After a long period of extremely low yields, municipals finally appear to be in a range that offers an attractive entry point for investors, particularly retail, if they can move past outside factors such as the debt ceiling fight and the banking crisis that has kept many sidelined so far this year.

"Ultimately, the case for fixed income generally, and munis specifically, is much stronger today than it was a year ago," said Nick Venditti, municipal bond fund portfolio manager with Allspring Global Investments. "We've seen this massive increase in yields, and what that means is that there is income in fixed income for really the first time in a long time."

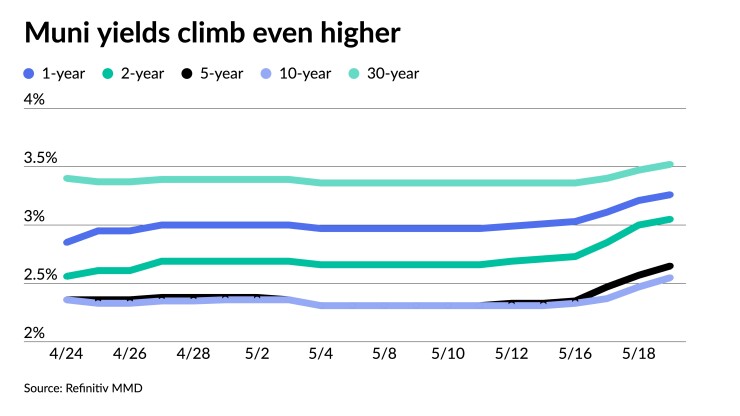

Last week, the market moved rapidly into a much higher yield range, furthering the calls for retail engagement.

In the span of a week, "muni yields sold off 25-30 basis points on the shorter end while maturities past 15 years rose 15-20 basis points," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

The one-year muni was at 3.26% Friday — the highest it has been in 10 years — and the two-year was at 3.05%, according to Refinitiv MMD. The five-year was at 2.65% and the 10-year at 2.55% Friday.

The last time the two-, five- and 10-year were higher than today was on October 24, 2022, when the yields were at 3.18%, 3.24% and 4.04%, respectively.

The 30-year was at 3.52% on Friday, and the last time it was higher was on September 5, 2013, when it was at 4.51%, amid the Taper Tantrum.

"What was surprising was the velocity of the moves rather than that the market wasn't in need of some adjustment," Olsan said, noting that for nearly a month, "most of the curve traded in a very narrow range at the same time relative value notched higher but (apparently) not enough for most muni buyers."

Whatever "the catalysts for an upwardly yielding UST curve, munis are now chasing the same theme," she said.

After 2022's "repricing in fixed income, yield is back, yet cash remains on the sidelines and recent banking sector stress has led investors to seek safety in money market funds," said Goldman Sachs strategists Sylvia Yeh, Scott Diamond and Matt Wrzesniewsky in a report.

While "many investors may have found a quick fix in cash," they said, these investors could "be missing out on a longer-term opportunity to lock in historically attractive rates."

The bond market, "against a backdrop of market-moving headlines," has been resilient in the first quarter of the year, posting positive returns for investors once more, they said.

Part of the hesitancy of the retail buyer is that last year was a difficult year for every asset class, and "investors are still feeling pretty fresh burns from that event," Venditti said.

Now, he added "investors have an opportunity to rethink their portfolio allocations holistically. 'What do we want to own? How much risk do we want to take and how much reward are we expecting?'"

All of a sudden, Venditti said, "that risk-reward equation is significantly easier to balance."

"You can take a lot less risk for a lot more reward," he said. "To the extent that you have a whole swath of investors who are hesitant to even dip their toe into anything other than money markets."

There has been a "huge run-up in money market assets because money markets yield a lot and have no risk," he noted.

But money market rates are ephemeral, disappearing quickly, he said.

"What's going to have to happen is that investors are going to have to decide very quickly do they want to lock in those rates for the next 90 days or for the next three, four or five years," he said.

Venditti said investors are more likely to do the latter, but they will take that step incrementally.

Investors will move from money markets into munis because they are the least volatile asset class. And so that "provides a pretty interesting dynamic or backdrop for retail investors," he said.

Retail is interested in munis primarily because of the higher yields, said Ann Ferentino, portfolio manager at Federated Hermes.

"For the yield-oriented buyer, for the retail buyer, this has been, from midway through the end of last year to now, an attractive entry point for them as yields are significantly higher than they've been in over a decade," she said.

Another contributing factor is that munis simply are a high-quality asset class. "And despite a few isolated problems, the default rates are very low," she said.

Goldman echoed this sentiment.

"While volatility toward the end of the second quarter stoked fears about the banking sector and overall financial stability, municipal credit has remained resilient," Goldman Sachs strategists said.

Municipalities have achieved near-record reserves due to "robust revenue growth and COVID-related federal monies," they said, while states and local governments "are well-positioned to withstand inflationary-related expenditure pressures, a potential slowdown or even elevated borrowing costs."

In all, they said, the cash "lends support and budgetary flexibility — an important fundamental that underpins the asset class."

While this year has seen more market volatility than initially expected at the end of 2022, said Jeff Lipton, managing director of credit research at Oppenheimer Inc. In spite of this, the absolute yield levels available on munis, "with the very compelling technical backdrop, has in large measure raised considerable interest for the retail investor," he said.

Lipton noted retail investors are also paying attention to variables that have factored into market volatility, such as inflation, monetary policy, geopolitical forces and the widely debated debt ceiling.

"All of this creates some hesitation on the part of the retail investor," Lipton said. "But, in spite of all of these concerning forces, retail has held bids quite nicely with respect to municipal participation."

The key reason why rates are so compelling right now "has as much to do with the current tightening cycle that the Fed has pursued over a little more than a year," he said. "So the question is, 'Has the Fed completed its tightening cycle, or is there going to be one or more rate increases left?"

"If we see a significant dislocation in the economy, along with the potential for further bank failures, that could theoretically move the Fed to pivot before year-end," Lipton said. "But there needs to be a rather sharp and dramatic shift in the economic outlook for that pivot to take place before the end of the year."

Another factor is the possibility of a recession, or at least an economic slowdown, Venditti said.

"When that happens, that generally doesn't provide a very good backdrop for equities and so that leaves you with fixed income because recession tends to be beneficial to fixed income, at least from a rate perspective, as rates have to come down a little bit," he said.

"We do think rates will be higher for longer, [and] the Fed probably will pause in June," Ferentino said.

"The one thing about munis that no other asset class has is as rates rise, the value of that tax-exemption is turbocharged; it's worth more as rates are higher," she said. "That's a definite catalyst for bringing money into [munis]."

Goldman Sachs strategists believe "the upcoming market environment presents several factors that [will] make municipal bonds attractive."

The spring historically "has been an attractive time to put money to work in municipal bonds, as the months of April and May have some of the lowest reinvestment totals and typically diminished demand," according to Goldman.

Conversely, they noted, "the summer months have tended to represent the largest percentage of maturing bonds during the calendar year, making it more challenging to find supply at a good value and leading to favorable to returns."

From a market technical perspective, Goldman Sachs strategists "expect muni primary market volumes — and high-yield issuance in particular — to remain subdued, which should add to strong credit fundamental tailwinds."

This makes investing strategies difficult to manage. "If I was a [portfolio manager] and had money to put to work, I would have been nibbling at the deals this past week," said Pat Luby, a CreditSights strategist. "But I also would want to keep some powder dry."

"That's not a risk-free strategy because we're going to have huge redemption flows on June 1, and there's going to be a lot of money coming into the market," he said. "So if you have money to put to work and you're waiting for resolution from the Treasury market [on the debt ceiling], that may get resolved at the same time we get Fed's June meeting and redemptions."

There are $115 billion of redemptions scheduled in June through August, Luby said.

"The money is going to have to go somewhere, and most of that demand will get directed toward the new-issue market," he said. "Where there will be pockets of opportunity will be in the secondary market. That demand will be pushing prices higher and yields lower."

And "with the Fed nearing a potential pause and the municipal bond market underpinned by strong fundamentals as we near the summertime, today's opportunities may not last as many investors look to lock in longer-term rates," Goldman Sachs strategists said.