-

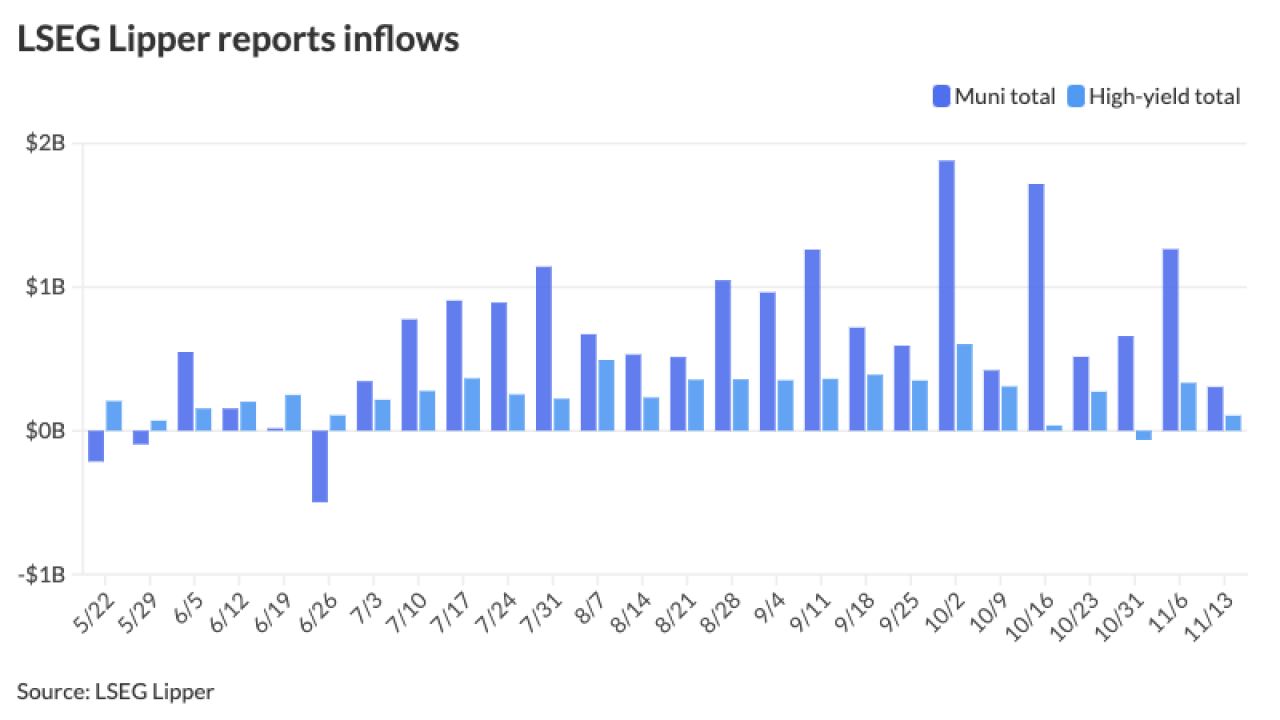

As headline risk swirls around the Fed and the transition to the Trump administration, municipals have largely stayed in their own lane. November finds the municipal market "in far better technical shape, with an attractive backdrop through at least year-end," J.P. Morgan's Peter DeGroot said.

November 15 -

The outlook change to negative comes in the wake of voter approval on Nov. 5 of a ballot measure requiring certain public safety spending by the city.

November 15 -

The Aloha State received three rating affirmations as it prepares to sell $750 million of taxable general obligation bonds.

November 15 -

A bond-financed rehab of the downtown sports arena is receiving pushback.

November 15 -

The Chicago City Council delivered a strong rebuke of Mayor Brandon Johnson's fiscal 2025 budget on Thursday, rejecting a $300 million property tax increase.

November 15 -

The announcement of $3.4 billion in grants for rail, roads and clean-energy efforts comes on the third anniversary of Biden's signature legislation.

November 15 -

The Los Angeles school district was at the forefront of a Build America Bond refunding wave with its $2.9 billion deal.

November 15 -

The Federal Reserve chair said there are no economic indicators calling for rapid rate cuts. He also addressed Fed independence, the impact of Trump's economic agenda and more.

November 14 -

This month is experiencing similar volatility as 2016 when generic yields traded higher by 50 to 70 basis points during November of that year, said Kim Olsan, a senior fixed income portfolio manager at NewSquare Capital.

November 14 -

Opposition from President-elect Trump and lawsuits from all sides persuaded Gov. Kathy Hochul to lift her pause on the tolling program.

November 14