-

RBC Capital Markets took the top spot for total education issuance, underwriting more than $10 billion in 2023.

May 29 -

Two California issuers take first and third spots on the list. The Regents of the University of California top the list with $2.875 billion in six deals while Los Angeles Unified School District lands at third with $1.189 billion in two deals.

May 29 -

Overall education issuance, including higher ed, K-12 and student loan debt, in 2023 totaled $94.9619 billion, or 3.6% more than 2022's totals.

May 29 -

Orrick Herrington took the top spot with nearly 50% of the market.

May 29 -

Goldman Sachs took the top spot in underwriting public power debt, coming in at nearly $6 billion in 2023.

May 29 -

The top 10 bond counsels saw some shuffling and welcomed two new entrants, Locke Lord and Ballard Spahr.

April 30 -

The top five bond financings have an average dollar volume of more than $1.9 billion.

April 22 -

The top two municipal bond insurers wrapped $7.132 billion in the first quarter of 2024, up from the $5.735 billion of deals in the first quarter of 2023, according to LSEG data.

April 12 -

DASNY, Washington, Massachusetts, Jefferson County, Alabama, and the New Jersey Education Facilities Authority entered the top 10, with the last three issuers coming to market after not issuing any debt in the first quarter of 2023.

April 10 -

Kaufman Hall & Associates, Piper Sandler and Montague DeRose & Associates moved into the top 10, while CSG Advisors, Estrada Hinojosa and RBC Capital Markets were bumped.

April 9 -

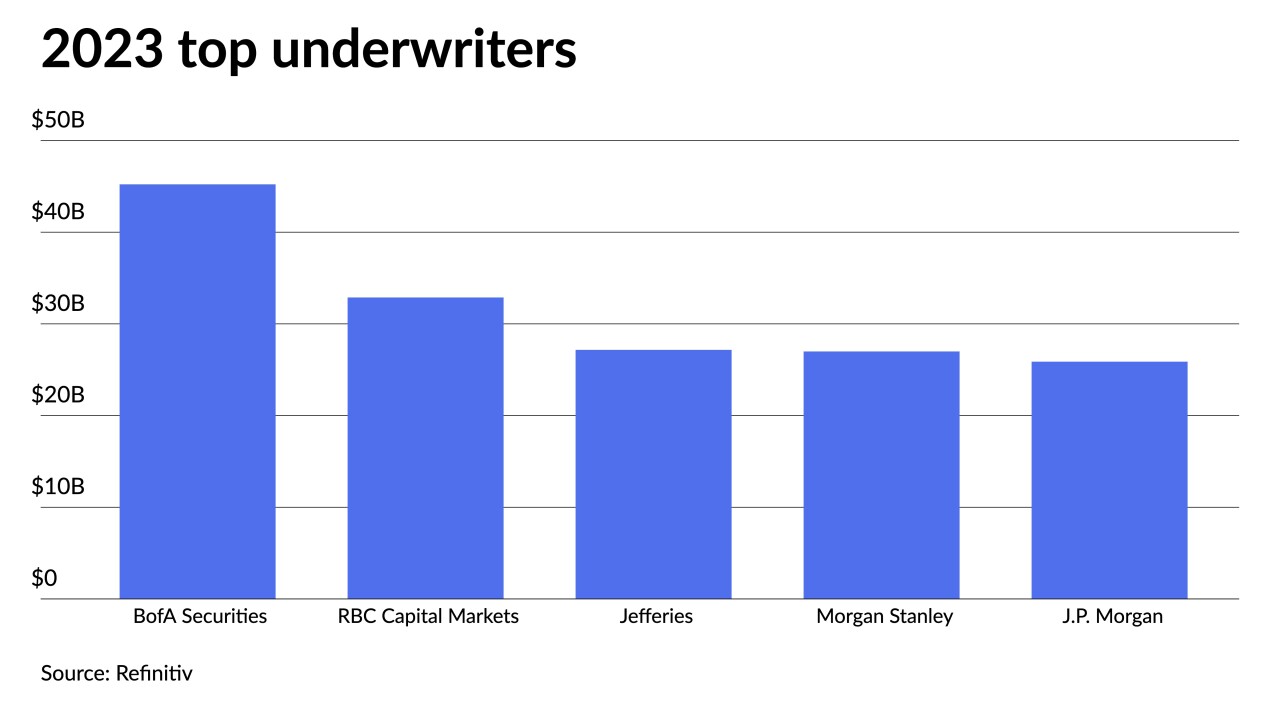

BofA Securities remained at the top of the list.

April 8 -

The top five bond financings have an average dollar volume of more than $957 million.

March 13 -

The top five bond financings have an average dollar volume of nearly $1.5 billion.

February 21 -

The top three co-managers have an average dollar volume of more than $11.7 billion as of the end of December 2023.

February 6 -

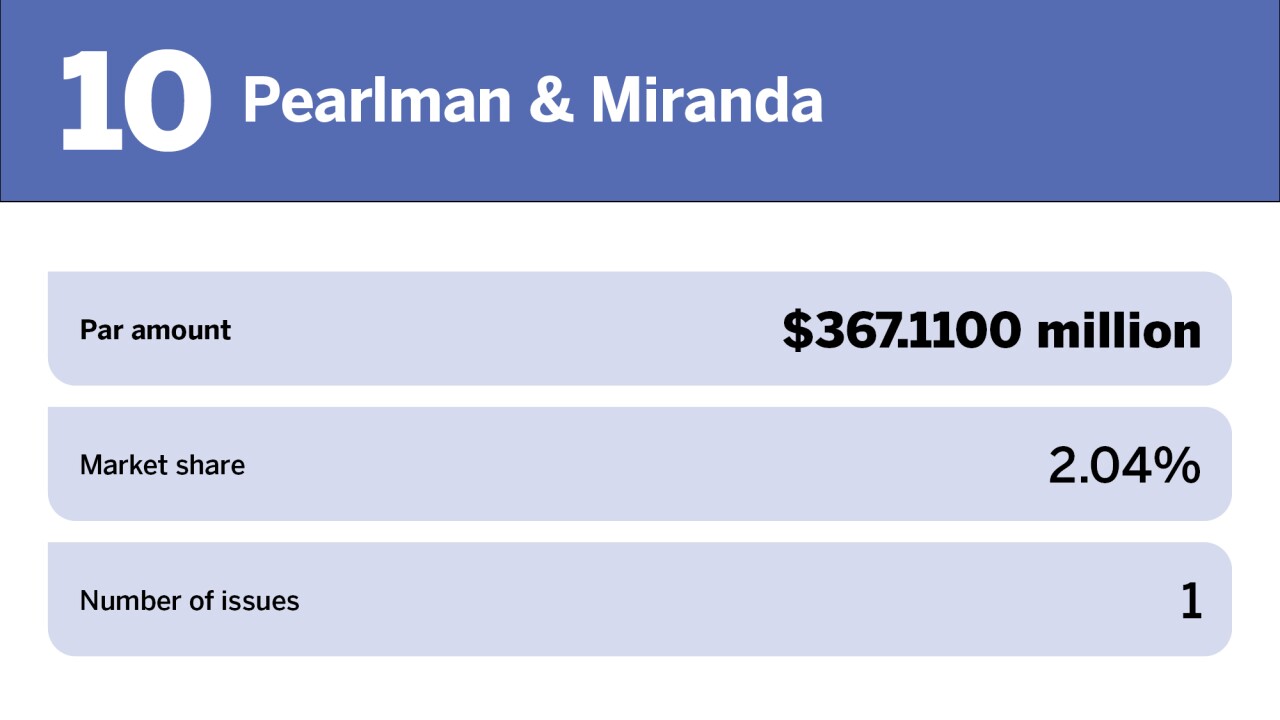

The top bond counsel in 2023 handled a combined $361.721 billion across 7,164 bond issues versus $359.189 billion in 7,882 transactions in 2022.

January 22 -

The top five bond financings have an average dollar volume of more than $917 million.

January 18 -

The top two municipal bond insurers wrapped $31.845 billion in 2023, up 10.4% from the $28.847 billion of deals in 2022, according to Refinitiv data.

January 12 -

Caine Mitter & Associates and RBC Capital Markets moved into the top 10, while Piper Sandler & Co. and Kaufman Hall & Associates were bumped to the top 15.

January 8 -

Half of the top 10 issuers were new entrants: the California Community Choice Finance Authority, Main Street Natural Gas, the state of Washington, the Texas Natural Gas Securitization Finance Corp. and Illinois.

January 8 -

RBC ramped up business to land at second place and Jefferies rose to third while Raymond James entered the top 10, knocking Barclays to 11th. Citi, which exited the business, closed at sixth place.

January 8