Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

Issuance shrinks to $722 million while Bond Buyer 30-day visible supply sits at little more than $7 billion.

November 18 -

Municipals improved again Thursday, pushing the 10-year yield firmly below 3%, while Refinitiv Lipper reported $604.704 million of inflows into municipal bond mutual funds for the week ending Wednesday.

November 17 -

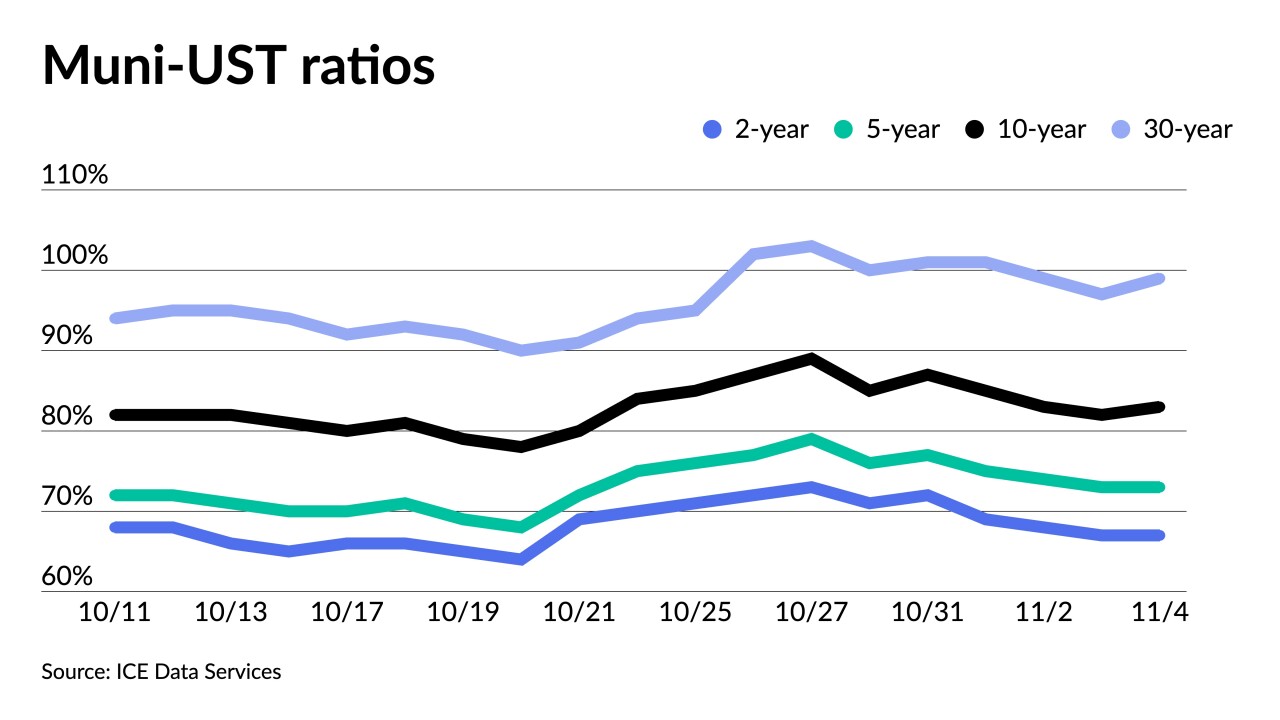

As market participants navigate through the remaining weeks of 2022, Jeff Lipton, managing director of credit research at Oppenheimer Inc., expects munis to maintain their outperformance over USTs

November 16 -

Along with Goldberg and Ninan, a dozen other honorees from the public and private sectors were chosen by the Northeast Women in Public Finance as Trailblazing Women in Public Finance.

November 16 -

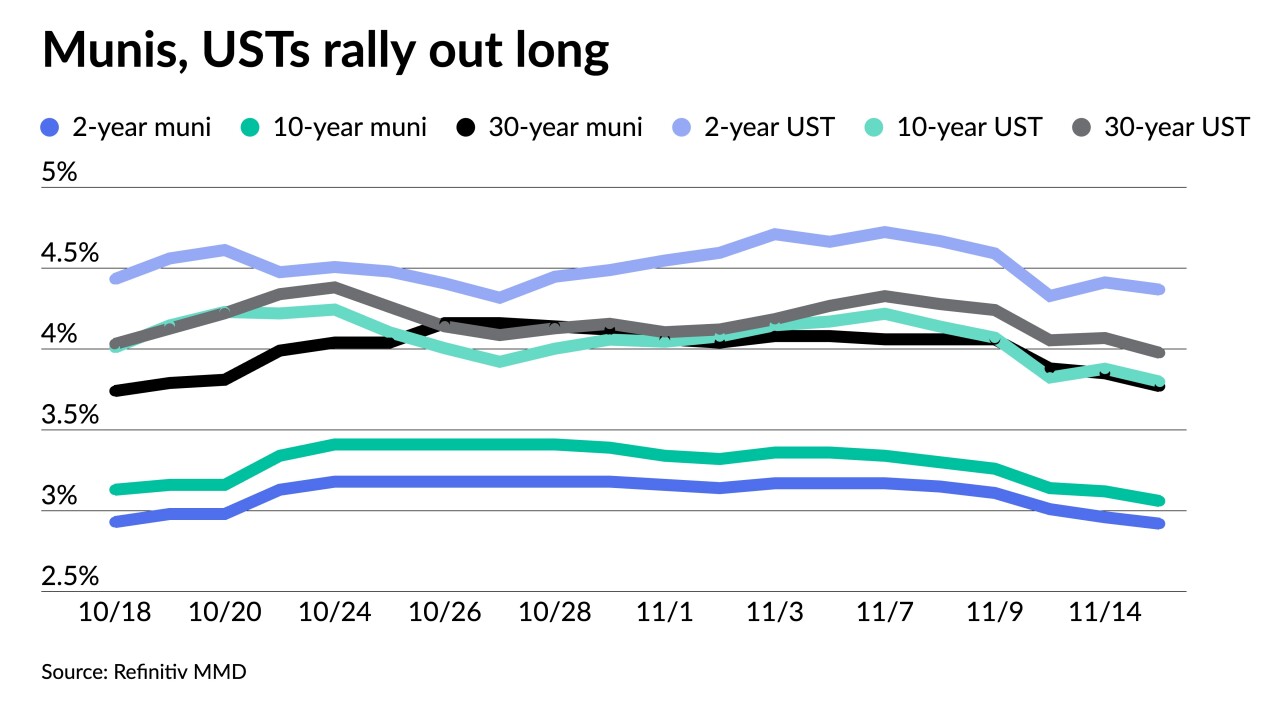

Triple-A yields fell five to eight basis points while UST saw yields fall up to nine out long, moving the 30-year UST below 4% for the first time since mid-October.

November 15 -

Munis were in their own lane while broader markets were mixed Monday as participants digested various Fed officials' comments on inflation and rate hike schedules.

November 14 -

"Having the team infrastructure and everybody looking to be on the same page and work together, that's something that has been really fun," Christopher Flosi said.

November 14 -

"It's almost like a mission now for me to build better efficiency and better tools for analysts everywhere," Abhishek Lodha said.

November 14 -

For Patrice Mitchell it's important to build and have sustainable affordable housing, especially in underserved communities.

November 14 -

Refinitiv Lipper reported $2.537 billion of outflows from municipal bond mutual funds for the week ending Wednesday after $2.389 billion the week prior.

November 10 -

Municipal bond mutual funds saw more losses on Wednesday with the Investment Company Institute reporting another week of multi-billion-dollar outflows, bringing year-to-date losses to $123.3 billion.

November 9 -

The market has seen outflows for 13 straight weeks, per Refinitiv Lipper, but Nuveen strategists Anders S. Persson and John V. Miller said "selling is due primarily to investors harvesting tax losses."

November 8 -

Voters will decide on more than $60 billion of bond ballot measures Tuesday with New York voters faced with the largest amount at $4.2 billion.

November 7 -

ICE TMC, part of ICE Bonds, provides market participants access to an all-to-all market for trading munis and other bonds.

November 7 -

Investors will be greeted Monday with a new-issue calendar estimated at $5.268 billion.

November 4 -

High-yield saw outflows of $867.067 million after $594.497 million of outflows the week prior while exchange-traded funds saw inflows of $736.967 million after $444.544 million of inflows the previous week.

November 3 -

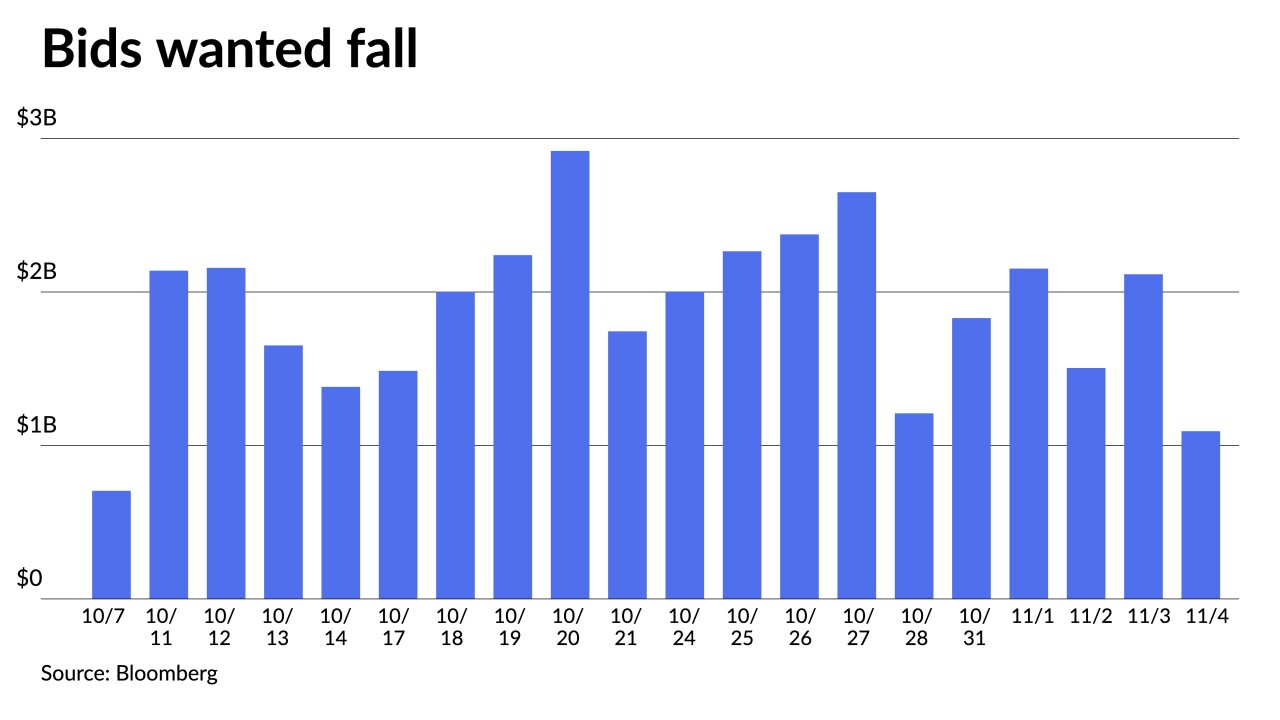

Investors pulled $3.843 billion from mutual funds in the week ending Oct. 26 after $3.876 billion of outflows the previous week, according to ICI.

November 2 -

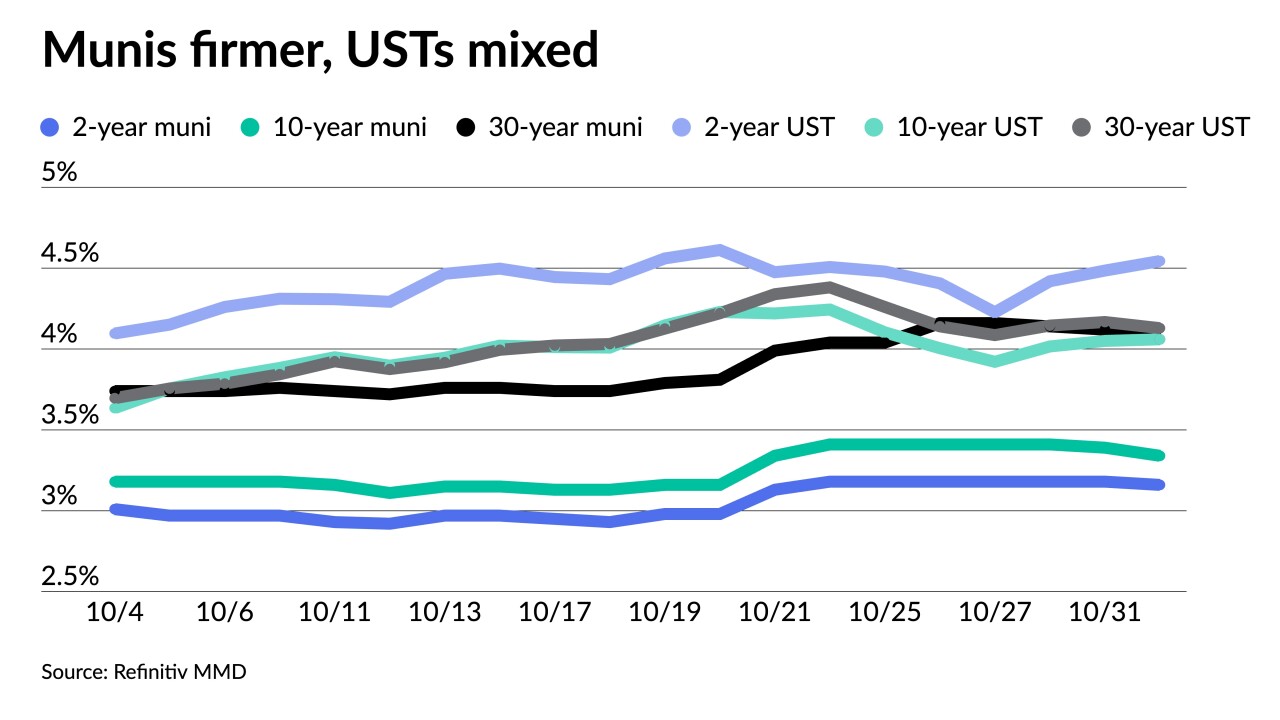

October returns were in the red with the Bloomberg Municipal Index showing a loss of 0.83% for the month, bringing total losses in 2022 to 12.86%. Only May and July saw positive returns for the asset class.

November 1 -

He will be the company's first ever full-time regional director of issuer solutions.

November 1 -

With the Federal Open Market Committee meeting this week and the next week shortened by the bond market observance of Veterans Day, CreditSights strategists said "investors should be prepared for two weeks of subdued new issuance."

October 31