-

In a supply-challenged market, foreign investors can play a role in buying taxable munis. 16Rock Asset Management's James Pruskowski discusses a 2023 reset in the muni market. Lynne Funk hosts (29 minutes)

May 2 -

Las Vegas sees March visitor totals similar to pre-pandemic March 2019, putting in on solid fiscal footing.

May 1 -

Municipals were in the red to close out April, down 0.2%, per the Bloomberg Municipal Index, but are in the black 2.5% year-to-date.

May 1 -

JPMorgan's move to acquire First Republic and its muni portfolio eases the risk of nearly $20 billion of munis flooding the market.

May 1 -

"Investors' jitters in the lead up to next week's Fed meeting resulted in some large macro market moves and a rise in volatility," noted BofA Securities strategists in a weekly report.

April 28 -

It's one of four state cases accusing Wall Street banks of a "robo-resetting" scheme that kept interest on variable-rate debt artificially high.

April 28 -

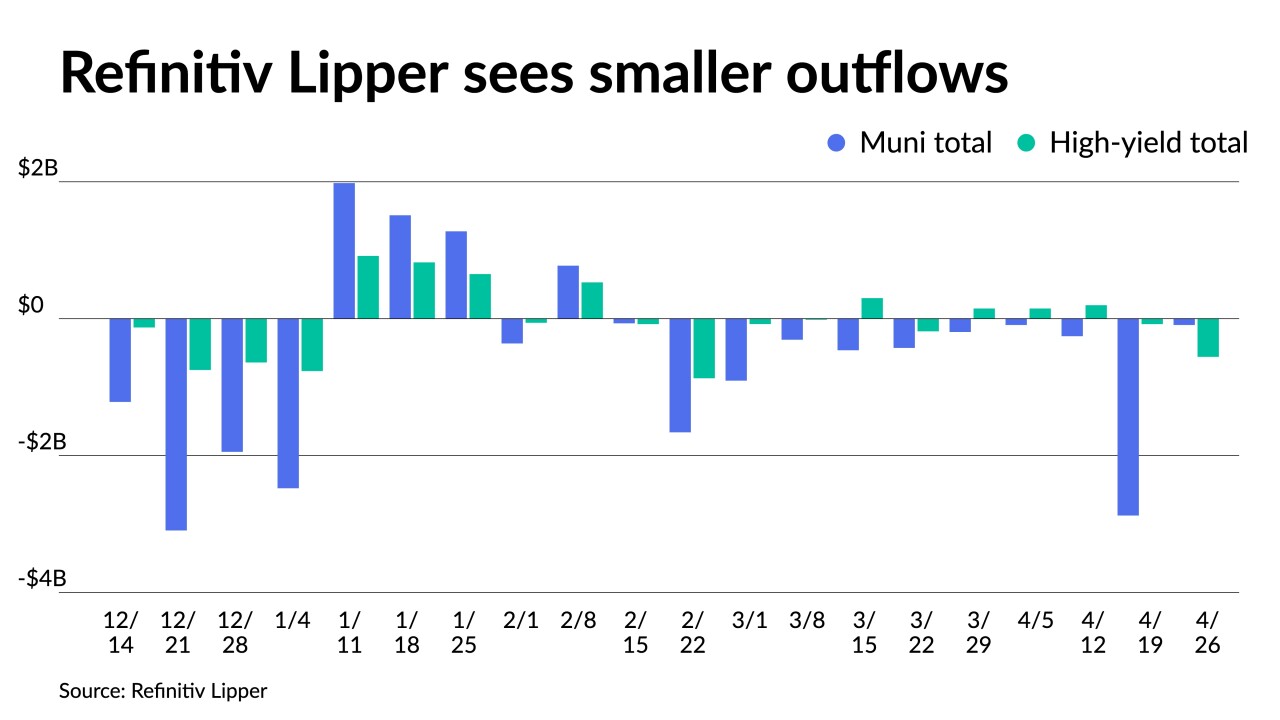

Outflows from municipal bond mutual funds receded as Refinitiv Lipper reported $92.055 million was pulled from them as of Wednesday after $2.876 billion of outflows the week prior.

April 27 -

S&P signaled the next lift needed for Detroit to shed junk status is within reach — in the next one to two years — by assigning a positive outlook to the BB-plus rating.

April 27 -

The Investment Company Institute reported investors pulled $377 million from to mutual funds in the week ending April 12, after $229 million of inflows the previous week.

April 26 -

One underwriter called it a "violent inversion," given that the short end of the municipal and Treasury yield curves were so dislocated.

April 25