Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

The secondary was quiet and the sole deal of size came from a $400 million-plus competitive water and sewer loan from Portland, Oregon. The recent rise in yields makes for more compelling levels.

May 3 -

"The market is expecting a 25 basis point rise in the Fed funds rate, but more importantly, investors are waiting for the comments for a better idea of what to expect going forward," said SWBC Investment Company's Roberto Roffo.

May 2 -

"Investors' jitters in the lead up to next week's Fed meeting resulted in some large macro market moves and a rise in volatility," noted BofA Securities strategists in a weekly report.

April 28 -

Total volume for the month was $30.599 billion in 577 issues, down from $40.423 billion in 900 issues a year earlier. Total issuance year-to-date is at $107.626 billion, falling 25.2% from the same period of 2022.

April 28 -

Taxable municipal issuance has decreased 40.9% year-over-year, but returns so far in 2023 are outperforming tax-exempts and high-yield.

April 28 -

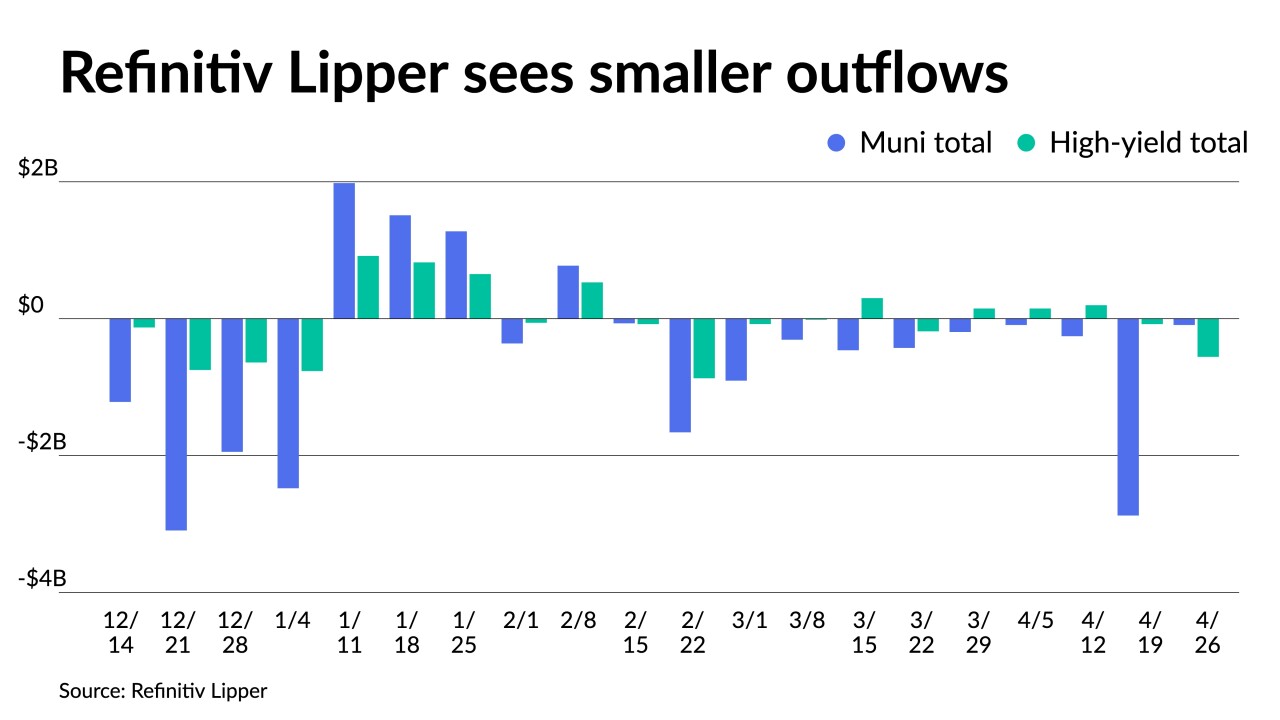

Outflows from municipal bond mutual funds receded as Refinitiv Lipper reported $92.055 million was pulled from them as of Wednesday after $2.876 billion of outflows the week prior.

April 27 -

The Investment Company Institute reported investors pulled $377 million from to mutual funds in the week ending April 12, after $229 million of inflows the previous week.

April 26 -

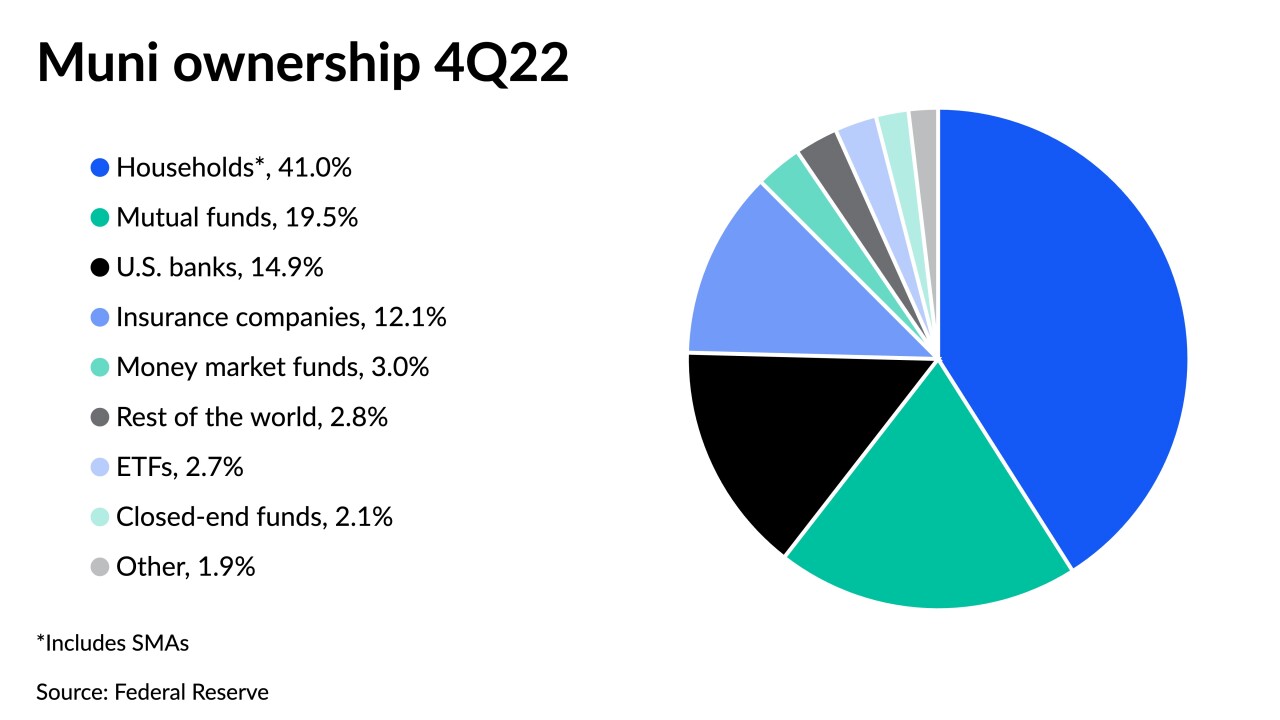

"We're in a market right now where there's heightened volatility in prices, inconsistent pace of supply, and for investors who need to put money to work, muni ETFs continued to play that role," CreditSights' Pat Luby said.

April 26 -

One underwriter called it a "violent inversion," given that the short end of the municipal and Treasury yield curves were so dislocated.

April 25 -

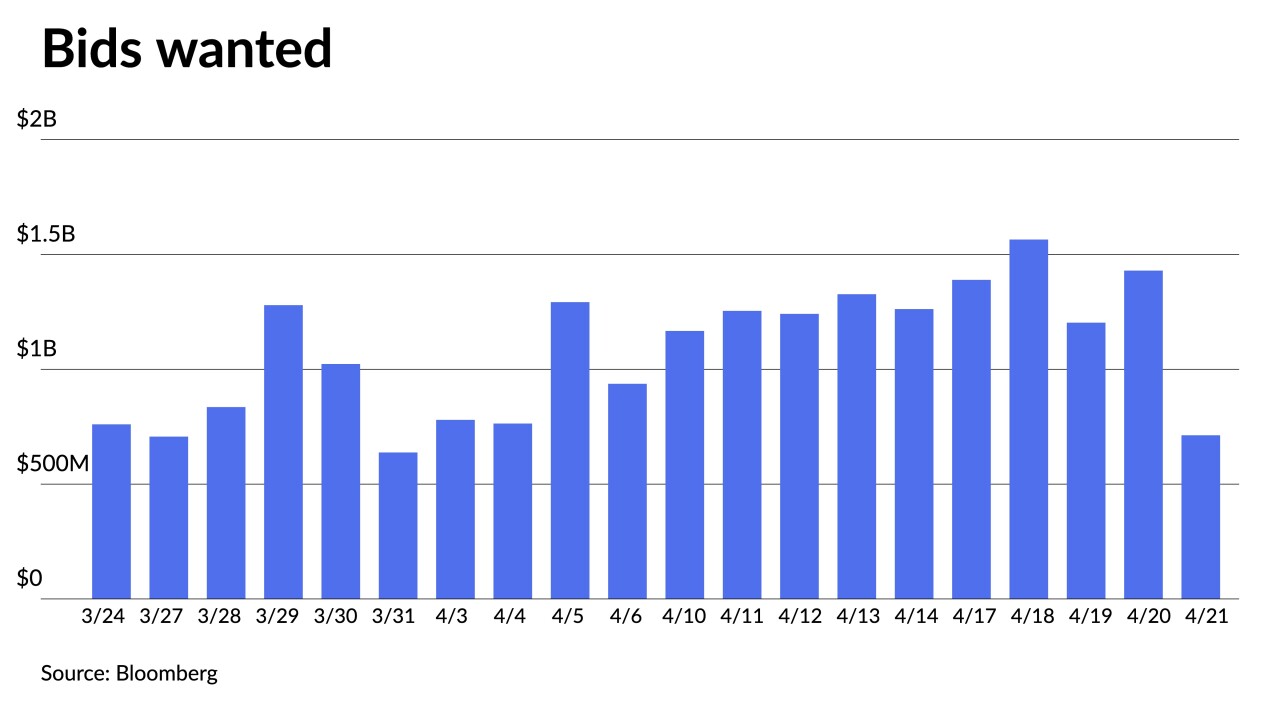

The "weakness in the secondary market will carry over into this week, which may lead to higher yields and wider spreads in the primary market," said CreditSights strategists Pat Luby and Sam Berzok.

April 24