Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

"This week will likely have been the last active week of the year, but it turned out to be quite eventful," according to Barclays PLC.

December 16 -

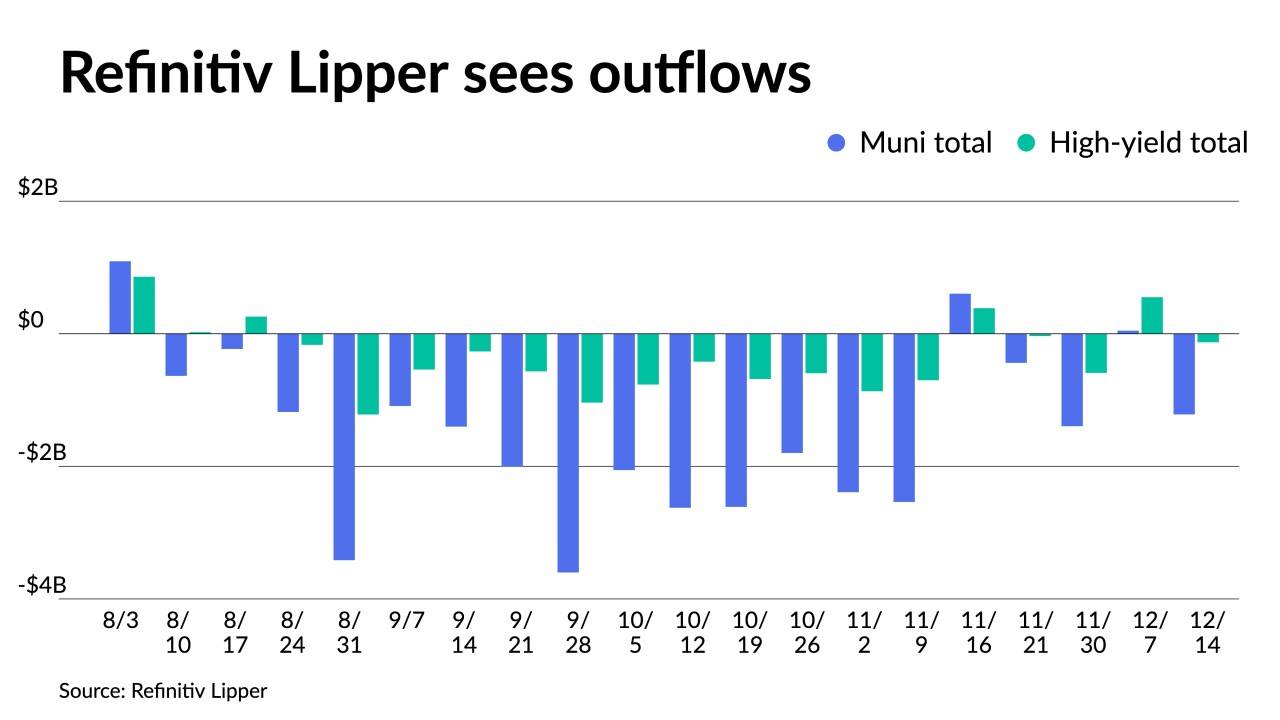

Outflows returned as Refinitiv Lipper reported $1.217 billion was pulled out of municipal bond mutual funds for the week ending Wednesday after $46.912 million of inflows the week prior.

December 15 -

The Fed chairman said he believes the Fed is getting close to a sufficiently restrictive level, but they're not quite there. While two good inflation reports are good, "there's still a long way to go to price stability."

December 14 -

The CPI report showed inflation had slowed to 7.1%, giving investors confidence the Federal Open Market Committee will hike rates 50 basis points as expected following Wednesday's much-anticipated meeting.

December 13 -

The December Federal Open Market Committee meeting, combined with the release of inflation data, "will test the good cheer currently prevailing in the bond market," said MSCI Research strategists Andy Sparks, Tamas Hanis and Edina Szirma.

December 12 -

Projections for total bond volume in 2023 are at a high of $500 billion and a low of $302 billion, continuing 2022's lackluster growth.

December 12 -

Investors will be greeted Monday with a new-issue calendar estimated at $3.214 billion, the majority of which is a nearly $1.9 billion private activity P3 bond deal from Pennsylvania.

December 9 -

Arrick was formerly a managing director and healthcare group leader for S&P Global Ratings.

December 9 -

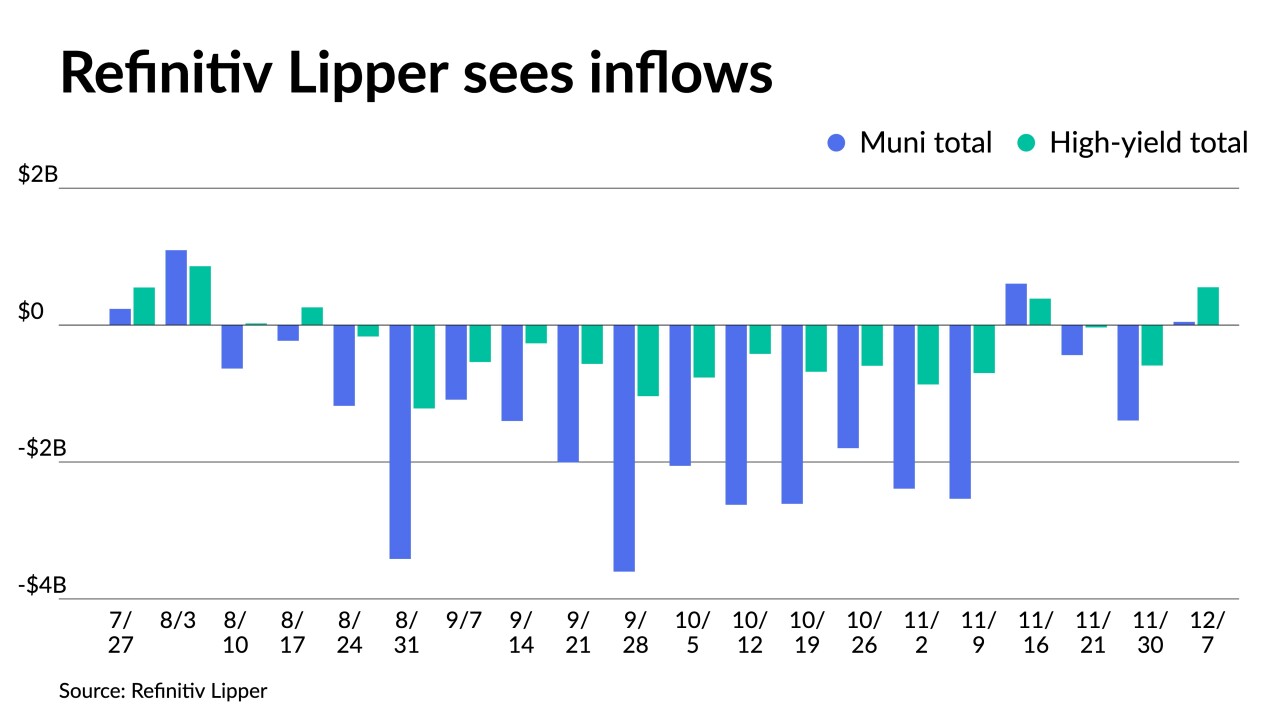

Refinitiv Lipper reported $46.912 million was added to municipal bond mutual funds for the week ending Wednesday after $1.394 billion of outflows the week prior.

December 8 -

"Yield curve inversion deepens and nears a four-decade low which is clearly setting up this economy for a recession that won't be a mild one," OANDA's Edward Moya said.

December 7 -

Despite the volatility in equities and Treasuries, the backdrop for munis is very positive.

December 6 -

"Munis are poised to continue this rally into December as we can end 2022 on a high note and close out the worst-performing year on record for munis," said Jason Wong, vice president of municipals at AmeriVet Securities.

December 5 -

Investors will be greeted Monday with a new-issue calendar estimated at $5.893 billion.

December 2 -

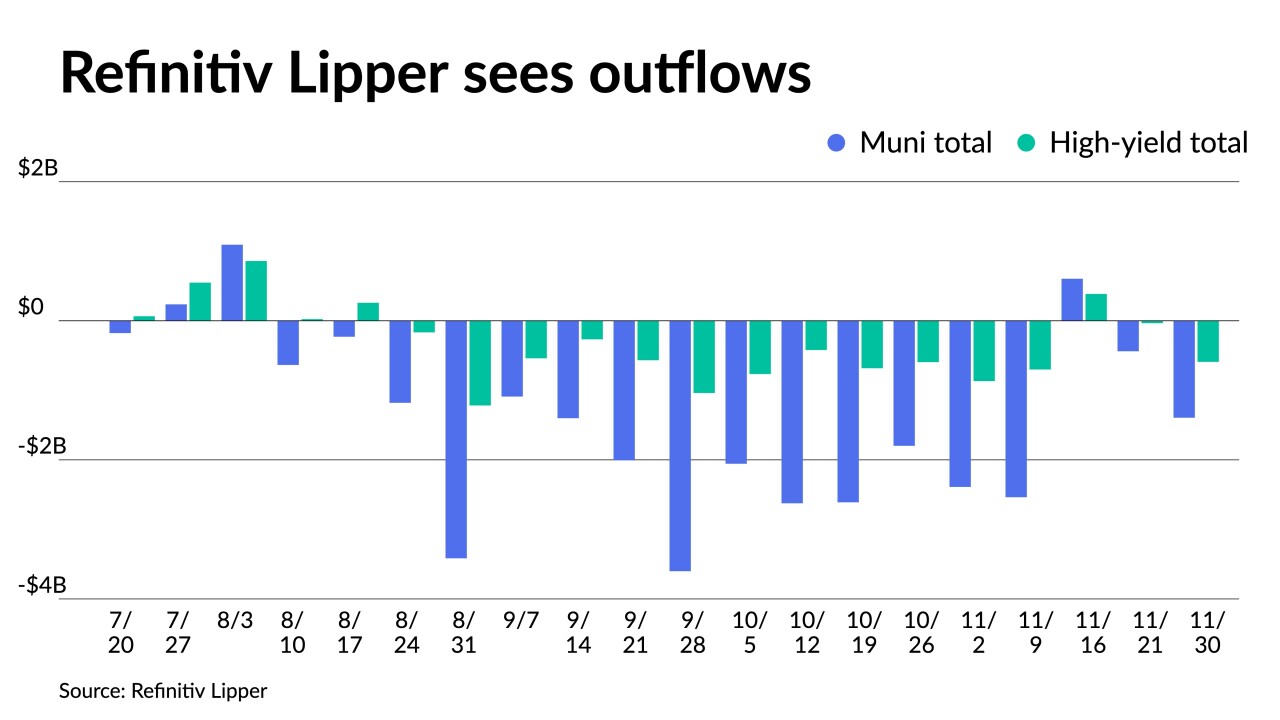

Munis saw the best performance in November in decades, with the asset class ending in the positive by 4.68%. The MSRB reported that trading volume reached another record in November, with 1.29 million municipal trades.

December 1 -

Powell said smaller interest rate increases are likely ahead — and could start as early as next month.

November 30 -

Total November volume stood at $19.712 billion, the lightest of any month year-to-date, in 527 versus $37.073 billion in 1,055 issues a year earlier, according to Refinitiv data.

November 30 -

Tax-exempt munis have now regained late September levels, and November's rally has eclipsed October's selloff, MMA notes in a weekly report.

November 29 -

The Bloomberg Municipal Index is at positive 4.06% as of Friday. Bloomberg indices show high-yield returning 4.17%, taxable munis returning 4.38% in November while the Impact Index is at positive 4.66%.

November 28 -

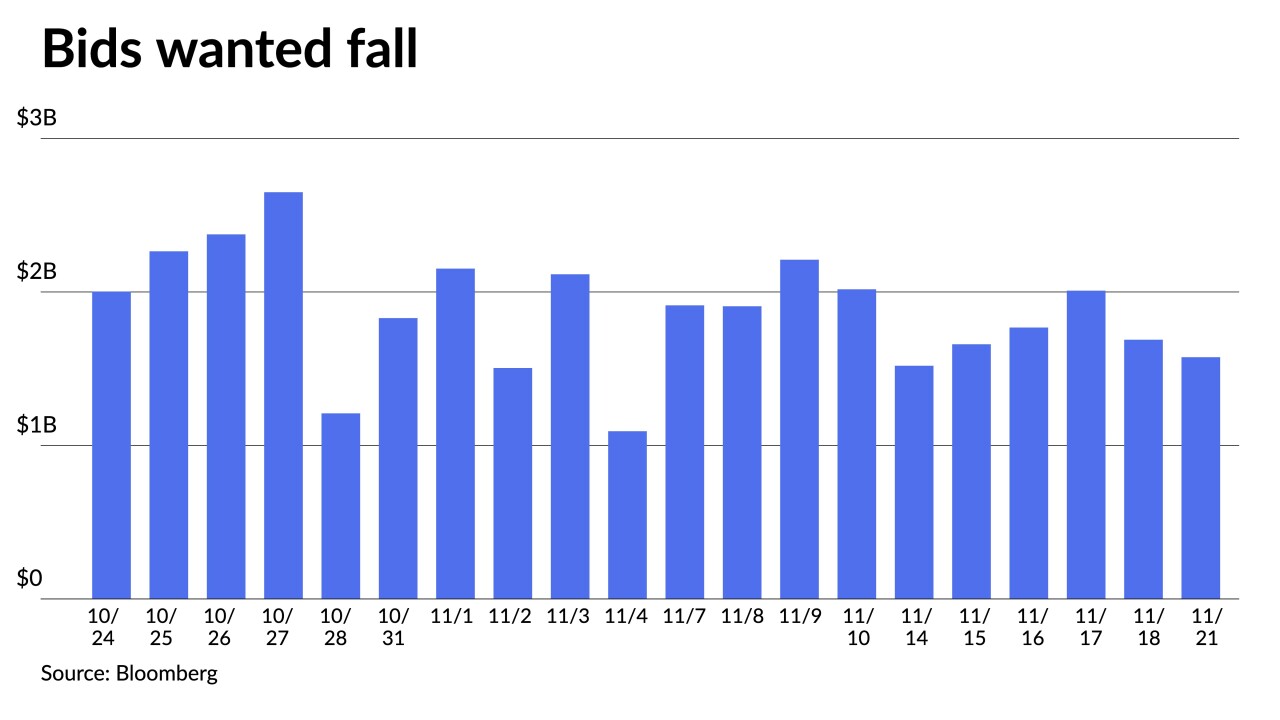

Lower supply in 2022 has somewhat helped the market avoid larger losses, many participants have said.

November 22 -

The negotiated calendar this week is very light due to the Thanksgiving holiday, with only four deals above $100 million.

November 21