Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

"The market has taken to heart the [Federal Open Market Committee] actions from last week," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

September 27 -

Yields have "risen substantially over the last week as the market seeks to find at least a minor level of balance or equilibrium," said Tom Kozlik, managing director and head of public policy and municipal strategy at HilltopSecurities.

September 26 -

Data for the second quarter show the face amount of munis outstanding rose 0.4% quarter-over-quarter, or $15.5 billion, to $4.043 trillion.

September 26 -

The Texas Water Development Board leads the new-issue calendar with $1 billion of revenue bonds.

September 22 -

The general bias toward muni rates is that they would be a bit higher with technicals "being a little less supportive than they were in August, plus what we heard with from the Fed 'higher for longer,' and potentially another hike," said Jeff MacDonald, head of Fixed Income Strategies at Fiduciary Trust International.

September 21 -

As was expected, the FOMC held rates in a range between 5.25% and 5.50%, but the dot plot in the Summary of Economic Projections showed 12 of 19 members expect another 25-basis-point rate hike this year.

September 20 -

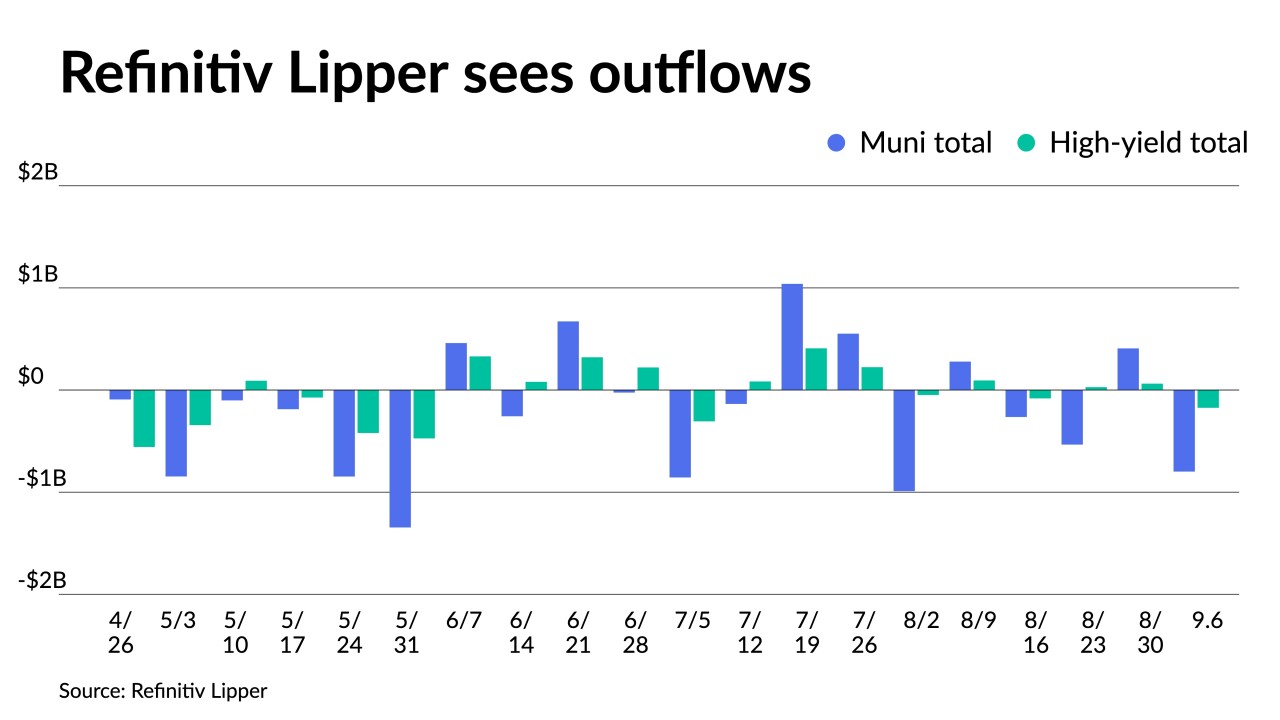

Fund flows "should be moving along a more positive trajectory, but they have yet to do so with munis unable to break free of the Treasury market's tight grip," Oppenheimer's Jeff Lipton said.

September 19 -

Refinitiv Lipper reported $116.737 million was pulled from municipal bond mutual funds for the week ending Wednesday after $798.474 million of outflows from the funds the previous week.

September 14 -

There hasn't been a huge return of capital in the muni market so far this year, with fund flows being rather anemic, said Chad Farrington, co-head of municipal bond strategy at DWS Group.

September 13 -

"One of the things that my parents said to me early on in my life is, 'If you have the will to do something, you can make it happen,'" Prachi Chandhok said.

September 13 -

"What has kept me so interested in this market is the ability to actually learn something new every day, which has been extremely rewarding," said Morgan Fahy.

September 13 -

"Matt has become a seasoned and well-respected credit/risk management analyst," said Victor Chu, managing director at Assured Guaranty.

September 13 -

While supply this week is "softer," uncertainty and volatility may prevail once more due to "yields still not exciting longer-term investors," said Matt Fabian, a partner at Municipal Market Analytics.

September 12 -

Munis have had a slow start "down roughly 0.25% for the first week of September bringing year-to-date returns to 1.34%," said Jason Wong, vice president of municipals at AmeriVet Securities.

September 11 -

Historically, "September and, to a lesser degree, October have not been kind to municipal investors."

September 8 -

Refinitiv Lipper reported $798.474 million was pulled from municipal bond mutual funds in the week ending Wednesday after $407.976 million of inflows into the funds the previous week.

September 7 -

California and the Port Authority of New York and New Jersey held one-day retail order periods for $1 billion-plus issues.

September 6 -

Investors remain hesitant about "jumping back into munis even as rates are nearing multi-year highs as tax-exempts are still not cheap enough with the front-end ratios still yielding under 70% while the historical averages are around 90%," AmeriVet Securities' Jason Wong noted.

September 5 -

The calendar will rebound with an estimated $7.141 billion next week with $6.323 billion of negotiated deals on tap and $817.6 million on the competitive calendar.

September 1 -

Refinitiv Lipper reported $407.976 million of inflows from municipal bond mutual funds for the week ending Wednesday after $534.428 million of outflows into the funds the previous week.

August 31