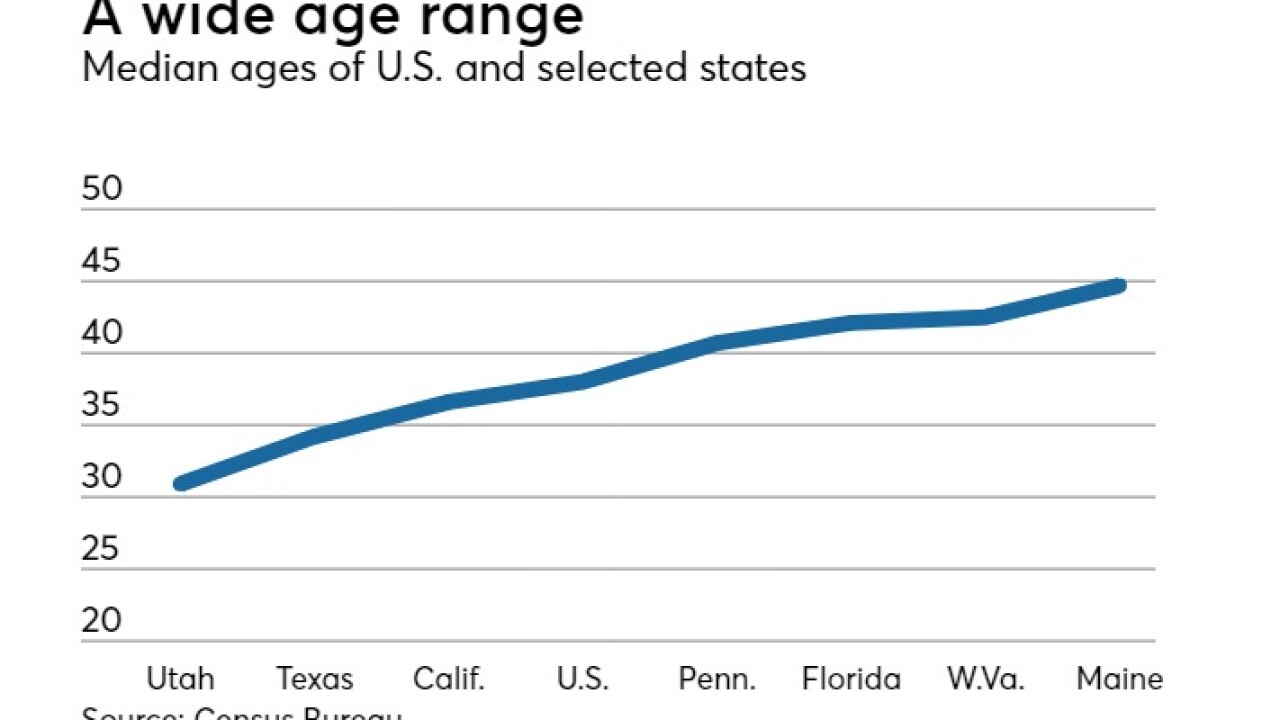

In an aging nation, Texas is showing the strongest demographic trends, according to S&P Global Ratings.

September 25 -

Candidates in the mayoral and governor's races acknowledge daunting pension burdens without offering concrete solutions.

September 25 -

State Comptroller Susana Mendoza blames Gov. Bruce Rauner for the two-year budget impasse, which she called a "man-made calamity." Paul Burton and Chip Barnett host.

September 25 -

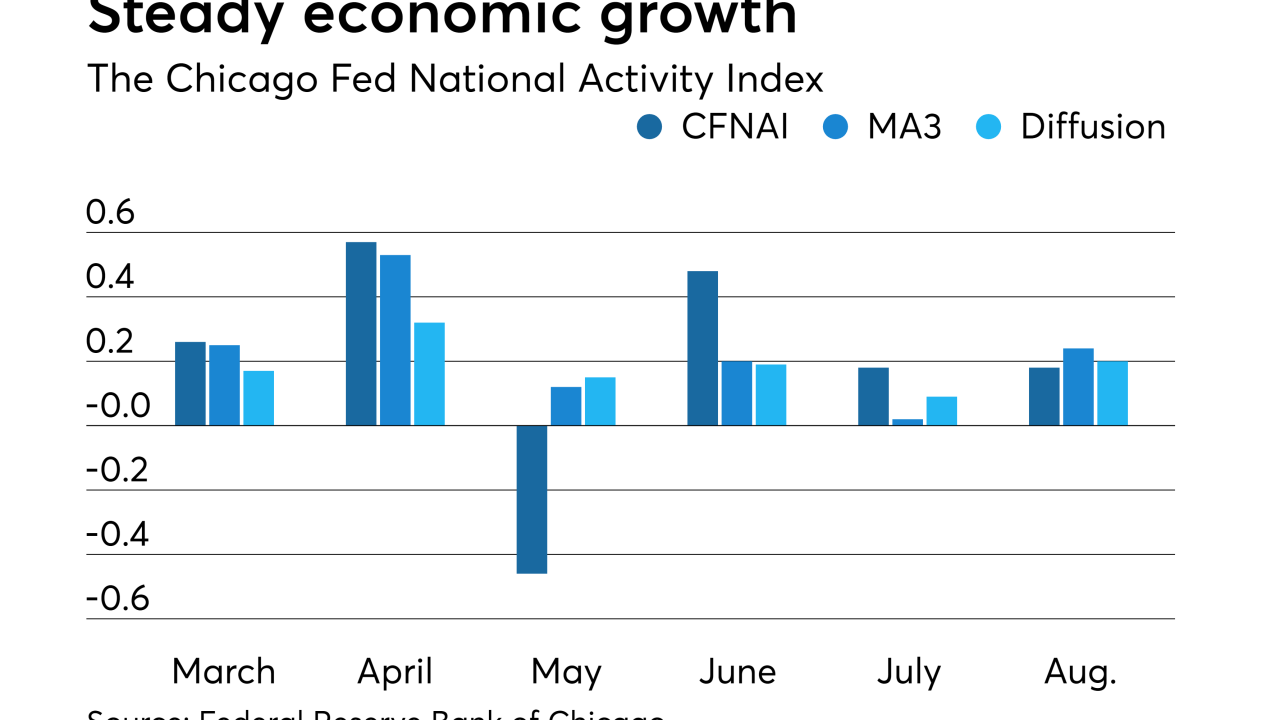

The Chicago Fed National Activity Index was unchanged at +0.18 in August.

September 24 -

The district will bring $75 million of new money and refunding bonds to market.

September 21 -

FINRA examiners alleged Mesirow violated disclosure and supervisory rules.

September 21 -

Lombard sold $3.9 million of unrated GOs in its first market test after reneging on a pledge to support bonds sold to fund a hotel.

September 21 -

Alton still needs a long-term public safety pension funding solution, S&P Global Ratings said as it downgraded the city.

September 20 -

New Illinois measures help without attacking the state's real budget problems, according to Moody's Investors Service.

September 19 -

The Chicago suburb will sell $3.9 million of GOs in its first bond market appearance after allowing hotel project bonds to default.

September 18 -

Thefirefighters' pension fund says Chicago shorted it $3.3 million, and wants to use an Illinois law to intercept state grant funds.

September 14 -

The authority hasn't sold bonds since 2010.

September 12 -

A $10 billion POB deal would be a tougher sell now that Rahm Emanuel has said he won't seek another term.

September 11 -

Bondholders are going after the city, county officials, and a court-appointed water receiver to ensure future payments.

September 7 -

The Securities and Exchange Commission has sent letters to the 12 top banks and broker-dealers that remarket variable rate demand obligations, seeking information and documents on their remarketing and rate resetting practices.

September 6