-

The president of St. Augustine University in North Carolina called the loan a "necessary evil" as it fights to remain solvent and accredited.

December 12 -

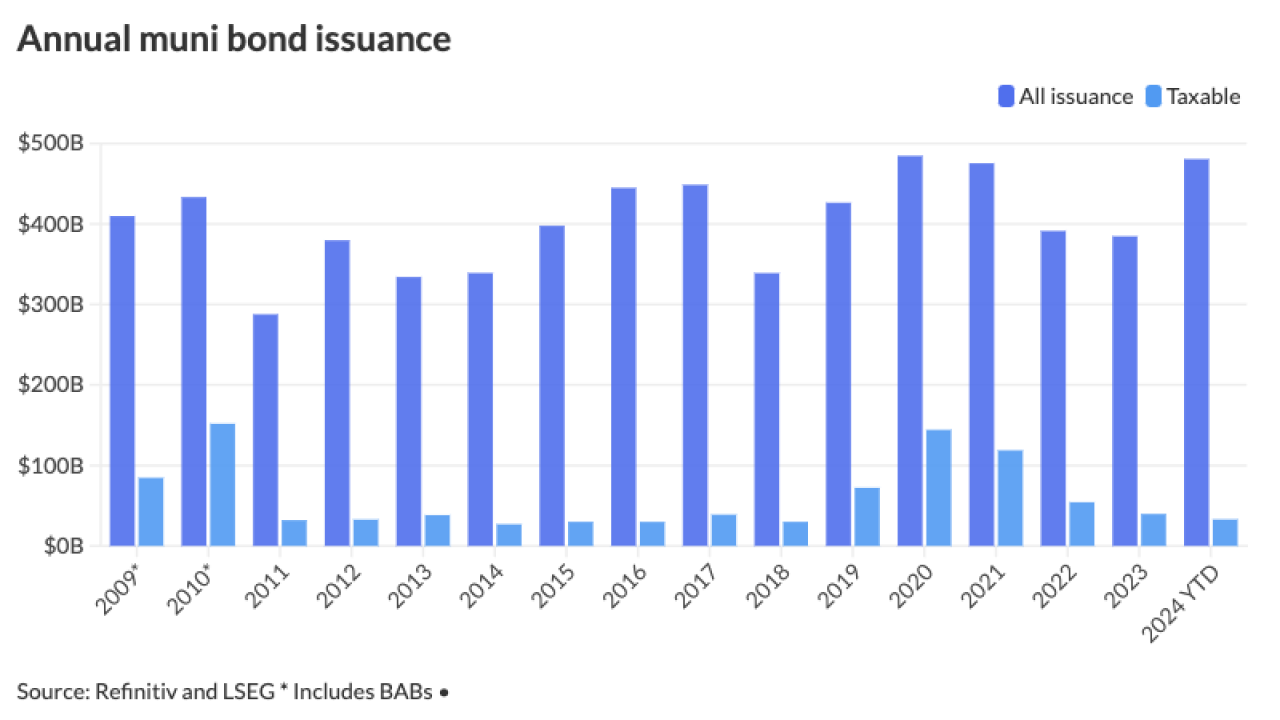

Most on the Street expect issuance to come in around $500 billion, but a few think volume will be much higher, primarily because of potential changes to the tax exemption. Most firms expect refunding volumes to also grow in 2025.

December 12 -

Brad Briner said the state may need to issue short-term debt in the near future to pay for Hurricane Helene expenses.

December 12 -

Pressing issues include market reactions to a second Trump administration, increased oversight from the Securities and Exchange Commission and more.

December 12 -

Municipal investors are more focused on the final new-issues coming down the pike and repositioning books as 2024 heads to a close. ICI reported another week of inflows into municipal bond mutual funds.

December 11 -

Operator ports, which rely on shipping volume for revenue, are more exposed to trade policy shifts than landlord ports, analysts said.

December 11 -

The lowest-rated municipalities in the state are benefitting the most from current economic tailwinds, Moody's reports.

December 11 -

Washington D.C. is lobbying Congress for an extra $47 million in expenses for the upcoming inauguration of President Trump while also raising concerns about the effects of debt ceiling squabbles on the city's credit rating.

December 11 -

Wednesday marks the 10-year anniversary of Detroit's exit from bankruptcy. Its Chapter 9 declaration in 2013 was the largest municipal bankruptcy in the U.S.

December 11 -

The top five bond financings came in above $5 billion.

December 11