-

In this third of a three-part 2026 municipal bond outlook series, Market Intelligence analyst Jeff Lipton explains how another year of heavy supply, surging ETF and SMA assets, climate and cyber risk, and growing use of bond insurance will drive muni market structure and strategy for both sell-side and buy-side stakeholders.

January 8 The Bond Buyer

The Bond Buyer -

The state's first-of-its-kind law allowing for tolling on its interstates is closely watched by transportation experts.

January 8 -

The balance of power in the House of Representatives continues to shift months before the midterms as Rep. Steny Hoyer, D-Md. who sits on the House Appropriations Committee announces he will not seek re-election this fall.

January 8 -

Bank of America and Wells Fargo will lead underwriting for $1.8 billion of sales tax and revenue bonds issued through the Kansas Development Finance Authority.

January 8 -

The Nashville Metropolitan Airport Authority is issuing municipal bonds to finance upgrades to an airport bulging at the seams after rapid traffic growth.

January 8 -

Gov.-elect Mickie Sherrill said she will nominate Aaron Binder, the state's deputy treasurer, to head the New Jersey Department of the Treasury.

January 8 -

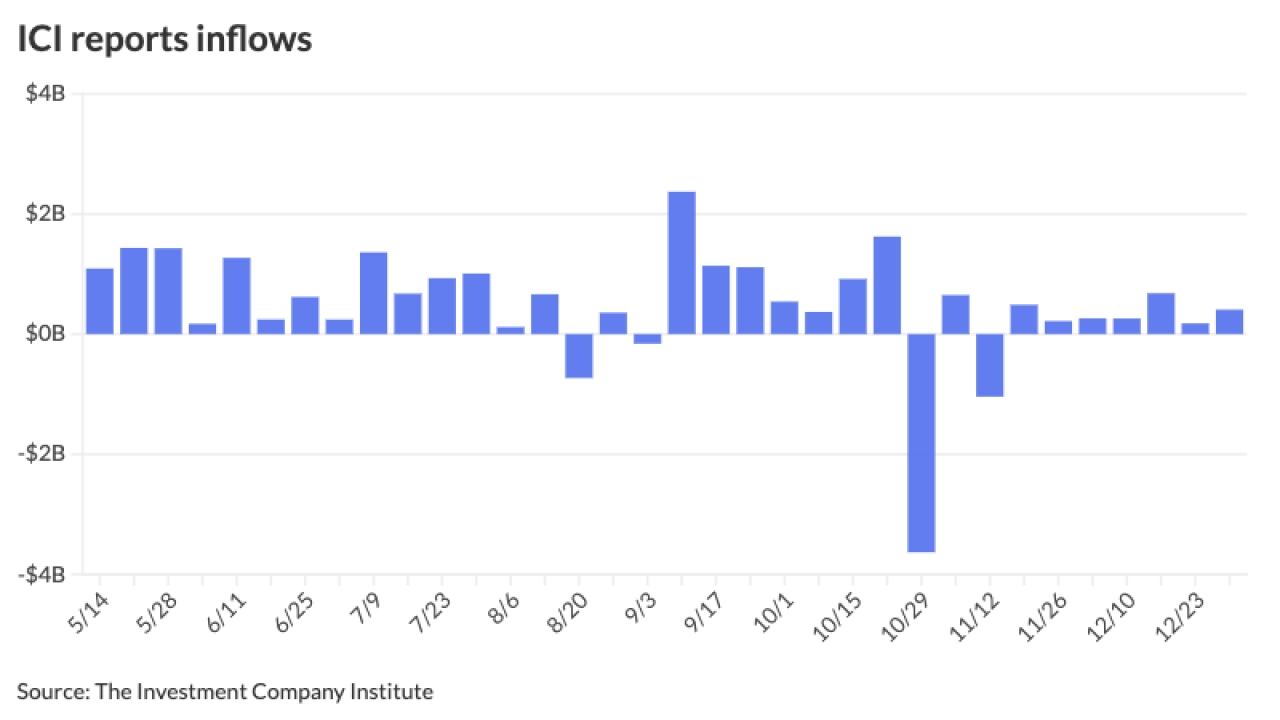

Surprisingly, the expected surge in net supply last year did not elicit a major repricing in the muni market, said Pat Luby, head of municipal strategy at CreditSights.

January 7 -

University Park joined four other cities in placing measures on the May 2 ballot asking voters to decide whether to withdraw from Dallas Area Rapid Transit.

January 7 -

The Port Authority of New York and New Jersey has already established itself as the frontrunner in the U.S. airport P3 space.

January 7 -

The Nederland Board of Trustees approved an agreement to purchase the Eldora Mountain Resort contingent on the sale of revenue bonds.

January 7