Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

The market is seeing a supportive environment for munis, said Nisha Patel, managing director of SMA Portfolio Management at Parametric.

May 16 -

"With rates volatility seemingly subsiding in the past few weeks, we could start to see outflows decrease and demand flow back into munis," according to AmeriVet Securities' Jason Wong.

May 15 -

Investors will be greeted Monday with a new-issue calendar estimated at $6.018 billion with a few bellwether, triple-A names coming from Loudoun County, Virginia, Frederick County, Maryland, and Columbia University with sizable deals.

May 12 -

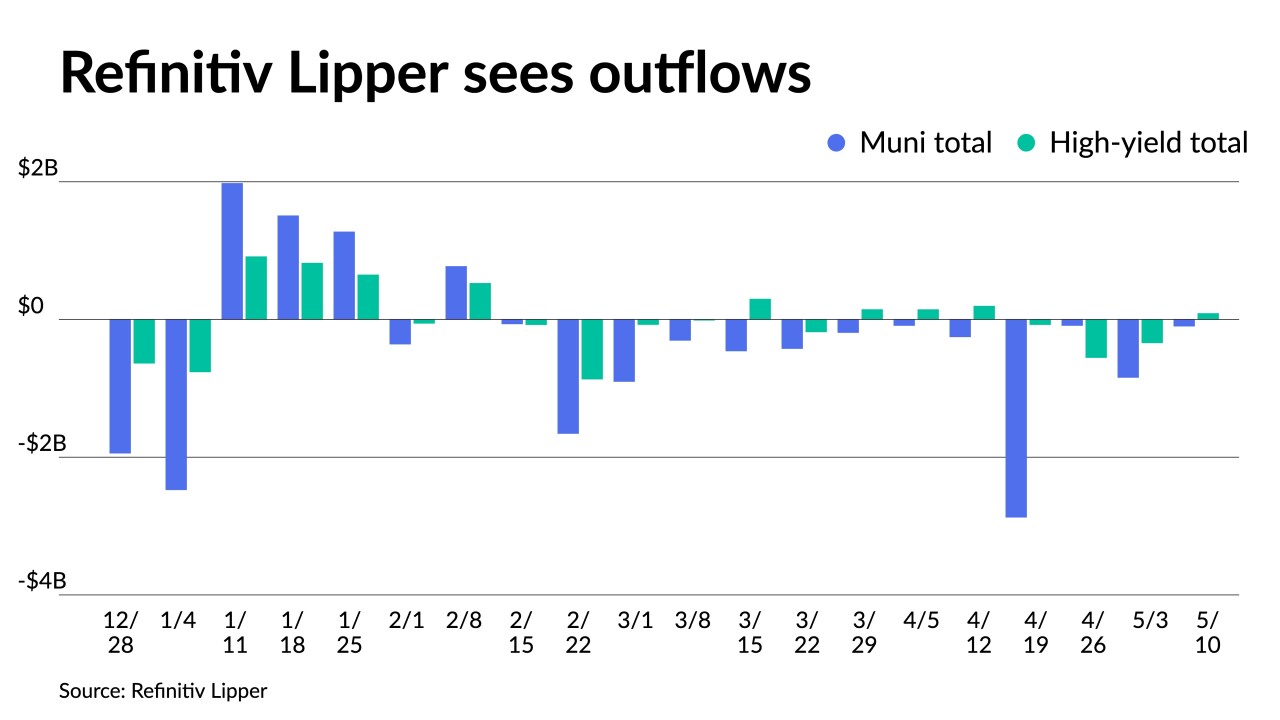

Outflows were seen again from municipal bond mutual funds, though they lessened this week as Refinitiv Lipper reported $101.664 million was pulled as of Wednesday.

May 11 -

The CPI numbers coming in pretty much as expected "was a relief" to the markets, with the bond market rallying after the release, said Luke Bartholomew, senior economist at abrdn.

May 10 -

Despite the attraction for new issues, sources said there is still uncertainty overall in the municipal market stemming from the regional banking crisis.

May 9 -

The application is a web-based workflow tool that houses data in a centralized location to reduce the need for users to go hunting all over the place for basic information, documents and records.

May 9 -

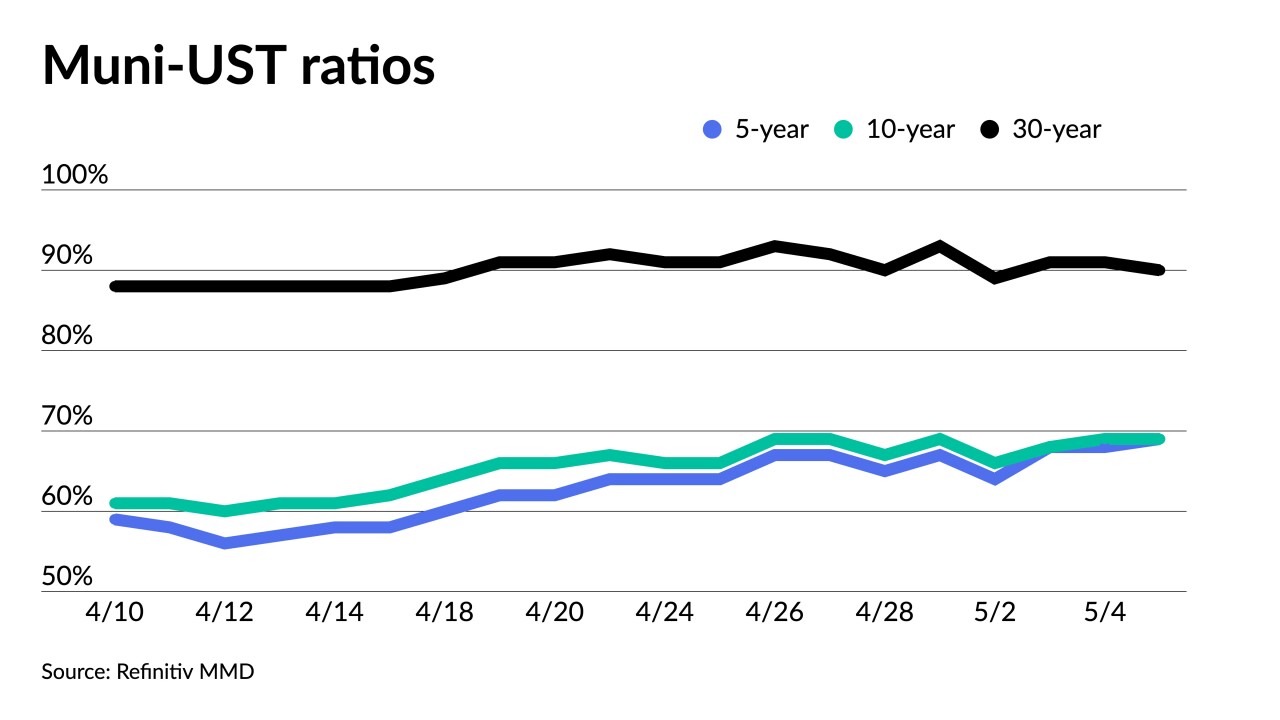

Now that there is more "clarity from the Fed on the path of interest rates, both investors and issuers may start to move off the sidelines," said Daniel Close, head of municipals at Nuveen.

May 8 -

Investors will be greeted Monday with a new-issue calendar estimated at $7.588 billion.

May 5 -

Outflows from municipal bond mutual funds intensified as Refinitiv Lipper reported $846.116 million was pulled from them as of Wednesday after $92.055 million of outflows the week prior.

May 4